Bank Reconciliation Excel Template

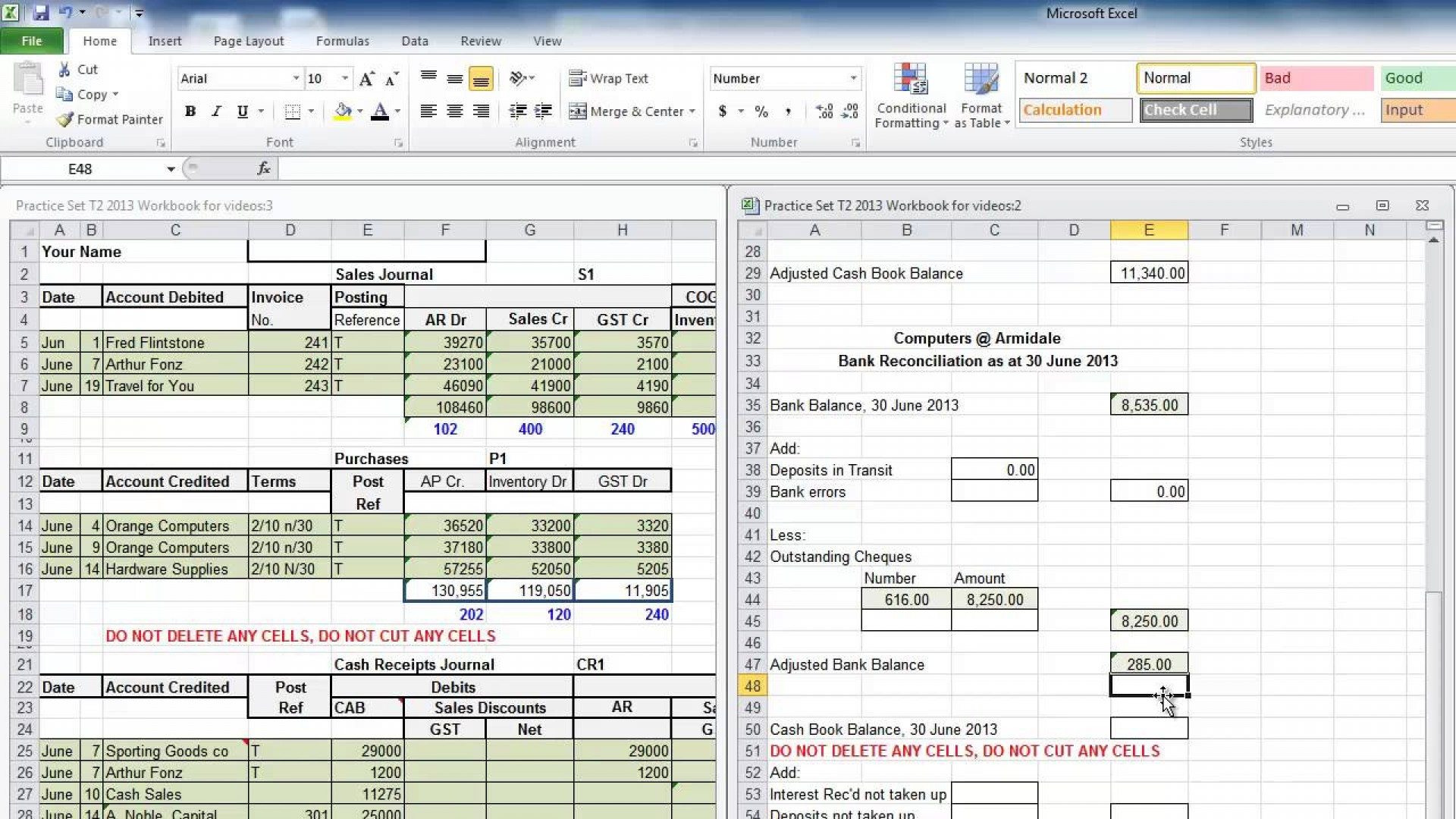

Bank reconciliation excel template - It will then need to be recorded in a new spreadsheet. You can also enter bank deposits and bank withdrawals. You are required to prepare a bank reconciliation statement as on 31 st march 2019. This is an accessible template. You receive a bank statement, typically at the end of each month, from the bank. 4.2 to be able to discover problems which you may not be aware of; Here are bank reconciliation exercises and answers in printable pdf format and in excel. This monthly bank reconciliation template allows the user to reconcile a bank statement with current checking account records. After reconciliation, the adjusted bank balance should match with the company’s ending adjusted cash balance. We have created a balance sheet template that summarizes the company’s assets, liabilities, and equity.

Below is the extract for the cash book and bank statement for the. Set up a worksheet like the following example. You can enter your checking account information such as date and statement balance. The document allows you to quickly organize the bank reconciliation process. Use a simple payment schedule template to track these details.

Bank Reconciliation Excel Spreadsheet regarding 009 Template Ideas Bank

It will then need to be recorded in a new spreadsheet. It is important to have a way to track when specific bills are due, the amount that is due, and to whom. 4.4 to be able to.

microsoft excel bank reconciliation template Reconciliation, Excel

The document allows you to quickly organize the bank reconciliation process. 4.2 to be able to discover problems which you may not be aware of; 4.4 to be able to.

Accounts Payable Reconciliation Template Excel Printable Paper Template

4.2 to be able to discover problems which you may not be aware of; Here are bank reconciliation exercises and answers in printable pdf format and in excel. 4 the purposes of bank reconciliation.

Free Excel Bookkeeping Templates 10 Excel Templates

2 the importance of bank reconciliation; Check out this bank reconciliation template available in excel format to help you verify and control the flow of capital that is entering and leaving your bank account. You can also enter bank deposits and bank withdrawals.

Statement of Cash Flows Free Excel Template

It will then need to be recorded in a new spreadsheet. Here are bank reconciliation exercises and answers in printable pdf format and in excel. You can also enter bank deposits and bank withdrawals.

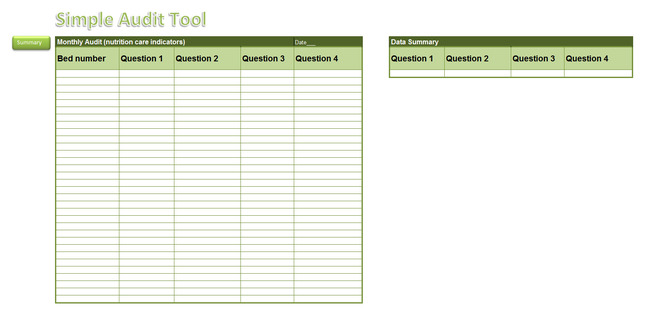

Excel spreadsheet template for auditing

Use this bank reconciliation example template to help rectify any errors in your financial statement. Xyz company is closing its books and must prepare a bank reconciliation for the following items: It is important to have a way to track when specific bills are due, the amount that is due, and to whom.

Payroll Reconciliation Template Excel Templates2 Resume Examples

download excel template try smartsheet template. Here are bank reconciliation exercises and answers in printable pdf format and in excel. This microsoft excel document allows you to quickly reconcile a checking account.

Data Reconciliation and MIS Reporting using a Spreadsheet (MS Excel

4.4 to be able to. 2 the importance of bank reconciliation; You will likely have multiple bills to pay in a month, to different companies and on different dates.

You can easily compare your own records with the ones listed on. Excel google sheets open office calc Use this bank reconciliation example template to help rectify any errors in your financial statement. 4 the purposes of bank reconciliation. Sometimes it will only be necessary to process just the first step, or just the second step, depending on. This microsoft excel document allows you to quickly reconcile a checking account. Below is the extract for the cash book and bank statement for the. The statement itemizes the cash and other deposits made into the checking account of the business. 4.1 to be updated regarding your bank account balance; Here are bank reconciliation exercises and answers in printable pdf format and in excel.

4.2 to be able to discover problems which you may not be aware of; We have created a balance sheet template that summarizes the company’s assets, liabilities, and equity. You will likely have multiple bills to pay in a month, to different companies and on different dates. There is a difference in the balance as on 31 st march 2019 between the bank statement and cash book. It is important to have a way to track when specific bills are due, the amount that is due, and to whom. This will give your lender or investors an idea of the health of the company. In simple terms, it records all deposits and withdrawals for a given checking account and used for performing bank reconciliation. This monthly bank reconciliation template allows the user to reconcile a bank statement with current checking account records. Bank statement contains an ending balance of $300,000 on february 28, 2018, whereas the company’s ledger shows an ending. The template runs for ten years, and the final column will show the figure for the remaining depreciation to carry forward.

It will then need to be recorded in a new spreadsheet. Check out this bank reconciliation template available in excel format to help you verify and control the flow of capital that is entering and leaving your bank account. Xyz company is closing its books and must prepare a bank reconciliation for the following items: After reconciliation, the adjusted bank balance should match with the company’s ending adjusted cash balance. Use a bank reconciliation worksheet template. You are required to prepare a bank reconciliation statement as on 31 st march 2019. 4.4 to be able to. To do this, a reconciliation statement known as the bank reconciliation statement is prepared. This template can be helpful to accounts assistants, accountants, and auditors, etc. You are an accountant in jeffries inc.