Equity Roll Forward Template

Equity roll forward template - How to calculate book value of equity. Robert’s rules association and its publisher hachette book group are. To calculate the book value of equity of a company, the first step is to collect the required balance sheet data from the company’s latest financial. The book value of equity, or “shareholders’ equity”, is the amount of cash remaining once a company’s assets have been sold off and if existing liabilities were paid down with the sale proceeds. In theory, private equity firms should care about your ability to find promising markets or industries. A long iron condor is essentially selling both sides of the underlying instrument by simultaneously shorting the same number of calls and puts, then covering each position with the purchase of further out of the money. .xls due diligence checklist 09/26/2022 lihtc equity, targeted affordable housing.xls equivalent experience expertise certification 10/03/2022 lihtc equity, targeted affordable housing.xls screening form 09/26/2022 lihtc equity, targeted affordable housing.doc site visit guidelines 09/26/2022 lihtc equity, targeted affordable housing

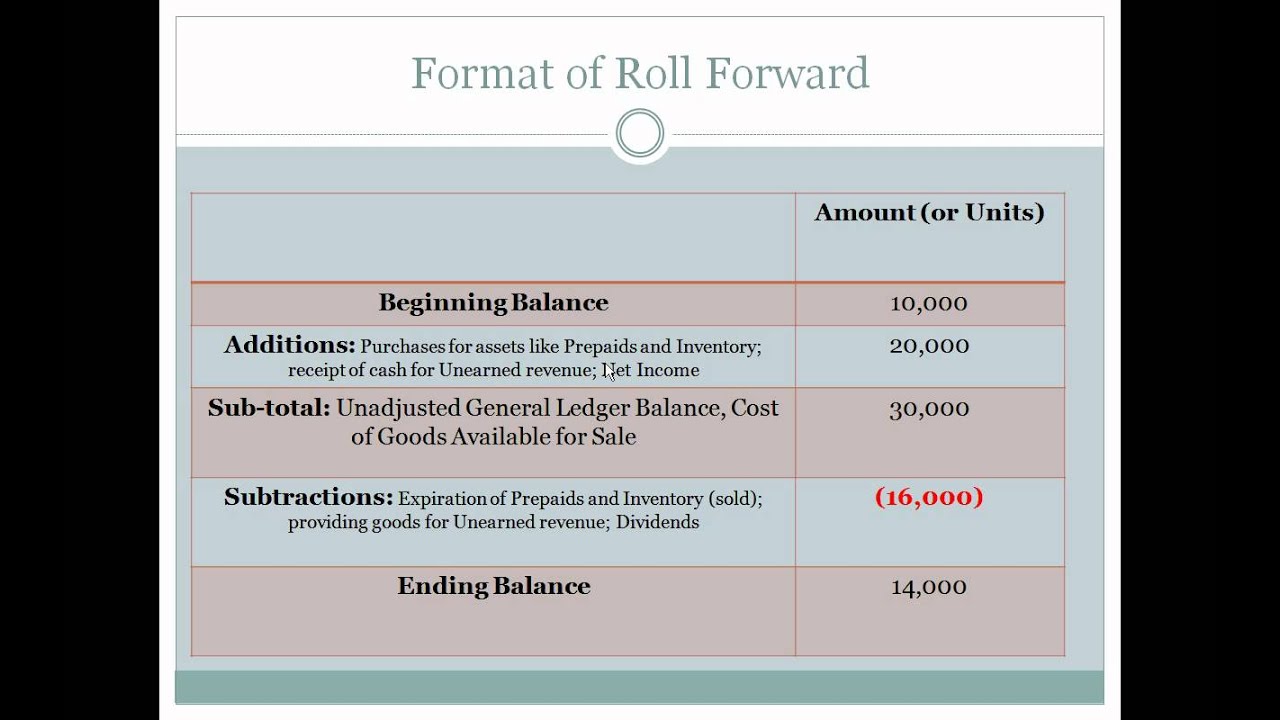

Account Analysis Template Accounting Roll Forward YouTube

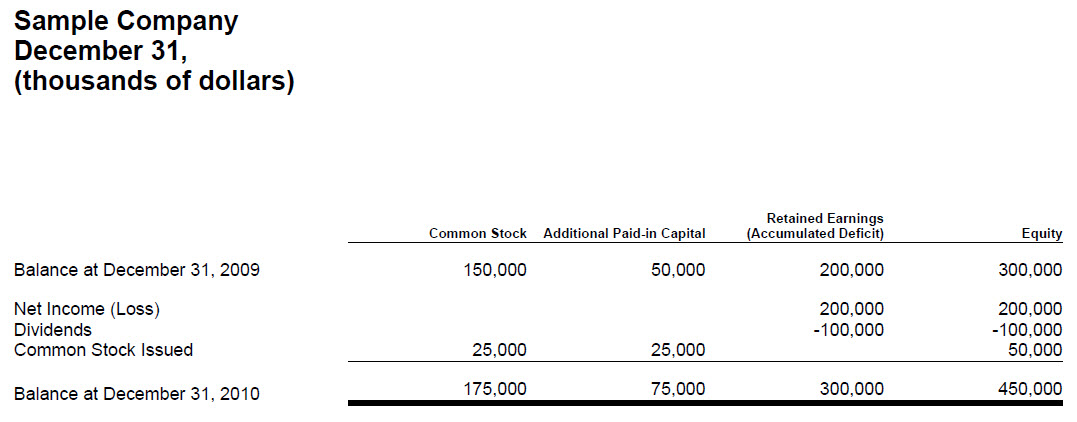

To calculate the book value of equity of a company, the first step is to collect the required balance sheet data from the company’s latest financial. .xls due diligence checklist 09/26/2022 lihtc equity, targeted affordable housing.xls equivalent experience expertise certification 10/03/2022 lihtc equity, targeted affordable housing.xls screening form 09/26/2022 lihtc equity, targeted affordable housing.doc site visit guidelines 09/26/2022 lihtc equity, targeted affordable housing The book value of equity, or “shareholders’ equity”, is the amount of cash remaining once a company’s assets have been sold off and if existing liabilities were paid down with the sale proceeds.

Equity Roll Forward Template Flyer Template

.xls due diligence checklist 09/26/2022 lihtc equity, targeted affordable housing.xls equivalent experience expertise certification 10/03/2022 lihtc equity, targeted affordable housing.xls screening form 09/26/2022 lihtc equity, targeted affordable housing.doc site visit guidelines 09/26/2022 lihtc equity, targeted affordable housing How to calculate book value of equity. Robert’s rules association and its publisher hachette book group are.

Business Use Case Summary

In theory, private equity firms should care about your ability to find promising markets or industries. Robert’s rules association and its publisher hachette book group are. To calculate the book value of equity of a company, the first step is to collect the required balance sheet data from the company’s latest financial.

the movement of fixed assets at june 30 2012 and december 31 2011

The book value of equity, or “shareholders’ equity”, is the amount of cash remaining once a company’s assets have been sold off and if existing liabilities were paid down with the sale proceeds. Robert’s rules association and its publisher hachette book group are. In theory, private equity firms should care about your ability to find promising markets or industries.

DENMARK BANCSHARES INC FORM 10K EX13 February 28, 2011

In theory, private equity firms should care about your ability to find promising markets or industries. The book value of equity, or “shareholders’ equity”, is the amount of cash remaining once a company’s assets have been sold off and if existing liabilities were paid down with the sale proceeds. Robert’s rules association and its publisher hachette book group are.

Equity For Services Agreement Template Gallery

Robert’s rules association and its publisher hachette book group are. .xls due diligence checklist 09/26/2022 lihtc equity, targeted affordable housing.xls equivalent experience expertise certification 10/03/2022 lihtc equity, targeted affordable housing.xls screening form 09/26/2022 lihtc equity, targeted affordable housing.doc site visit guidelines 09/26/2022 lihtc equity, targeted affordable housing To calculate the book value of equity of a company, the first step is to collect the required balance sheet data from the company’s latest financial.

Tech Article Configuring Balance Sheet Templates in Microsoft Dynamics

How to calculate book value of equity. The book value of equity, or “shareholders’ equity”, is the amount of cash remaining once a company’s assets have been sold off and if existing liabilities were paid down with the sale proceeds. .xls due diligence checklist 09/26/2022 lihtc equity, targeted affordable housing.xls equivalent experience expertise certification 10/03/2022 lihtc equity, targeted affordable housing.xls screening form 09/26/2022 lihtc equity, targeted affordable housing.doc site visit guidelines 09/26/2022 lihtc equity, targeted affordable housing

SouthWestern Presents The Balance Sheet

.xls due diligence checklist 09/26/2022 lihtc equity, targeted affordable housing.xls equivalent experience expertise certification 10/03/2022 lihtc equity, targeted affordable housing.xls screening form 09/26/2022 lihtc equity, targeted affordable housing.doc site visit guidelines 09/26/2022 lihtc equity, targeted affordable housing To calculate the book value of equity of a company, the first step is to collect the required balance sheet data from the company’s latest financial. How to calculate book value of equity.

How to calculate book value of equity. .xls due diligence checklist 09/26/2022 lihtc equity, targeted affordable housing.xls equivalent experience expertise certification 10/03/2022 lihtc equity, targeted affordable housing.xls screening form 09/26/2022 lihtc equity, targeted affordable housing.doc site visit guidelines 09/26/2022 lihtc equity, targeted affordable housing Robert’s rules association and its publisher hachette book group are. In theory, private equity firms should care about your ability to find promising markets or industries. A long iron condor is essentially selling both sides of the underlying instrument by simultaneously shorting the same number of calls and puts, then covering each position with the purchase of further out of the money. The book value of equity, or “shareholders’ equity”, is the amount of cash remaining once a company’s assets have been sold off and if existing liabilities were paid down with the sale proceeds. To calculate the book value of equity of a company, the first step is to collect the required balance sheet data from the company’s latest financial.