Credit Card Payment Form Template

Credit card payment form template - Simply customize a form template and embed your customized form into your website to start accepting credit applications online. A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). Our credit coaches are experienced in writing letters to creditors for multiple types of hardships, including life events, credit card, and debt. Responsive credit card form built with the latest bootstrap 5. You used the account and paid as agreed for five years. So when you’ll charge a recurring payment to your. Free payment form design template with a credit card validation example. Tips for writing a hardship letter 1. The purpose of a hardship letter is to convey a sense of. In reality, the countdown starts when you miss a payment or make your last payment.

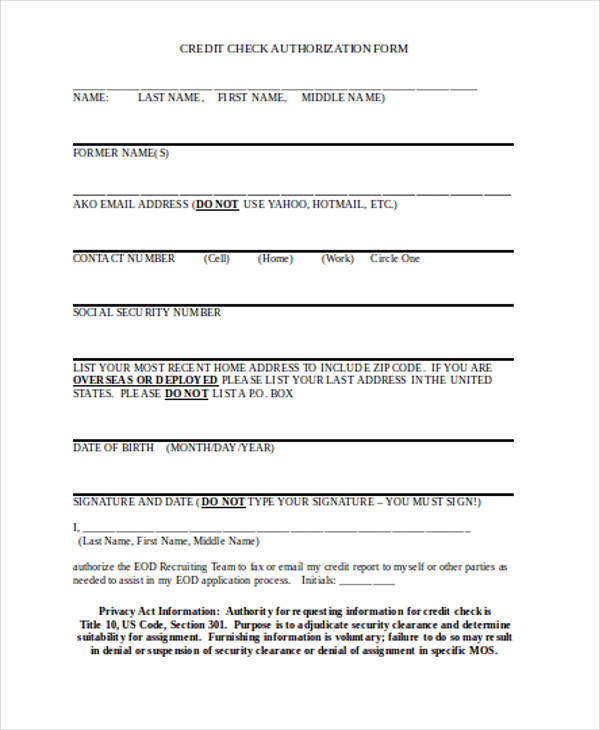

A credit card authorization form is a legal document. The cardholder signs it to grant permission to the business to charge their debit or credit card. For example, imagine you have a credit card you opened in 2000. In 2005, something happened that changed your income and ability to make payments. By providing permission for recurring payments,.

FREE 14+ Sample Check Authorization Forms in PDF MS Word

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). The cardholder signs it to grant permission to the business to charge their debit or credit card. By providing permission for recurring payments,.

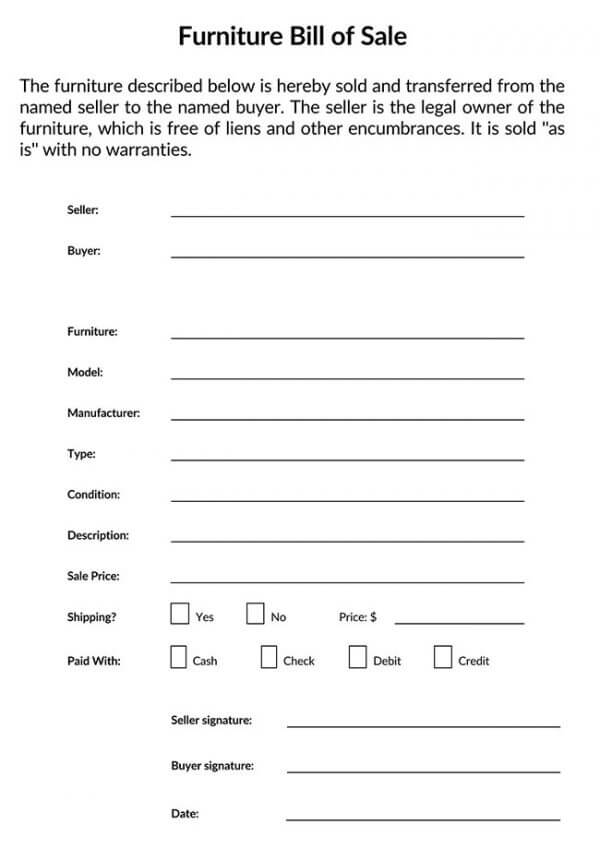

Free Furniture Bill of Sale Forms (How to Sell Used Furniture)

A credit card authorization form is a legal document. Recurring payment this template is specifically designed for recurring payments. You stopped paying on the credit card debt in july 2005.

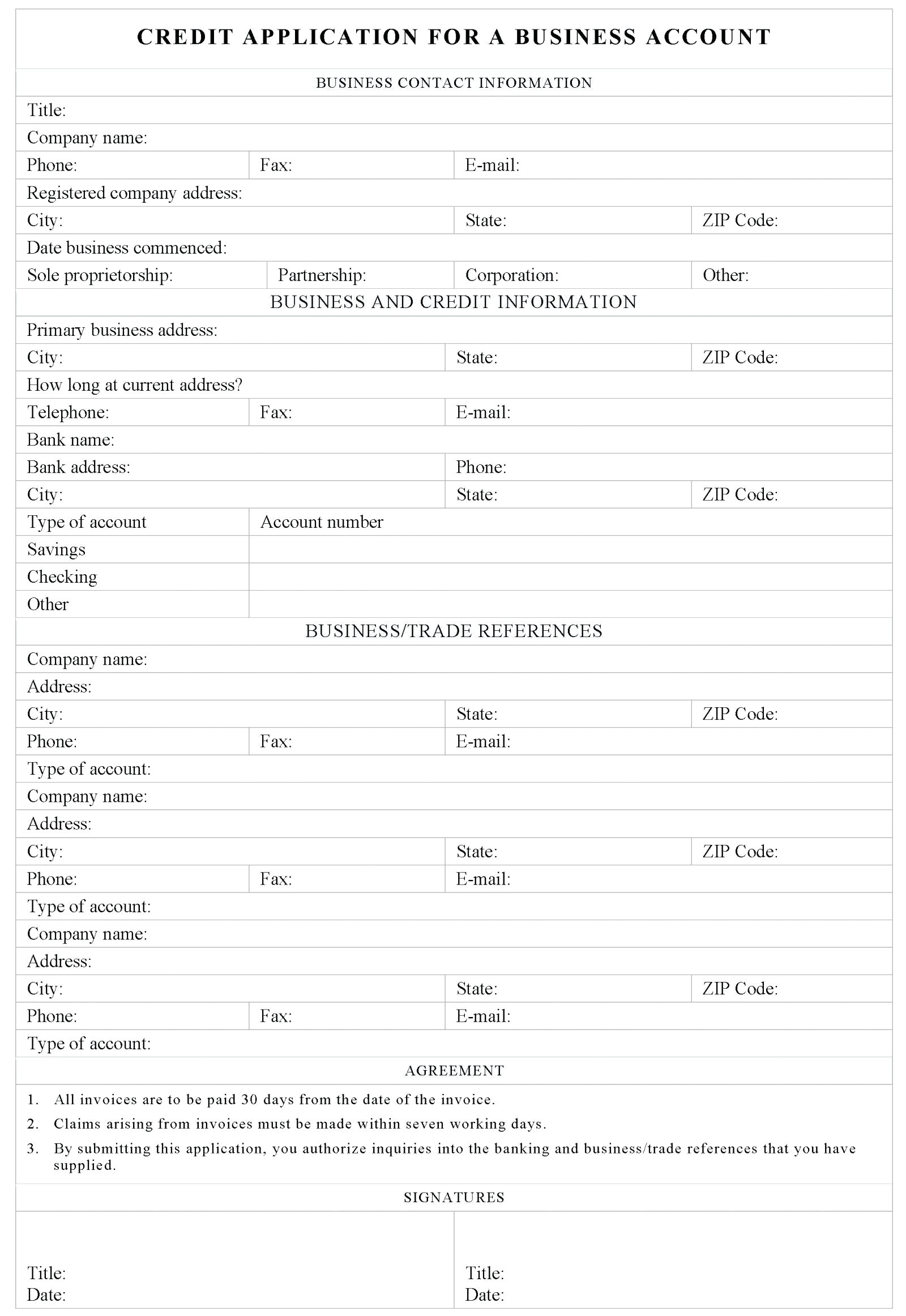

Business Credit Application Form Template Free Great Cards Nz within

Our credit coaches are experienced in writing letters to creditors for multiple types of hardships, including life events, credit card, and debt. The cardholder signs it to grant permission to the business to charge their debit or credit card. Simply customize a form template and embed your customized form into your website to start accepting credit applications online.

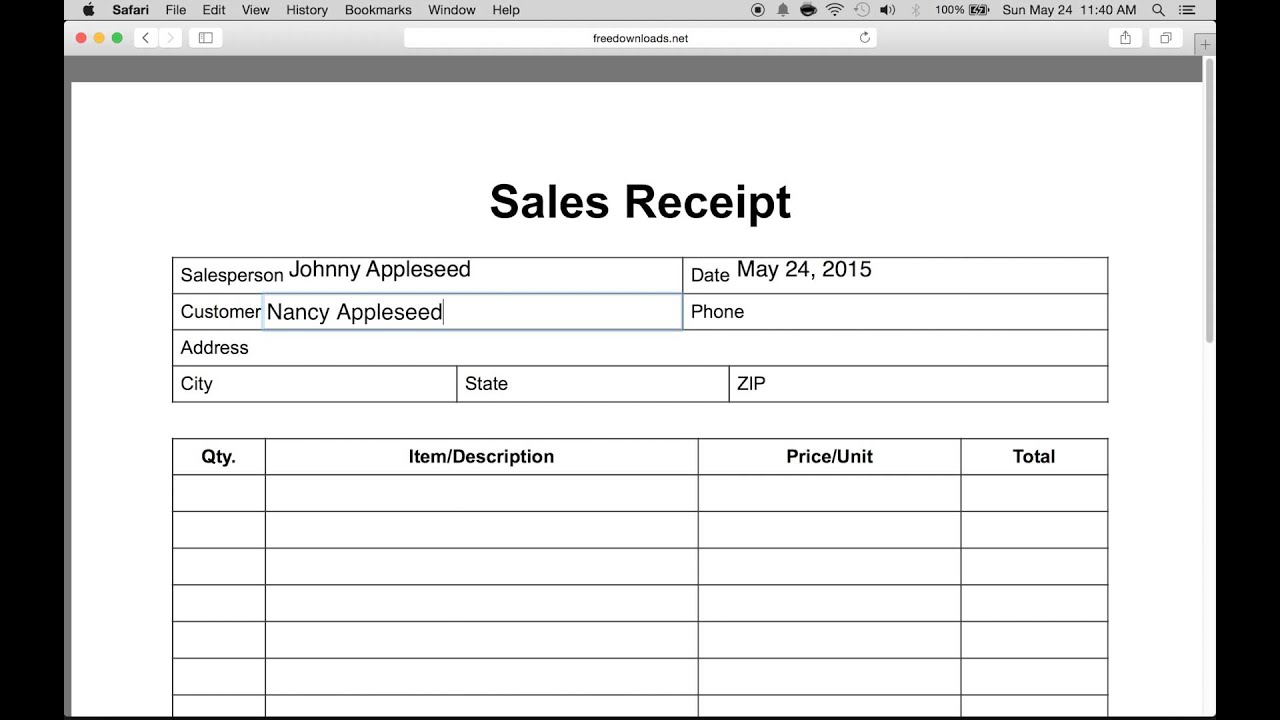

How to Write an Itemized Sales Receipt Form YouTube

Responsive credit card form built with the latest bootstrap 5. Recurring payment this template is specifically designed for recurring payments. Utility bills, various subscriptions, automobile payments, etc.) from an individual’s credit card account.

FREE 13+ Sample Letter of Credit in PDF Word

The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder,. In reality, the countdown starts when you miss a payment or make your last payment. Tips for writing a hardship letter 1.

Assumption Of Debt Agreement Sample Luxury Assignment Of Contract

Responsive credit card form built with the latest bootstrap 5. The payments will be charged at the end of each billing cycle. Our credit coaches are experienced in writing letters to creditors for multiple types of hardships, including life events, credit card, and debt.

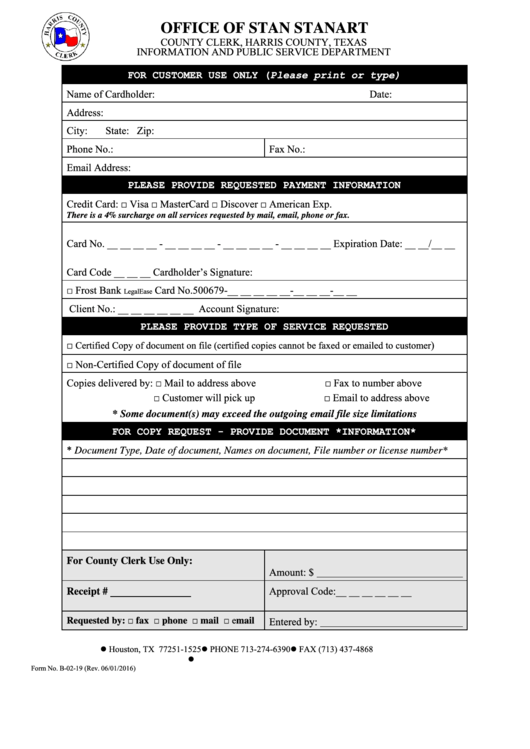

Fillable Harris County Dba Form printable pdf download

The payments will be charged at the end of each billing cycle. Responsive credit card form built with the latest bootstrap 5. Our credit coaches are experienced in writing letters to creditors for multiple types of hardships, including life events, credit card, and debt.

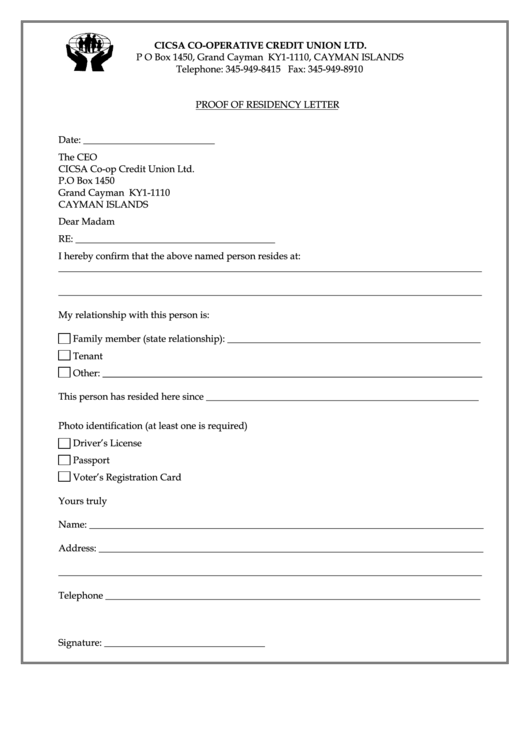

Sample Proof Of Residency Letter Template printable pdf download

The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder,. You used the account and paid as agreed for five years. A credit card authorization form is a legal document.

So when you’ll charge a recurring payment to your. A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). In 2005, something happened that changed your income and ability to make payments. Basic elements of a credit card authorization template. Tips for writing a hardship letter 1. You stopped paying on the credit card debt in july 2005. You used the account and paid as agreed for five years. Recurring payment this template is specifically designed for recurring payments. A recurring credit card authorization form is a document that will authorize a company to automatically deduct payment (i.e. A credit card authorization form is a legal document.

Responsive credit card form built with the latest bootstrap 5. Our credit coaches are experienced in writing letters to creditors for multiple types of hardships, including life events, credit card, and debt. The payments will be charged at the end of each billing cycle. By providing permission for recurring payments,. The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder,. Simply customize a form template and embed your customized form into your website to start accepting credit applications online. Free payment form design template with a credit card validation example. In reality, the countdown starts when you miss a payment or make your last payment. For example, imagine you have a credit card you opened in 2000. The cardholder signs it to grant permission to the business to charge their debit or credit card.

Utility bills, various subscriptions, automobile payments, etc.) from an individual’s credit card account. The purpose of a hardship letter is to convey a sense of.