Cash Reconciliation Template

Cash reconciliation template - You need to check and verify all cash transactions weekly or monthly to balance your finances. Update the bank book and enter the outstanding cheques, outstanding deposits, bank charges, etc. You receive a bank statement, typically at the end of each month, from the bank. 4 the purposes of bank reconciliation. 4.3 to be able to identify any checks which haven’t been encashed yet; 4.1 to be updated regarding your bank account balance; The statement itemizes the cash and other deposits made into the checking account of the business. To do this, a reconciliation statement known as the bank reconciliation statement is prepared. This monthly bank reconciliation template allows the user to reconcile a bank statement with current checking account records. And the template will automatically display the difference.

2 the importance of bank reconciliation; 4.2 to be able to discover problems which you may not be aware of; 4.4 to be able to. The daily cash sheet template makes sure that the user gets alerts whenever a transaction occurs. Use this bank reconciliation example template to help rectify any errors in your financial statement.

Petty Cash Reconciliation Form Template Resume Examples

4.2 to be able to discover problems which you may not be aware of; 4 the purposes of bank reconciliation. And the template will automatically display the difference.

Contractor Invoice Template (word) Dotxes

4.4 to be able to. You receive a bank statement, typically at the end of each month, from the bank. In this way, the user will be able to keep the financial record in a better way.

Cash Drawer Count Sheet Template Awesome 7 Best Daily Cash Sheet Images

The statement itemizes the cash and other deposits made into the checking account of the business. 4.2 to be able to discover problems which you may not be aware of; The daily cash sheet template makes sure that the user gets alerts whenever a transaction occurs.

6 Petty Cash Spreadsheet Template Excel SampleTemplatess

The daily cash sheet template makes sure that the user gets alerts whenever a transaction occurs. Use this bank reconciliation example template to help rectify any errors in your financial statement. Update the bank book and enter the outstanding cheques, outstanding deposits, bank charges, etc.

Statement of Cash Flows Free Excel Template

This monthly bank reconciliation template allows the user to reconcile a bank statement with current checking account records. You receive a bank statement, typically at the end of each month, from the bank. And the template will automatically display the difference.

10 Reconciliation Template Excel Excel Templates

Update the bank book and enter the outstanding cheques, outstanding deposits, bank charges, etc. 4.4 to be able to. 2 the importance of bank reconciliation;

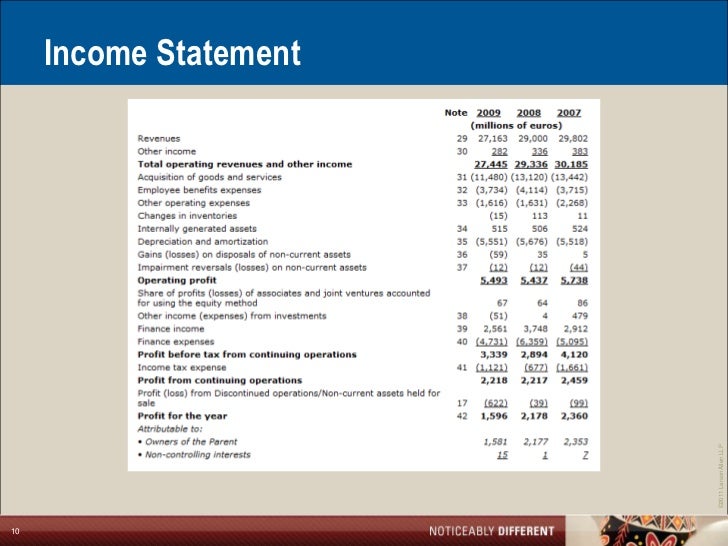

IFRS vs. GAAP

4.2 to be able to discover problems which you may not be aware of; You need to check and verify all cash transactions weekly or monthly to balance your finances. 4.4 to be able to.

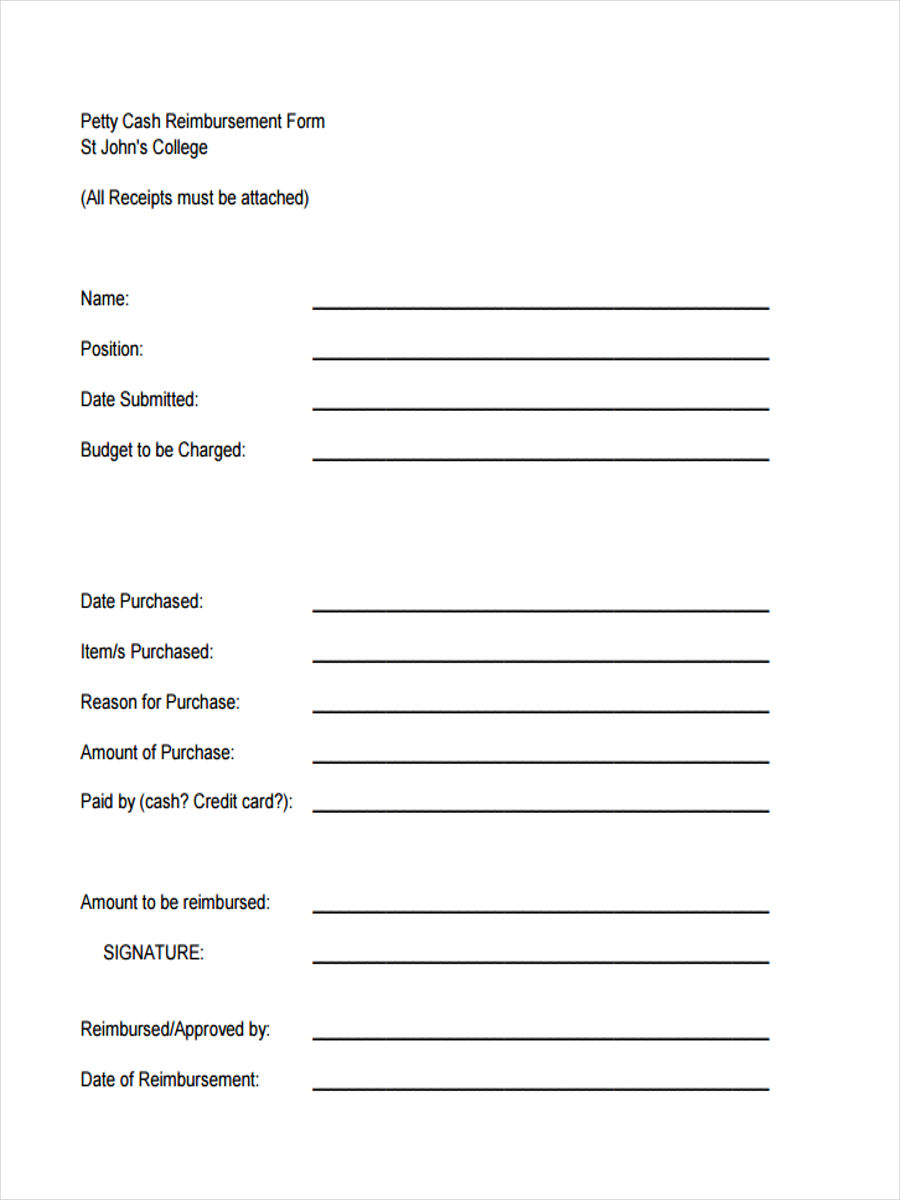

FREE 10+ Petty Cash Reimbursement Forms in PDF Ms Word Excel

You need to check and verify all cash transactions weekly or monthly to balance your finances. In this way, the user will be able to keep the financial record in a better way. You receive a bank statement, typically at the end of each month, from the bank.

4.1 to be updated regarding your bank account balance; In this way, the user will be able to keep the financial record in a better way. 4 the purposes of bank reconciliation. The daily cash sheet template makes sure that the user gets alerts whenever a transaction occurs. This monthly bank reconciliation template allows the user to reconcile a bank statement with current checking account records. 4.2 to be able to discover problems which you may not be aware of; Update the bank book and enter the outstanding cheques, outstanding deposits, bank charges, etc. 2 the importance of bank reconciliation; You need to check and verify all cash transactions weekly or monthly to balance your finances. You receive a bank statement, typically at the end of each month, from the bank.

And the template will automatically display the difference. The user is not required to hire an accounting specialist to do the job which is done by the daily cash sheet template free of cost. 4.3 to be able to identify any checks which haven’t been encashed yet; To do this, a reconciliation statement known as the bank reconciliation statement is prepared. The statement itemizes the cash and other deposits made into the checking account of the business. Use this bank reconciliation example template to help rectify any errors in your financial statement. 4.4 to be able to.