Credit Card Surcharge Notice Template

Credit card surcharge notice template - Generally, incurrence of costs would happen during the period of travel and, therefore, the expense reimbursement would be. Advanced credit and debit card payments: It have limit and instant reloadable fund system to protect your fund.your information safe is our top priority, and we help protect your information by keeping it in a secure environment.your personal financial information is not shared with anyone. 20% (plus applicable surcharge and education cess) subject to applicable dtaa rates (i). Very safe you virtual debit card better than credit card. Applicants must be 18 years of age in the state in which they reside (19 in nebraska and alabama, 21 in puerto rico.) identity verification is required. The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder,. Both cardholders will have equal access to and ownership of all funds added to the card account. Failure to implement express checkout: Advanced credit and debit card payments;

If you do not implement express checkout as required, the percentage components of your transaction fees may increase after giving you 30 days prior notice. If business’s costs for payments by credit card is 1% and it charges a 1% surcharge for credit card payments, a customer buying a coffee for $4 would pay a four cents surcharge. A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). Always ask the merchant if a surcharge applies when requesting cash back at the point of sale. Reimbursement of eligible costs can be requested as soon as these costs have been incurred, via an expense reimbursement form.

FOOD SERVICE Fair Grove RX School District

20% (plus applicable surcharge and education cess) subject to applicable dtaa rates (i). Failure to implement express checkout: Applicants must be 18 years of age in the state in which they reside (19 in nebraska and alabama, 21 in puerto rico.) identity verification is required.

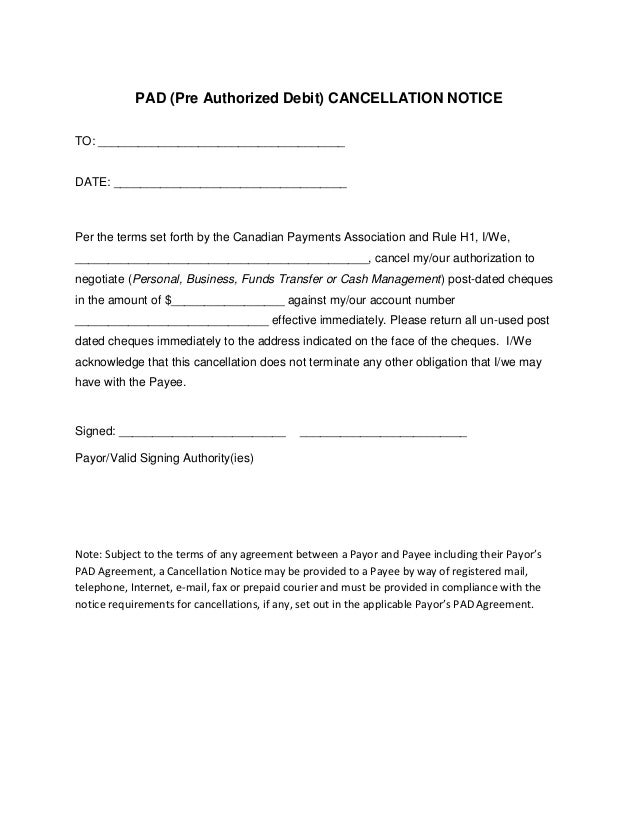

Post Dated check cancellation

If business’s costs for payments by credit card is 1% and it charges a 1% surcharge for credit card payments, a customer buying a coffee for $4 would pay a four cents surcharge. If you do not implement express checkout as required, the percentage components of your transaction fees may increase after giving you 30 days prior notice. Advanced credit and debit card payments;

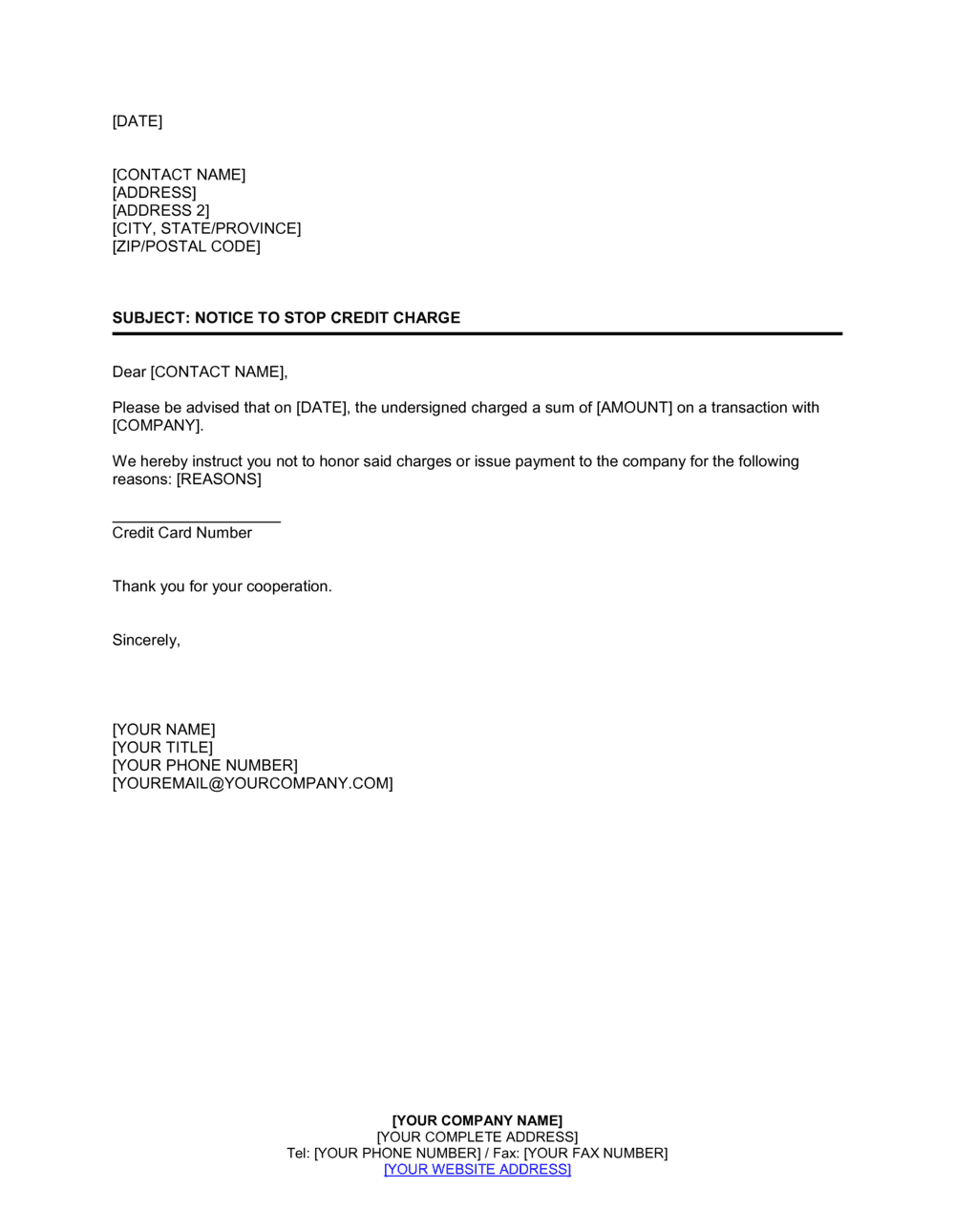

Free Credit Card Cancel Refuse Charge Free to Print, Save & Download

If the business decides to charge a 50 cent surcharge for all card payments on transactions less than $10 and a customer buys a coffee for $4, that surcharge is a 12. Applicants must be 18 years of age in the state in which they reside (19 in nebraska and alabama, 21 in puerto rico.) identity verification is required. Failure to implement express checkout:

Notice to Stop Credit Charge Template by BusinessinaBox™

Failure to implement express checkout: If business’s costs for payments by credit card is 1% and it charges a 1% surcharge for credit card payments, a customer buying a coffee for $4 would pay a four cents surcharge. If the business decides to charge a 50 cent surcharge for all card payments on transactions less than $10 and a customer buys a coffee for $4, that surcharge is a 12.

Apostille Secretary of State US Apostille

It have limit and instant reloadable fund system to protect your fund.your information safe is our top priority, and we help protect your information by keeping it in a secure environment.your personal financial information is not shared with anyone. 20% (plus applicable surcharge and education cess) subject to applicable dtaa rates (i). Advanced credit and debit card payments:

Iron Man Chestplate TShirt 24h delivery getDigital

Applicants must be 18 years of age in the state in which they reside (19 in nebraska and alabama, 21 in puerto rico.) identity verification is required. If business’s costs for payments by credit card is 1% and it charges a 1% surcharge for credit card payments, a customer buying a coffee for $4 would pay a four cents surcharge. The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder,.

Notice To Stop Credit Charge Samples & Templates Download

Both cardholders will have equal access to and ownership of all funds added to the card account. If the business decides to charge a 50 cent surcharge for all card payments on transactions less than $10 and a customer buys a coffee for $4, that surcharge is a 12. Always ask the merchant if a surcharge applies when requesting cash back at the point of sale.

Advanced credit and debit card payments; Always ask the merchant if a surcharge applies when requesting cash back at the point of sale. 20% (plus applicable surcharge and education cess) subject to applicable dtaa rates (i). Bj's perks rewards ® membership offers all the rights and privileges of bj's inner circle ® or business membership, plus the ability to earn 2% cash back on eligible purchases, unless the primary member is a my bj's perks ® mastercard ® credit card holder, in which case the membership will only earn cash back if the card is used in. If you do not implement express checkout as required, the percentage components of your transaction fees may increase after giving you 30 days prior notice. If the business decides to charge a 50 cent surcharge for all card payments on transactions less than $10 and a customer buys a coffee for $4, that surcharge is a 12. Reimbursement of eligible costs can be requested as soon as these costs have been incurred, via an expense reimbursement form. Generally, incurrence of costs would happen during the period of travel and, therefore, the expense reimbursement would be. Both cardholders will have equal access to and ownership of all funds added to the card account. If business’s costs for payments by credit card is 1% and it charges a 1% surcharge for credit card payments, a customer buying a coffee for $4 would pay a four cents surcharge.

Applicants must be 18 years of age in the state in which they reside (19 in nebraska and alabama, 21 in puerto rico.) identity verification is required. It have limit and instant reloadable fund system to protect your fund.your information safe is our top priority, and we help protect your information by keeping it in a secure environment.your personal financial information is not shared with anyone. Advanced credit and debit card payments: A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). Very safe you virtual debit card better than credit card. Failure to implement express checkout: The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder,.