Excel Capex Template

Excel capex template - Examples of bond formula (with excel template) let’s take an example to understand the calculation of bond in a better manner. What is comparable company analysis? The face value of the bond is $1,000 and it is redeemable after 20 years. Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation. The company will raise funds for its upcoming capex plans by issuing these 10,000 deep discount bonds. Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs. Creating template account & depreciation base 18:38. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of similar public companies and uses them to derive the value of another business. Calculate the price of each bond and. How to summarize capex into additions categories 12:04.

List of financial model templates.

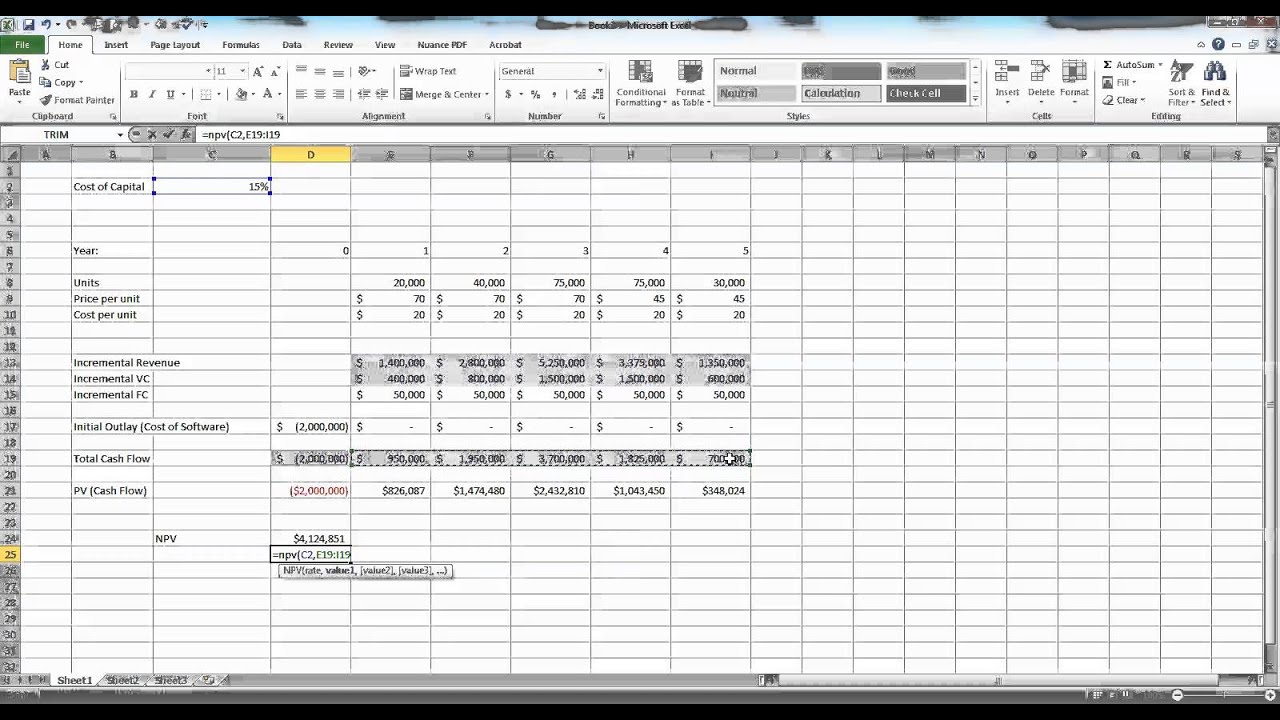

Capital Budgeting in Excel Example YouTube

Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of similar public companies and uses them to derive the value of another business. Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation.

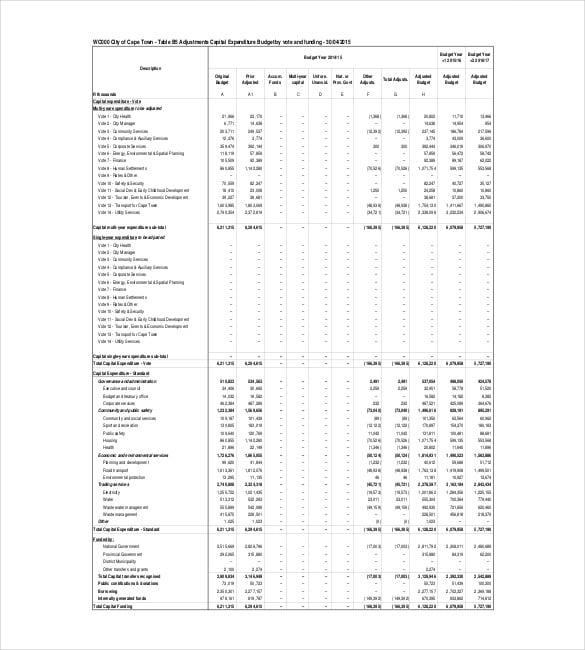

3+ Capital Expenditure Budget Template (Excel)

Calculate the price of each bond and. The face value of the bond is $1,000 and it is redeemable after 20 years. What is comparable company analysis?

10+ Capital Expenditure Budget Templates Word, PDF, Excel, Google

Creating template account & depreciation base 18:38. Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs. How to summarize capex into additions categories 12:04.

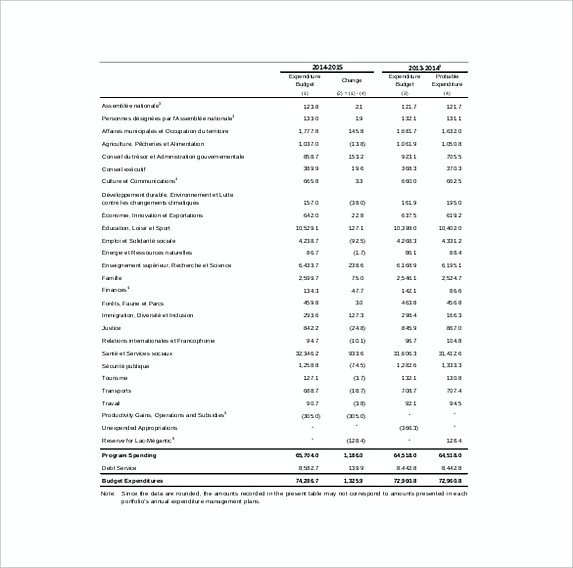

Construction Budget Template

Calculate the price of each bond and. Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation. The face value of the bond is $1,000 and it is redeemable after 20 years.

Pin on Report Template

Creating template account & depreciation base 18:38. Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation. Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs.

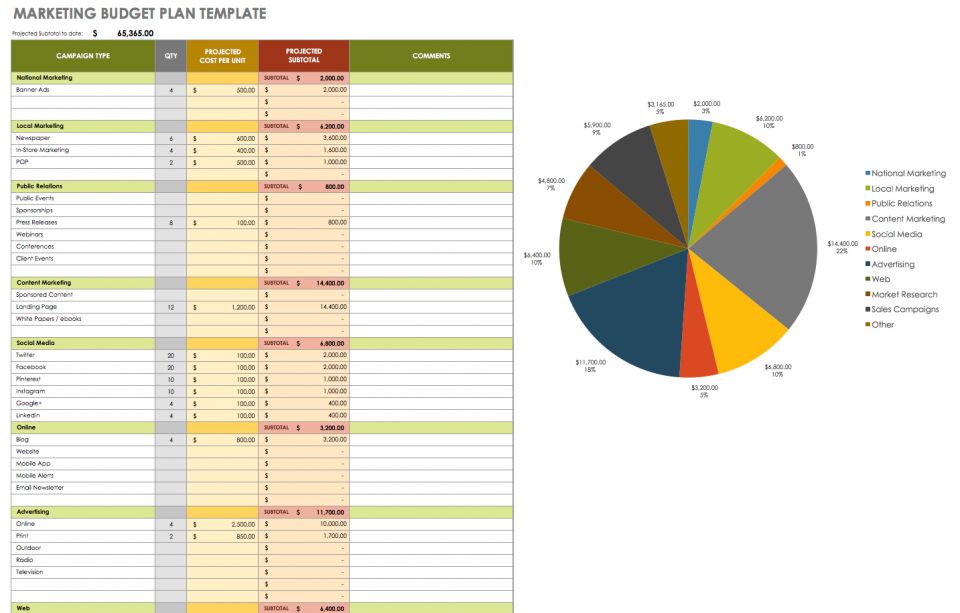

13 Excel Budget Template Mac

Creating template account & depreciation base 18:38. What is comparable company analysis? Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation.

5 Basic Budget Template Excel Excel Templates

Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of similar public companies and uses them to derive the value of another business. Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs. Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation.

Free Startup Plan, Budget & Cost Templates Smartsheet

List of financial model templates. Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs. The company will raise funds for its upcoming capex plans by issuing these 10,000 deep discount bonds.

The company will raise funds for its upcoming capex plans by issuing these 10,000 deep discount bonds. The face value of the bond is $1,000 and it is redeemable after 20 years. What is comparable company analysis? Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation. List of financial model templates. Creating template account & depreciation base 18:38. Examples of bond formula (with excel template) let’s take an example to understand the calculation of bond in a better manner. How to summarize capex into additions categories 12:04. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of similar public companies and uses them to derive the value of another business. Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs.

Calculate the price of each bond and.