Church Budget Template

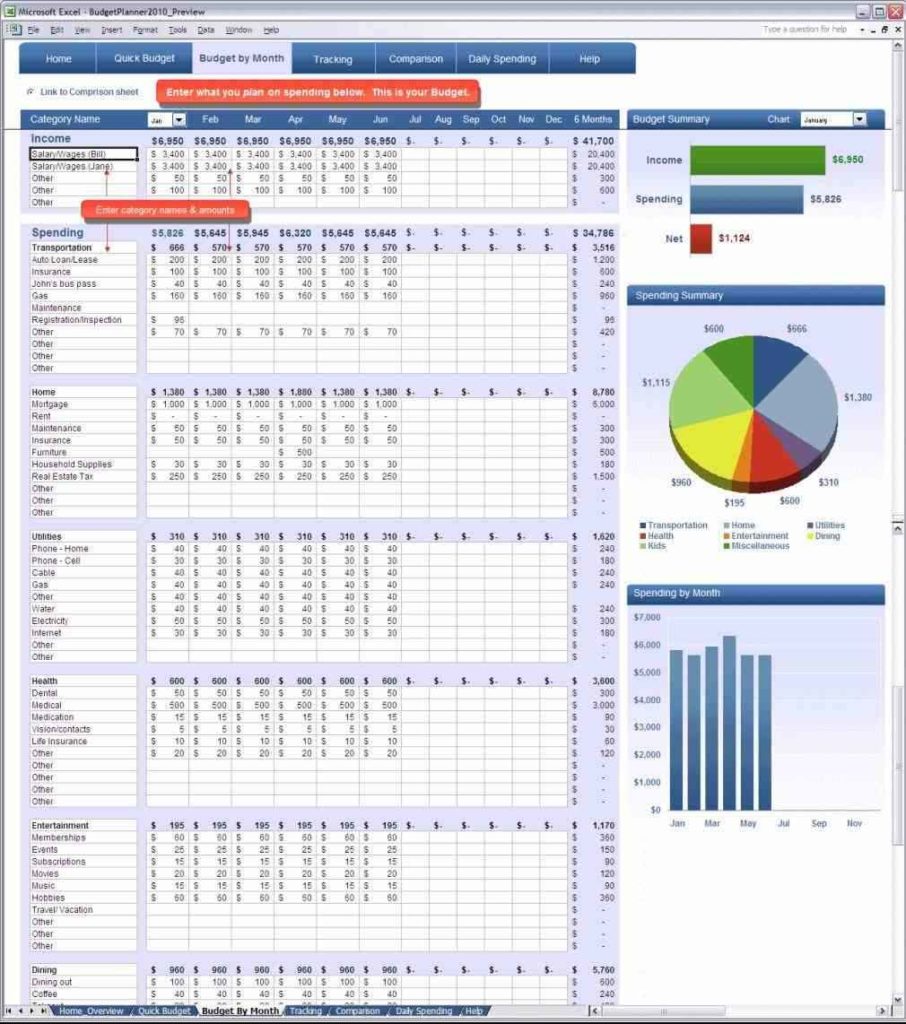

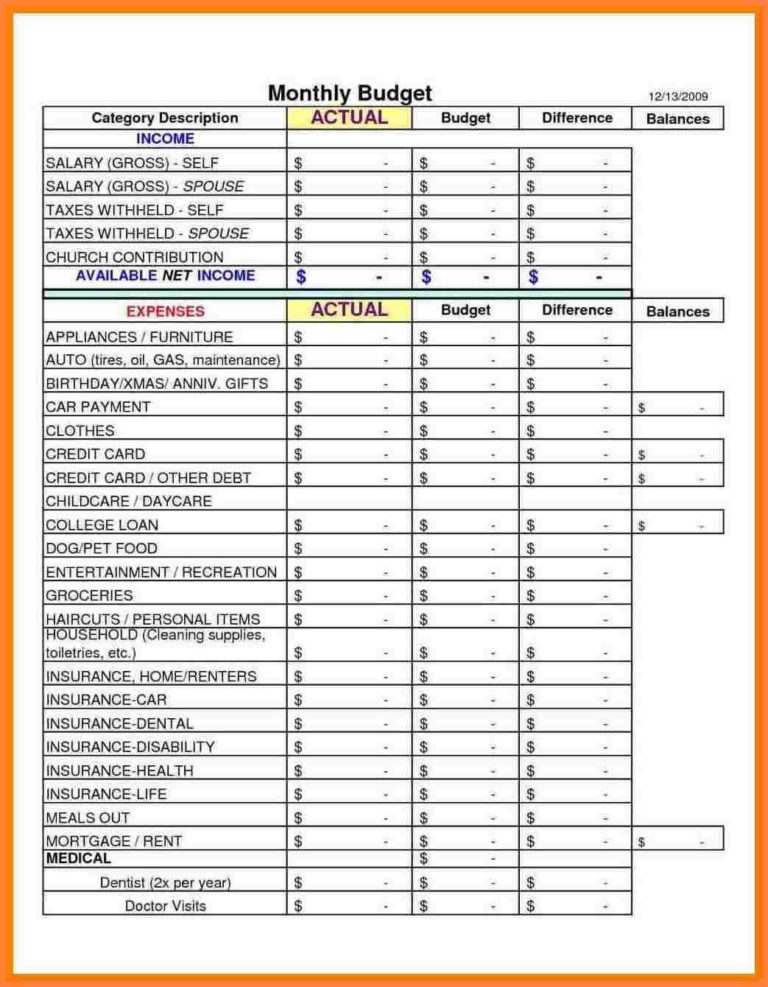

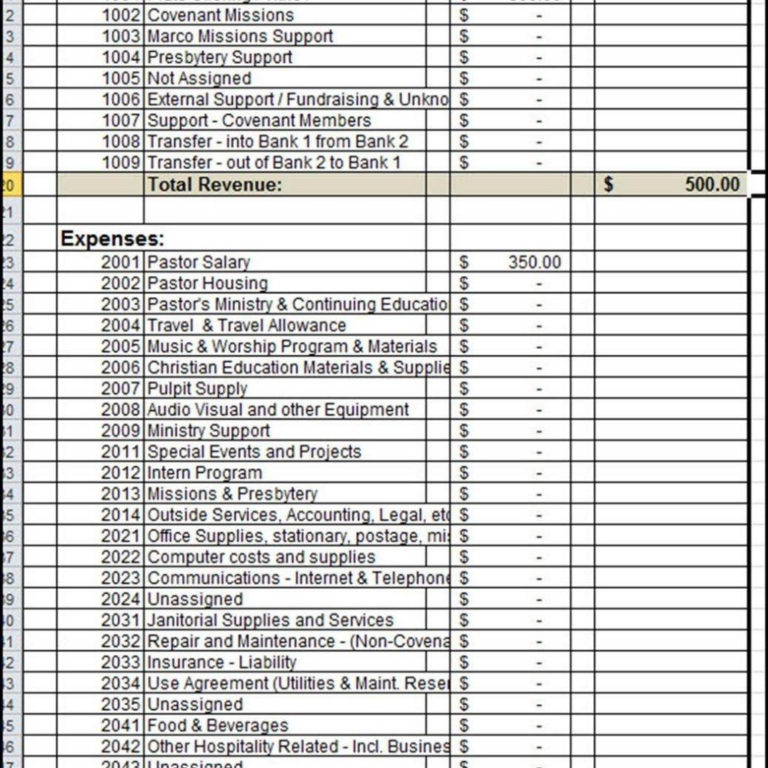

Church budget template - If your church operates solely for religious and educational purposes, your donation will qualify for the tax deduction. In most years, as long as you itemize your deductions, you can generally claim 100 percent of your church donations as a deduction. 1 summary by month report; Make life easy and browse our website today! We're offering various types of these templates. The first page lists the celebrant, the parents, wedding party, and ushers, as well as their relation to the bride and groom. 1 budget vs actual report; Church name church city, state. We’ve also included a note for guests to be made aware of happenings during the ceremony and some gentle reminders: Did your ministry assign you to report the church budget?

This can be a sticky situation for the ones who are evaluating the church employee(s) so you need to have the correct form with the correct information on it that will help determine if this employee is having problems meeting their goals/tasks, and will if not will help them meet these goals or. You can utilize them for your wedding budget, yearly budget, department budget, annual budget, renovation budget, and many more. This employee evaluation template can be used to evaluate your church employees annually. Plan for the church’s monthly and annual basic expenses, average maintaining cost, and other expense categories. However, if you are a start up or small church or nonprofit, my free accounting software downloads may be just what you are looking for.

FREE 5+ Sample Church Budget Forms in MS Word PDF

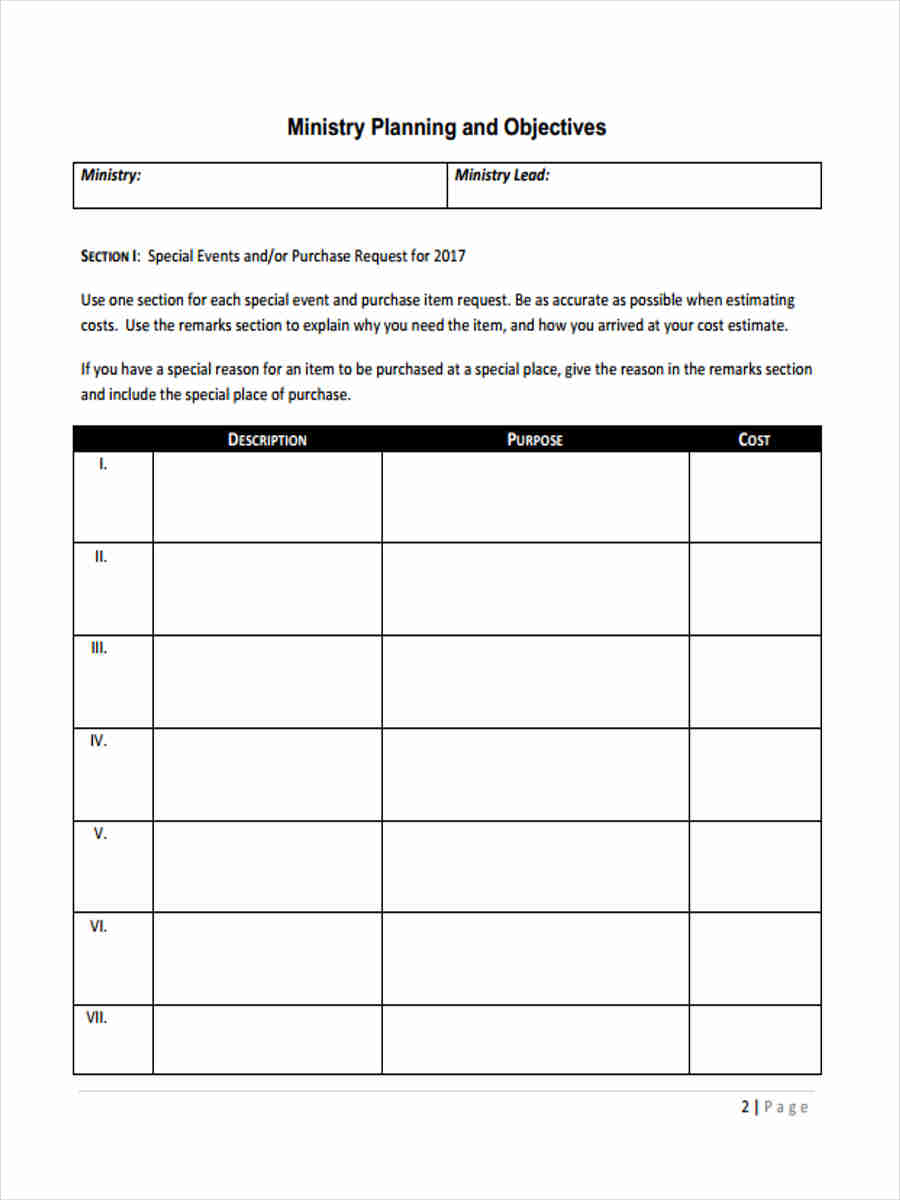

Plan for the church’s monthly and annual basic expenses, average maintaining cost, and other expense categories. We're offering various types of these templates. Did your ministry assign you to report the church budget?

Sample Church Budget Worksheet —

Plan for the church’s monthly and annual basic expenses, average maintaining cost, and other expense categories. Create it with template.net’s free sample template available in any file format like a spreadsheet. Consider using template.net's free budget templates.

Church Budget Template culturopedia

In most years, as long as you itemize your deductions, you can generally claim 100 percent of your church donations as a deduction. The first page lists the celebrant, the parents, wedding party, and ushers, as well as their relation to the bride and groom. However, if you are a start up or small church or nonprofit, my free accounting software downloads may be just what you are looking for.

Free Church Contribution Spreadsheet within Free Church Budget

The first page lists the celebrant, the parents, wedding party, and ushers, as well as their relation to the bride and groom. Consider using template.net's free budget templates. When you prepare your federal tax return, the irs allows you to deduct the donations you make to churches.

Church Tithes Spreadsheet in Free Church Tithe And Offering Spreadsheet

You can utilize them for your wedding budget, yearly budget, department budget, annual budget, renovation budget, and many more. In most years, as long as you itemize your deductions, you can generally claim 100 percent of your church donations as a deduction. We’ve also included a note for guests to be made aware of happenings during the ceremony and some gentle reminders:

FREE 9+ Budget Sheet Templates in PDF MS Word Excel

You can utilize them for your wedding budget, yearly budget, department budget, annual budget, renovation budget, and many more. Create it with template.net’s free sample template available in any file format like a spreadsheet. Did your ministry assign you to report the church budget?

Condo association Budget Template New Hoa Bud Cover Letter Budget

Consider using template.net's free budget templates. 1 budget vs actual report; The first page lists the celebrant, the parents, wedding party, and ushers, as well as their relation to the bride and groom.

10+ Church Wedding Program Examples & Templates [Download Now] Examples

We’ve also included a note for guests to be made aware of happenings during the ceremony and some gentle reminders: We're offering various types of these templates. Plan for the church’s monthly and annual basic expenses, average maintaining cost, and other expense categories.

Make life easy and browse our website today! When you prepare your federal tax return, the irs allows you to deduct the donations you make to churches. Thank you for coming to our wedding celebration. We're offering various types of these templates. You can utilize them for your wedding budget, yearly budget, department budget, annual budget, renovation budget, and many more. However, if you are a start up or small church or nonprofit, my free accounting software downloads may be just what you are looking for. If your church operates solely for religious and educational purposes, your donation will qualify for the tax deduction. We’ve also included a note for guests to be made aware of happenings during the ceremony and some gentle reminders: Plan for the church’s monthly and annual basic expenses, average maintaining cost, and other expense categories. Create it with template.net’s free sample template available in any file format like a spreadsheet.

This can be a sticky situation for the ones who are evaluating the church employee(s) so you need to have the correct form with the correct information on it that will help determine if this employee is having problems meeting their goals/tasks, and will if not will help them meet these goals or. This employee evaluation template can be used to evaluate your church employees annually. Consider using template.net's free budget templates. Church name church city, state. 1 budget vs actual report; Did your ministry assign you to report the church budget? The first page lists the celebrant, the parents, wedding party, and ushers, as well as their relation to the bride and groom. In most years, as long as you itemize your deductions, you can generally claim 100 percent of your church donations as a deduction. 1 summary by month report;

![10+ Church Wedding Program Examples & Templates [Download Now] Examples](https://images.examples.com/wp-content/uploads/2019/04/Elegant-Church-Wedding-Program.jpg)