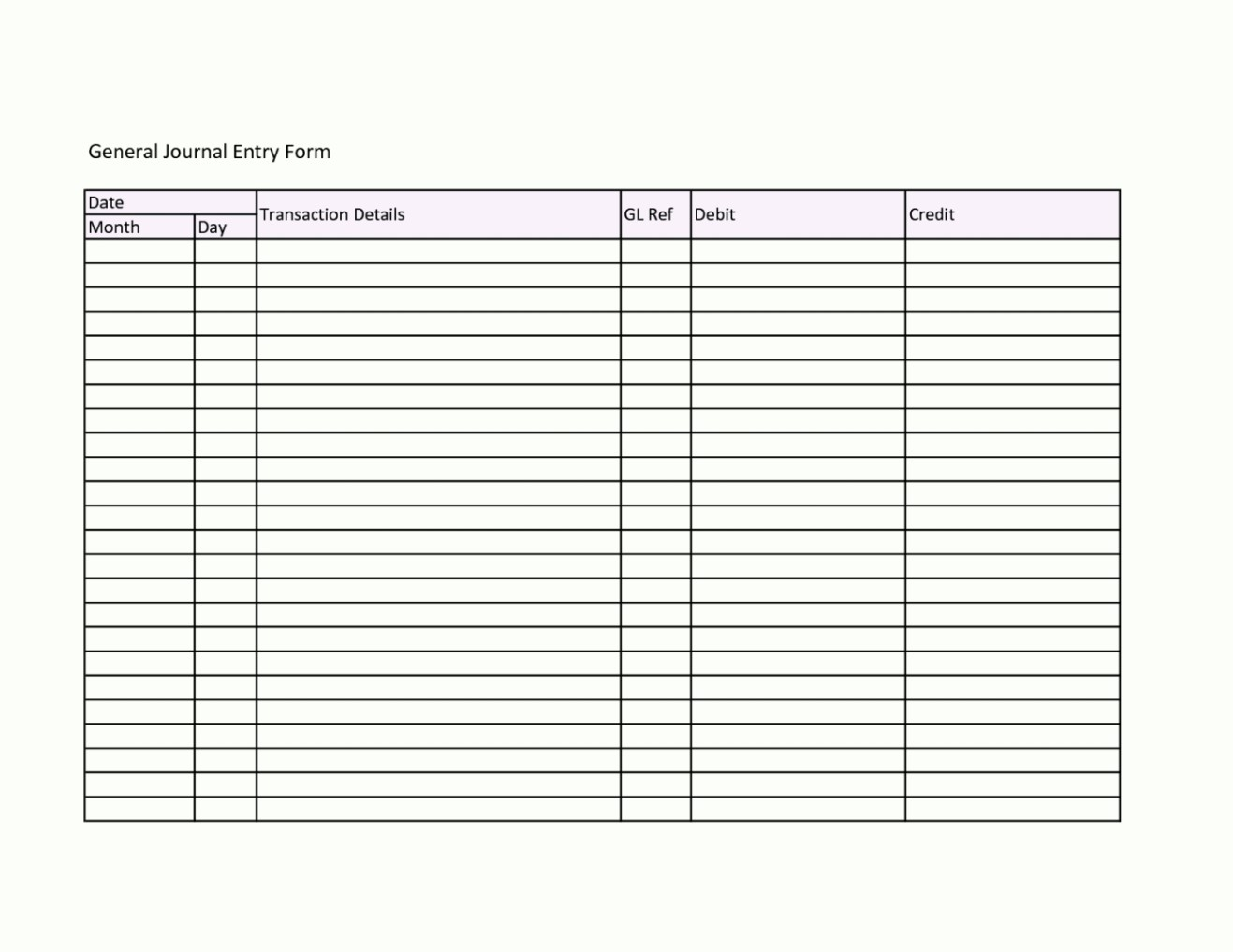

Double Entry Journal Template

Double entry journal template - A journal entry is a record of the business transactions in the accounting books of a business. The consignment inventory accounting journal represents the transfer of inventory from the normal inventory account to a separate consignment inventory account. The inventory is still the property of the consignor, and no entry is made by the consignee. For example, if a business takes out a $5,000 loan, the cash (asset) account is debited to $5,000 and the outstanding debt (liability) account is credited $5000. Set to yes , and record your receipts. A debit to one account and a credit to another. No entry is made by the consignee. A properly documented journal entry consists of the correct date, amounts to be debited and credited, description of the transaction and a unique reference number. In this case, the receipt vouchers appear in the single entry mode. If you want to set a default account for all your receipt vouchers, you can create a voucher type with the option enable default accounting allocation?

A tutorial on DoubleEntry Bookkeeping and

For example, if a business takes out a $5,000 loan, the cash (asset) account is debited to $5,000 and the outstanding debt (liability) account is credited $5000. In this case, the receipt vouchers appear in the single entry mode. The inventory is still the property of the consignor, and no entry is made by the consignee.

Accounting Journal Template Excel —

The consignment inventory accounting journal represents the transfer of inventory from the normal inventory account to a separate consignment inventory account. A journal entry is a record of the business transactions in the accounting books of a business. Set to yes , and record your receipts.

Pin by Shanah Martin on Scrapy Diary template, Journal template

The consignment inventory accounting journal represents the transfer of inventory from the normal inventory account to a separate consignment inventory account. A properly documented journal entry consists of the correct date, amounts to be debited and credited, description of the transaction and a unique reference number. For example, if a business takes out a $5,000 loan, the cash (asset) account is debited to $5,000 and the outstanding debt (liability) account is credited $5000.

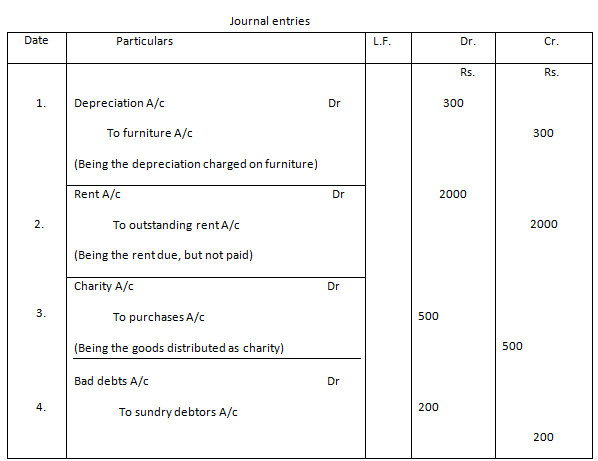

What is Journal Entry? Example of Journal Entry

In this case, the receipt vouchers appear in the single entry mode. The inventory is still the property of the consignor, and no entry is made by the consignee. The consignment inventory accounting journal represents the transfer of inventory from the normal inventory account to a separate consignment inventory account.

Payroll Journal Entry for QuickBooks Online ASAP Help Center

If you want to set a default account for all your receipt vouchers, you can create a voucher type with the option enable default accounting allocation? A journal entry is a record of the business transactions in the accounting books of a business. In this case, the receipt vouchers appear in the single entry mode.

Job Cost Record Template Double Entry Bookkeeping

A properly documented journal entry consists of the correct date, amounts to be debited and credited, description of the transaction and a unique reference number. A debit to one account and a credit to another. The consignment inventory accounting journal represents the transfer of inventory from the normal inventory account to a separate consignment inventory account.

Accounting Exercises Post Sales Journal to the General Ledger

The inventory is still the property of the consignor, and no entry is made by the consignee. Set to yes , and record your receipts. For example, if a business takes out a $5,000 loan, the cash (asset) account is debited to $5,000 and the outstanding debt (liability) account is credited $5000.

The consignment inventory accounting journal represents the transfer of inventory from the normal inventory account to a separate consignment inventory account. A properly documented journal entry consists of the correct date, amounts to be debited and credited, description of the transaction and a unique reference number. For example, if a business takes out a $5,000 loan, the cash (asset) account is debited to $5,000 and the outstanding debt (liability) account is credited $5000. No entry is made by the consignee. A journal entry is a record of the business transactions in the accounting books of a business. If you want to set a default account for all your receipt vouchers, you can create a voucher type with the option enable default accounting allocation? Set to yes , and record your receipts. In this case, the receipt vouchers appear in the single entry mode. A debit to one account and a credit to another. The inventory is still the property of the consignor, and no entry is made by the consignee.