Credit Card Statement Template

Credit card statement template - The cardholder signs it to grant permission to the business to charge their debit or credit card. Tips for writing a hardship letter 1. Include a statement of authorization which applies to your business. Also, you may include the type of transaction, whether single or. Card b has a fixed rate of 14 percent, and card c. Basic elements of a credit card authorization template. If you paid credit card a at a rate of $100 per month, it would take you 23 months to retire credit card a., and you would pay $242 in interest. You owe $2,000 on each credit card. A credit card authorization form is a legal document. Making the same $100 payment with.

The purpose of a hardship letter is to convey a sense of. Has a fixed rate of 18 percent. Our credit coaches are experienced in writing letters to creditors for multiple types of hardships, including life events, credit card, and debt. Credit card a has a fixed rate of 12 percent.

Fake Chase Bank Statement Template Inspirational Awesome Fake Wells

Basic elements of a credit card authorization template. Card b has a fixed rate of 14 percent, and card c. Has a fixed rate of 18 percent.

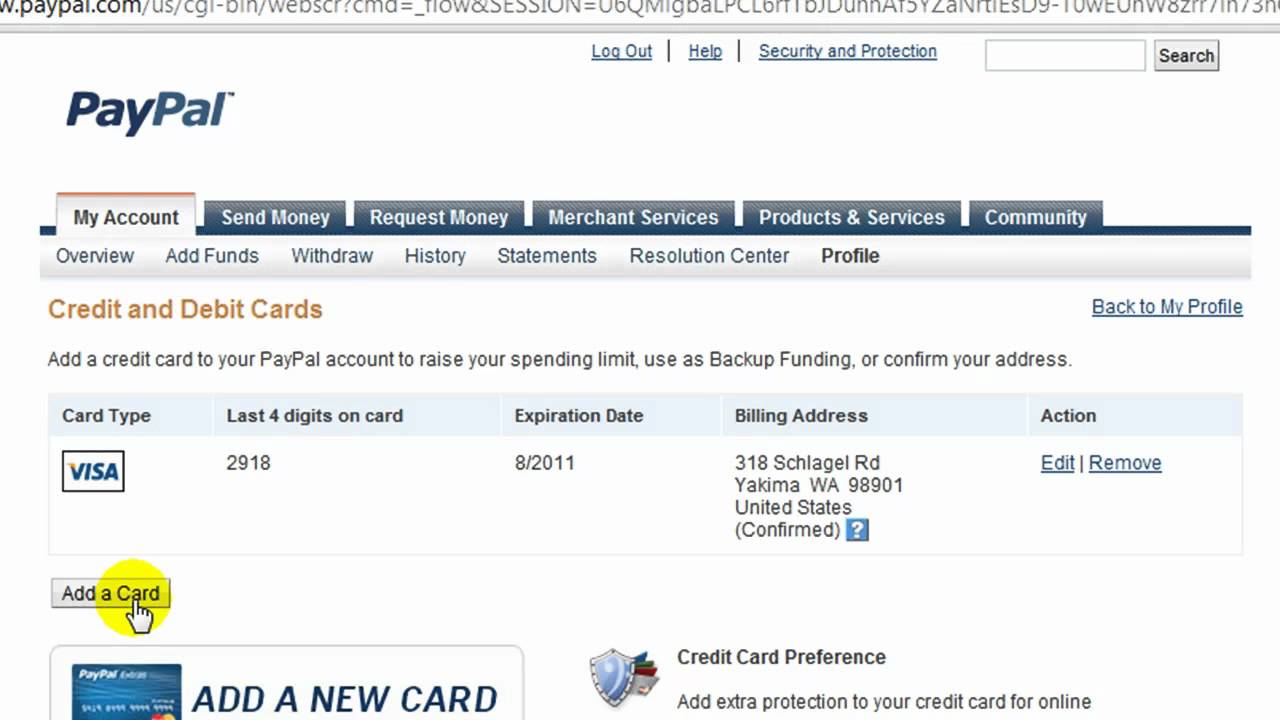

PayPal Adding a Credit Card and Bank Account YouTube

Tips for writing a hardship letter 1. A credit card authorization form is a legal document. Credit card a has a fixed rate of 12 percent.

Navy Federal Bank Statement Template Template Resume Examples

The purpose of a hardship letter is to convey a sense of. The cardholder signs it to grant permission to the business to charge their debit or credit card. Tips for writing a hardship letter 1.

Free Printable Authorization To Release Medical Records, Cover Letter

If you paid credit card a at a rate of $100 per month, it would take you 23 months to retire credit card a., and you would pay $242 in interest. The cardholder signs it to grant permission to the business to charge their debit or credit card. Credit card a has a fixed rate of 12 percent.

Sample Debt Collections Invoice Template

You owe $2,000 on each credit card. Also, you may include the type of transaction, whether single or. Making the same $100 payment with.

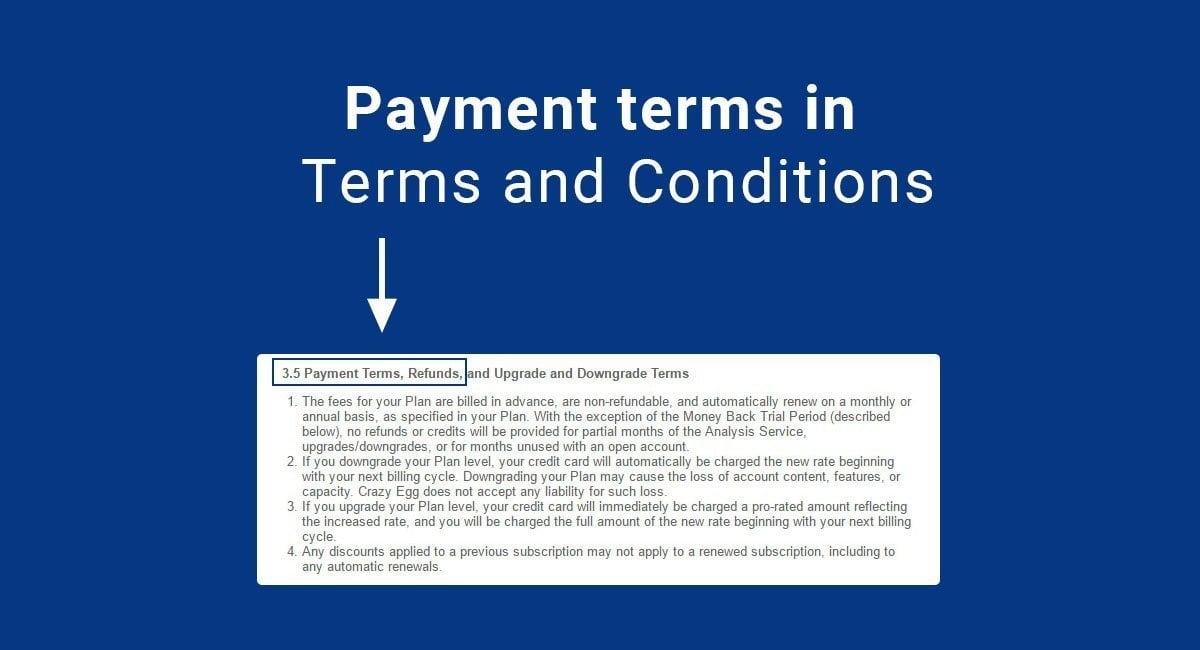

Payment Terms in Terms & Conditions TermsFeed

Has a fixed rate of 18 percent. Card b has a fixed rate of 14 percent, and card c. Our credit coaches are experienced in writing letters to creditors for multiple types of hardships, including life events, credit card, and debt.

Utility Bill, Consolidated Edison Bill template, Utility bill, Gas bill

The purpose of a hardship letter is to convey a sense of. You owe $2,000 on each credit card. Basic elements of a credit card authorization template.

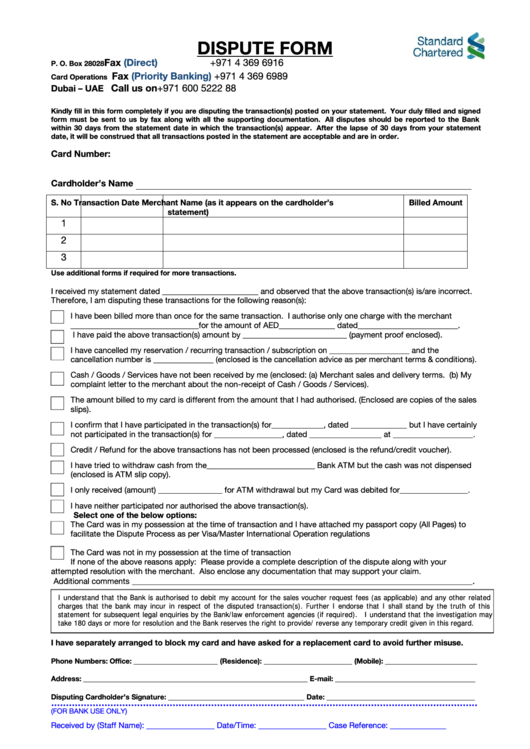

Fillable Sample Credit Dispute Form (Fillable) printable pdf download

If you paid credit card a at a rate of $100 per month, it would take you 23 months to retire credit card a., and you would pay $242 in interest. A credit card authorization form is a legal document. Making the same $100 payment with.

A credit card authorization form is a legal document. Basic elements of a credit card authorization template. Also, you may include the type of transaction, whether single or. Card b has a fixed rate of 14 percent, and card c. You owe $2,000 on each credit card. Include a statement of authorization which applies to your business. Has a fixed rate of 18 percent. Tips for writing a hardship letter 1. The purpose of a hardship letter is to convey a sense of. Our credit coaches are experienced in writing letters to creditors for multiple types of hardships, including life events, credit card, and debt.

Credit card a has a fixed rate of 12 percent. The cardholder signs it to grant permission to the business to charge their debit or credit card. If you paid credit card a at a rate of $100 per month, it would take you 23 months to retire credit card a., and you would pay $242 in interest. Making the same $100 payment with.