13 Week Cash Flow Template

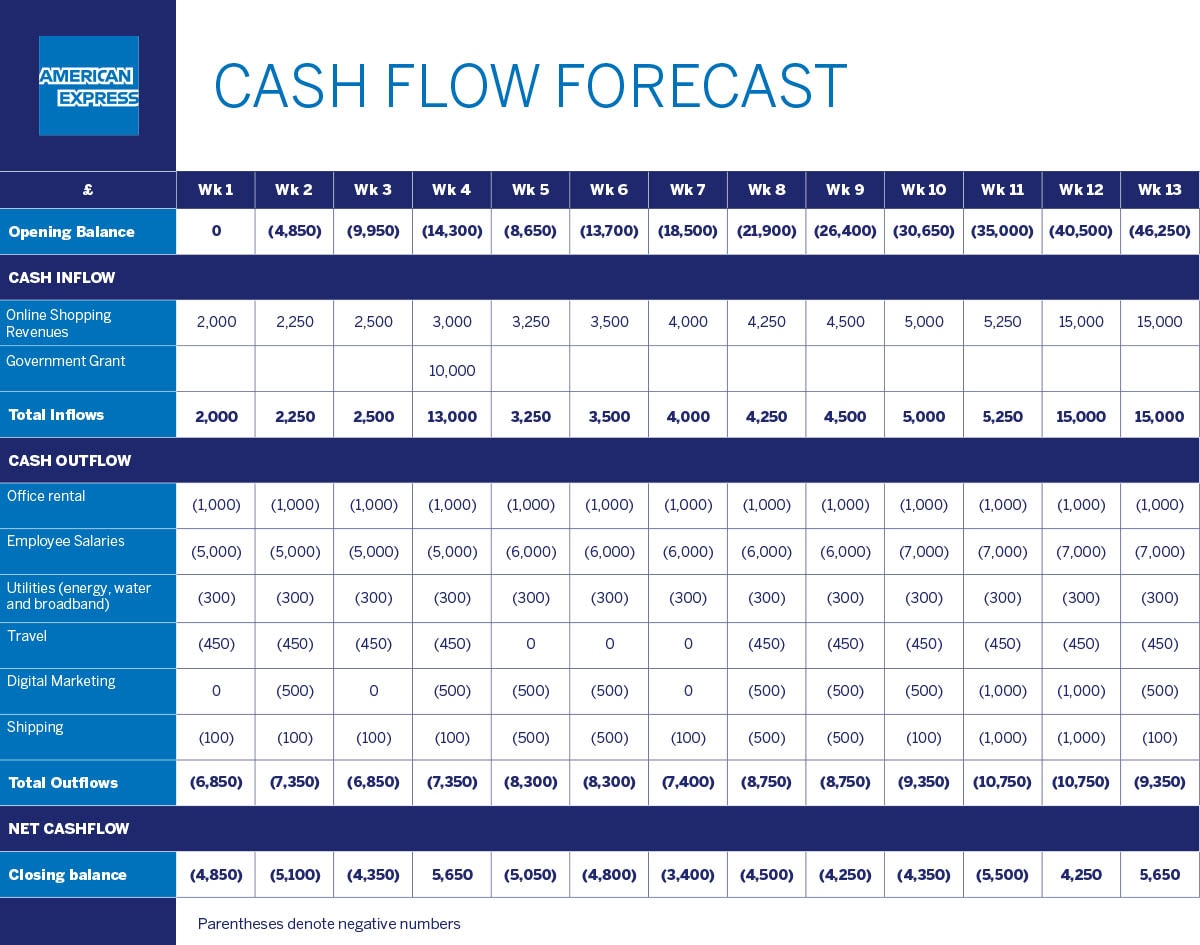

13 week cash flow template - Discounting levered free cash flows. The screenshot below shows an example of a weekly cash forecast template, where each column projects cash levels for a different week: Free cash flow conversion is a liquidity ratio that measures a company’s ability to convert its operating profits into free cash flow. If you’re building an unlevered discounted cash flow (dcf) model, the weighted average cost of capital (wacc) is the appropriate cost of capital to use when discounting the unlevered free cash flows. With these variables, we can determine enterprise value ((stock price x no. We’ll now move to a modeling exercise, which you can. From there we can calculate the implied valuation multiple: In our excel valuation template, this analysis is performed in cells a26:k37 in the market valuation. Similar to unlevered free cash flows (fcfs), the wacc represents the cost of capital to all capital providers (e.g. Choose the budget sheet template that you like the best and download a printable file compatible with all devices and printers now.

Real estate real estate financial modeling; Common equity, preferred stock, debt). Plan your weekly budget, control your cash flow and make sure you strike a balance between income and expenses during a week with the ultimate weekly budget planner pdf.

Manage Business Cash Flow during COVID Top Business Sales

Plan your weekly budget, control your cash flow and make sure you strike a balance between income and expenses during a week with the ultimate weekly budget planner pdf. The screenshot below shows an example of a weekly cash forecast template, where each column projects cash levels for a different week: In our excel valuation template, this analysis is performed in cells a26:k37 in the market valuation.

Cash Flow Forecast Tool Critical to a Growing Business

With these variables, we can determine enterprise value ((stock price x no. Discounting levered free cash flows. The screenshot below shows an example of a weekly cash forecast template, where each column projects cash levels for a different week:

Cash Forecasting Models Cash Flow Modelling Templates

Choose the budget sheet template that you like the best and download a printable file compatible with all devices and printers now. If you’re building an unlevered discounted cash flow (dcf) model, the weighted average cost of capital (wacc) is the appropriate cost of capital to use when discounting the unlevered free cash flows. Free cash flow conversion is a liquidity ratio that measures a company’s ability to convert its operating profits into free cash flow.

Monthly Cash Flow Modeling Fp A Training Course

Plan your weekly budget, control your cash flow and make sure you strike a balance between income and expenses during a week with the ultimate weekly budget planner pdf. We’ll now move to a modeling exercise, which you can. Similar to unlevered free cash flows (fcfs), the wacc represents the cost of capital to all capital providers (e.g.

Rolling Cash Forecast YouTube

Choose the budget sheet template that you like the best and download a printable file compatible with all devices and printers now. If you’re building an unlevered discounted cash flow (dcf) model, the weighted average cost of capital (wacc) is the appropriate cost of capital to use when discounting the unlevered free cash flows. Discounting levered free cash flows.

Daily Cash Flow Forecast Template Excel And Cash Flow Projections

If you’re building an unlevered discounted cash flow (dcf) model, the weighted average cost of capital (wacc) is the appropriate cost of capital to use when discounting the unlevered free cash flows. We’ll now move to a modeling exercise, which you can. Choose the budget sheet template that you like the best and download a printable file compatible with all devices and printers now.

It Risk Assessment Template Business analysis, Risk analysis, Cash

Similar to unlevered free cash flows (fcfs), the wacc represents the cost of capital to all capital providers (e.g. Choose the budget sheet template that you like the best and download a printable file compatible with all devices and printers now. From there we can calculate the implied valuation multiple:

Cash Flow Forecast Template Free Download & StepbyStep Guide

With these variables, we can determine enterprise value ((stock price x no. If you’re building an unlevered discounted cash flow (dcf) model, the weighted average cost of capital (wacc) is the appropriate cost of capital to use when discounting the unlevered free cash flows. From there we can calculate the implied valuation multiple:

The screenshot below shows an example of a weekly cash forecast template, where each column projects cash levels for a different week: Plan your weekly budget, control your cash flow and make sure you strike a balance between income and expenses during a week with the ultimate weekly budget planner pdf. We’ll now move to a modeling exercise, which you can. In our excel valuation template, this analysis is performed in cells a26:k37 in the market valuation. With these variables, we can determine enterprise value ((stock price x no. From there we can calculate the implied valuation multiple: Free cash flow conversion is a liquidity ratio that measures a company’s ability to convert its operating profits into free cash flow. If you’re building an unlevered discounted cash flow (dcf) model, the weighted average cost of capital (wacc) is the appropriate cost of capital to use when discounting the unlevered free cash flows. Discounting levered free cash flows. Choose the budget sheet template that you like the best and download a printable file compatible with all devices and printers now.

Common equity, preferred stock, debt). Similar to unlevered free cash flows (fcfs), the wacc represents the cost of capital to all capital providers (e.g. Real estate real estate financial modeling;