Credit Card Debt Payoff Printable

Credit card debt payoff printable - Which repayment strategy will cost the least and get me out of debt the fastest? Keep all your credit card numbers and contact information here so you know what was paid, when it was paid, and where the money was sent. How long until i pay off my credit card debt using a variety of payment strategies? Effective ways to pay off credit card debt faster. The federal reserve bank states that the total credit card debt reached $1.088 in october 2019. This is a debt payoff printable that will simply allow you to track your payments. You’ll enter the date, the exact debt (credit card, student loan, etc), the amount paid, and the amount left to goal. If you have credit card debt, you’re one of thousands of americans struggling to clear their balance. Debt snowball calculator template excel is a debt lessening procedure, whereby one who owes on more than one record pays off the records beginning with the littlest adjusts in the first place, while paying the base installment on bigger obligations.once the littlest obligation is paid off, one continues to the following somewhat bigger little obligation over that, et cetera,. Free credit card payoff spreadsheet (get out of debt in 2022!!) how do you create a debt spreadsheet?

You can either use it on a monthly basis or keep a running log for the year. Don’t forget what you spend at restaurants when you consider your food budget. Credit unions in the united states served 100 million members, comprising 43.7% of the economically active population, in 2014. Get your debt snowball rolling. Guide published by jose abuyuan on january 13, 2020.

Debt Payment Plan Printable Debt payoff plan, Credit card debt payoff

List all of your debts smallest to largest, and use this sheet to mark them off one. The federal reserve bank states that the total credit card debt reached $1.088 in october 2019. If you have credit card debt, you’re one of thousands of americans struggling to clear their balance.

Credit Card Debt Payoff Tracker Printable Etsy Credit card debt

Now, let’s discuss the two. Don’t forget what you spend at restaurants when you consider your food budget. Get help navigating a divorce from beginning to end with advice on how to file, a guide to the forms you might need, and more.

FREE Debt Payoff Tracker Printables The Little Frugal House

Keep all your credit card numbers and contact information here so you know what was paid, when it was paid, and where the money was sent. Debt snowball calculator template excel is a debt lessening procedure, whereby one who owes on more than one record pays off the records beginning with the littlest adjusts in the first place, while paying the base installment on bigger obligations.once the littlest obligation is paid off, one continues to the following somewhat bigger little obligation over that, et cetera,. Credit unions in the united states served 100 million members, comprising 43.7% of the economically active population, in 2014.

Debt Tracker Printable Yearly Monthly Debt Goal Payoff Etsy

Which repayment strategy will cost the least and get me out of debt the fastest? Keep all your credit card numbers and contact information here so you know what was paid, when it was paid, and where the money was sent. How long until i pay off my credit card debt using a variety of payment strategies?

Free budget printables, Finance

Free credit card payoff spreadsheet (get out of debt in 2022!!) how do you create a debt spreadsheet? So you’re ready to jump in and pay off your debts. Which repayment strategy will cost the least and get me out of debt the fastest?

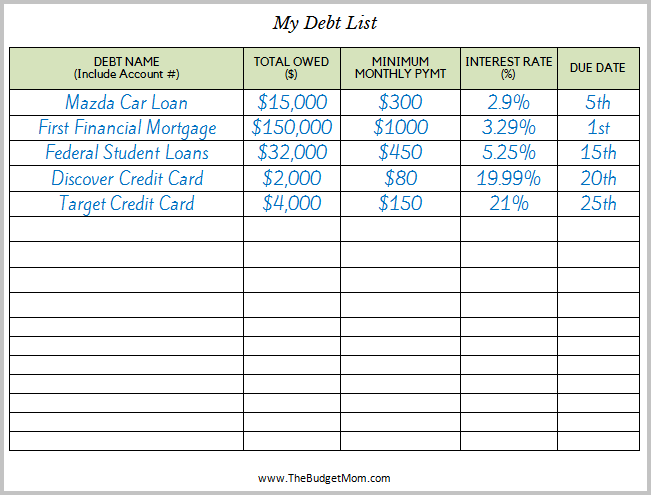

How to Create a Plan to Pay Off Debt The Budget Mom

Guide published by jose abuyuan on january 13, 2020. Don’t forget what you spend at restaurants when you consider your food budget. It’s time to get organized and put all your debts down on paper or in an excel spreadsheet.

printable debt snowball form Google Search Credit card payoff plan

Get help navigating a divorce from beginning to end with advice on how to file, a guide to the forms you might need, and more. The federal reserve bank states that the total credit card debt reached $1.088 in october 2019. Keep all your credit card numbers and contact information here so you know what was paid, when it was paid, and where the money was sent.

Debt Repayment Printables Simply Stacie

You can either use it on a monthly basis or keep a running log for the year. Get help navigating a divorce from beginning to end with advice on how to file, a guide to the forms you might need, and more. Now, let’s discuss the two.

Keep all your credit card numbers and contact information here so you know what was paid, when it was paid, and where the money was sent. Guide published by jose abuyuan on january 13, 2020. Effective ways to pay off credit card debt faster. Get help navigating a divorce from beginning to end with advice on how to file, a guide to the forms you might need, and more. How long until i pay off my credit card debt using a variety of payment strategies? Credit unions in the united states served 100 million members, comprising 43.7% of the economically active population, in 2014. You can either use it on a monthly basis or keep a running log for the year. You’ll enter the date, the exact debt (credit card, student loan, etc), the amount paid, and the amount left to goal. Get help navigating a divorce from beginning to end with advice on how to file, a guide to the forms you might need, and more. Free credit card payoff spreadsheet (get out of debt in 2022!!) how do you create a debt spreadsheet?

Debt snowball calculator template excel is a debt lessening procedure, whereby one who owes on more than one record pays off the records beginning with the littlest adjusts in the first place, while paying the base installment on bigger obligations.once the littlest obligation is paid off, one continues to the following somewhat bigger little obligation over that, et cetera,. If you have credit card debt, you’re one of thousands of americans struggling to clear their balance. So you’re ready to jump in and pay off your debts. List all of your debts smallest to largest, and use this sheet to mark them off one. This is a debt payoff printable that will simply allow you to track your payments. Get your debt snowball rolling. Credit card payment calculator : Don’t forget what you spend at restaurants when you consider your food budget. The federal reserve bank states that the total credit card debt reached $1.088 in october 2019. It’s time to get organized and put all your debts down on paper or in an excel spreadsheet.

That’s an increase of 8.8 percent from. Which repayment strategy will cost the least and get me out of debt the fastest? The clients of the credit unions become partners of the financial institution and their presence focuses in certain neighborhoods because they center their services in one. Now, let’s discuss the two. You’ve got to know… what debts you actually have