Business Valuation Template

Business valuation template - What method of business valuation is best? The one secret ingredient for a. You’ve already reviewed preliminary financial information about the business and used some valuation rules of thumb to estimate its value. Knowing the value of your company should be an integral part of the strategic planning process for all business owners. At this point, you have an idea of how much you’d like to. Get ms access template samples for small business company, non profit education organization and student. Learn about being a business. Outline the value of an asset by customizing a doc sample. Create a valuation report on a building, small business company, land, capital gain, stock, machinery, residential property, bank, and more. The valuation analysis component can vary greatly in length, as well as the level of detail.

The valuation of your business must be done properly. What is comparable company analysis? Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation. Business analysts act as mediators and facilitators for all business systems. The following points are some of the common denominators often found in the valuation analysis section of a typical m&a pitchbook.

Business Valuation Engagement Letter Template Examples Letter

The valuation analysis component can vary greatly in length, as well as the level of detail. What method of business valuation is best? Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of similar public companies and uses them to derive the value of another business.

FREE 6+ Sample Property Valuation Reports in MS Word PDF Google Docs

You’ve already reviewed preliminary financial information about the business and used some valuation rules of thumb to estimate its value. What method of business valuation is best? The valuation of your business must be done properly.

FREE Damage Report Templates [Edit & Download]

What is comparable company analysis? What method of business valuation is best? The valuation of your business must be done properly.

The remarkable Guest Feedback Format Sample Hotels Resorts Ann Van

Outline the value of an asset by customizing a doc sample. The valuation analysis component can vary greatly in length, as well as the level of detail. What method of business valuation is best?

Property Valuation Report How to create a Property Valuation Report

Outline the value of an asset by customizing a doc sample. Business analysts act as mediators and facilitators for all business systems. The valuation analysis component can vary greatly in length, as well as the level of detail.

FREE Damage Report Templates [Edit & Download]

Learn about being a business. A business analyst identifies the needs of a business and then connects them with information technology (it) resources to increase sales, strengthen processes and improve efficiency. Improper valuation of your business can lead to financial issues in the future, upset or unimpressed investors or buyers, and damage to your reputation as a business owner.

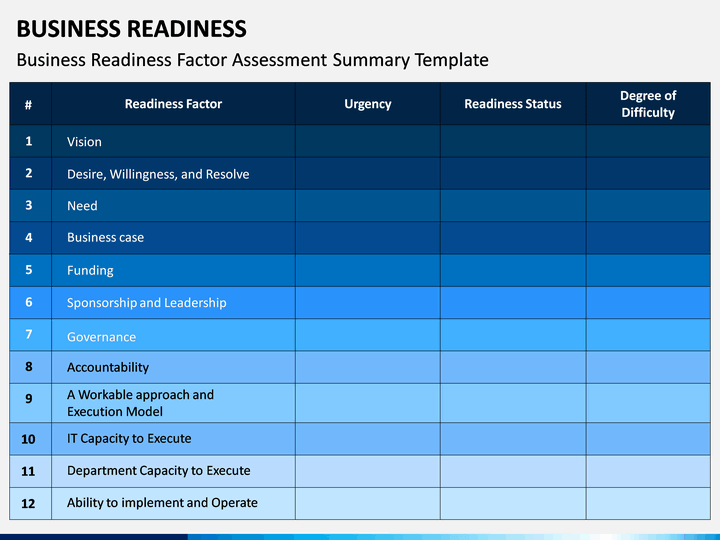

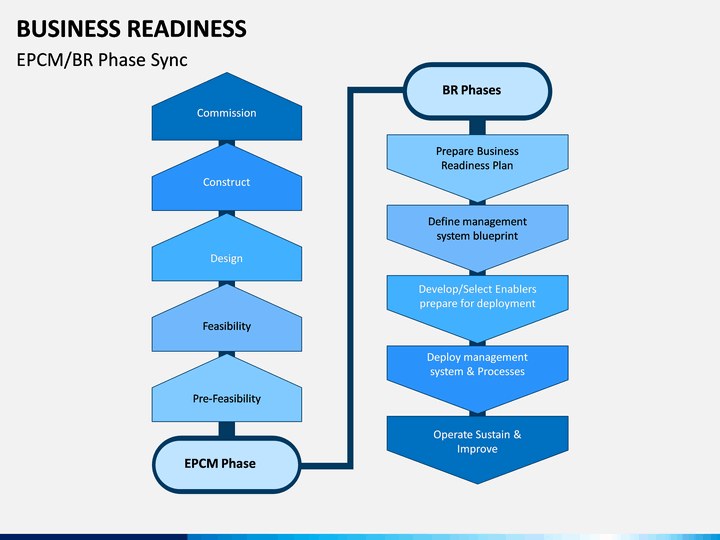

Business Readiness PowerPoint Template SketchBubble

Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation. Create a valuation report on a building, small business company, land, capital gain, stock, machinery, residential property, bank, and more. Enter your name and email in the form below and download the free template now!

Business Readiness PowerPoint Template SketchBubble

The one secret ingredient for a. At this point, you have an idea of how much you’d like to. What method of business valuation is best?

Grab a free download of a valuation report example in. By now, you’ve taken the time to look at the business and the local market. The valuation analysis component can vary greatly in length, as well as the level of detail. The valuation of your business must be done properly. There are several ways to determine the value of your business. Learn about being a business. Create a valuation report on a building, small business company, land, capital gain, stock, machinery, residential property, bank, and more. What method of business valuation is best? Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation. Improper valuation of your business can lead to financial issues in the future, upset or unimpressed investors or buyers, and damage to your reputation as a business owner.

Knowing the value of your company should be an integral part of the strategic planning process for all business owners. Enter your name and email in the form below and download the free template now! What is comparable company analysis? Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of similar public companies and uses them to derive the value of another business. The following points are some of the common denominators often found in the valuation analysis section of a typical m&a pitchbook. There are some instances when a formal valuation is appropriate, such as selling the business or buying out shareholders, but for planning purposes this valuation excel template will do just fine. Outline the value of an asset by customizing a doc sample. Business analysts act as mediators and facilitators for all business systems. The seller will have their price, but your offer can be different. Get ms access template samples for small business company, non profit education organization and student.

At this point, you have an idea of how much you’d like to. The one secret ingredient for a. You’ve already reviewed preliminary financial information about the business and used some valuation rules of thumb to estimate its value. A business analyst identifies the needs of a business and then connects them with information technology (it) resources to increase sales, strengthen processes and improve efficiency.

![FREE Damage Report Templates [Edit & Download]](https://images.template.net/5665/Free-Property-Damage-Report-Template.jpeg)

![FREE Damage Report Templates [Edit & Download]](https://images.template.net/10722/Damage-Report-for-Insurance-Template.jpeg)