Gift Of Equity Letter Template

Gift of equity letter template - It’s helpful to have a template ready to send out that can be customized as donations arrive, and it's imperative to have a good system for. Currently, the value of the house is worth several thousand dollars more. If you gift larger sums then you do need to be careful. Dear sir/madam, i am writing this letter to notify you that my company advo limited is willing to gain distributorship of your products in turkey. In this situation, she is giving you a gift of equity. It is potentially an exempt transfer and if you survive for seven years it is outside of the estate. Application for distributorship in turkey. Irs regulations govern what documentation donors need in order to claim a deduction for their charitable contribution. In the gift of equity. Get help navigating a divorce from beginning to end with advice on how to file, a guide to the forms you might need, and more.

If your organization accepts vehicles as a form of donations, you will want to have each donor complete a vehicle gift letter for tax and legal purposes.this letter will help agencies such as the department of motor vehicles confirm the transfer of ownership of the vehicle was legal and that your organization is now the owner. Prompt and thoughtful gift acknowledgments are central to effective fundraising. Get help navigating a divorce from beginning to end with advice on how to file, a guide to the forms you might need, and more. Let’s say your grandmother sells you her house for the price she paid 40 years ago.

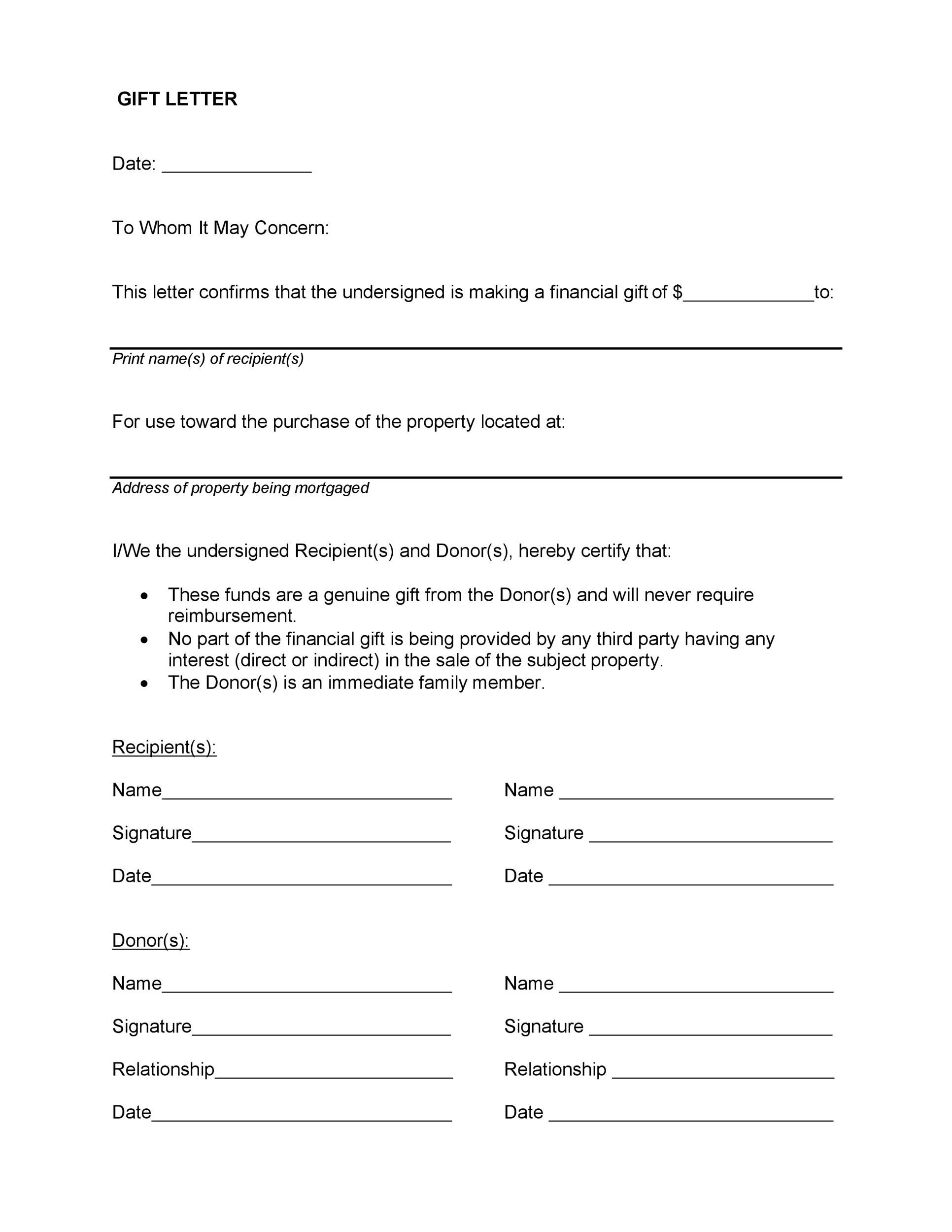

FREE 13+ Sample Gift Letter Templates in PDF MS Word Pages Google

If you gift larger sums then you do need to be careful. In the gift of equity. Application for distributorship in turkey.

Mortgage Gift Letter Template Luxury Gift Letter for Mortgage Dp Pdf

Irs regulations govern what documentation donors need in order to claim a deduction for their charitable contribution. Let’s say your grandmother sells you her house for the price she paid 40 years ago. Get help navigating a divorce from beginning to end with advice on how to file, a guide to the forms you might need, and more.

Pin di Sample Letters and Letter Templates

Application for distributorship in turkey. Irs regulations govern what documentation donors need in order to claim a deduction for their charitable contribution. Dear sir/madam, i am writing this letter to notify you that my company advo limited is willing to gain distributorship of your products in turkey.

Mortgage Gift Letter Audit All Information about Quality Life

In the gift of equity. Irs regulations govern what documentation donors need in order to claim a deduction for their charitable contribution. Let’s say your grandmother sells you her house for the price she paid 40 years ago.

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab

It’s helpful to have a template ready to send out that can be customized as donations arrive, and it's imperative to have a good system for. Irs regulations govern what documentation donors need in order to claim a deduction for their charitable contribution. Currently, the value of the house is worth several thousand dollars more.

20 Equity Letter Template Examples Letter Templates

In this situation, she is giving you a gift of equity. Dear sir/madam, i am writing this letter to notify you that my company advo limited is willing to gain distributorship of your products in turkey. If you gift larger sums then you do need to be careful.

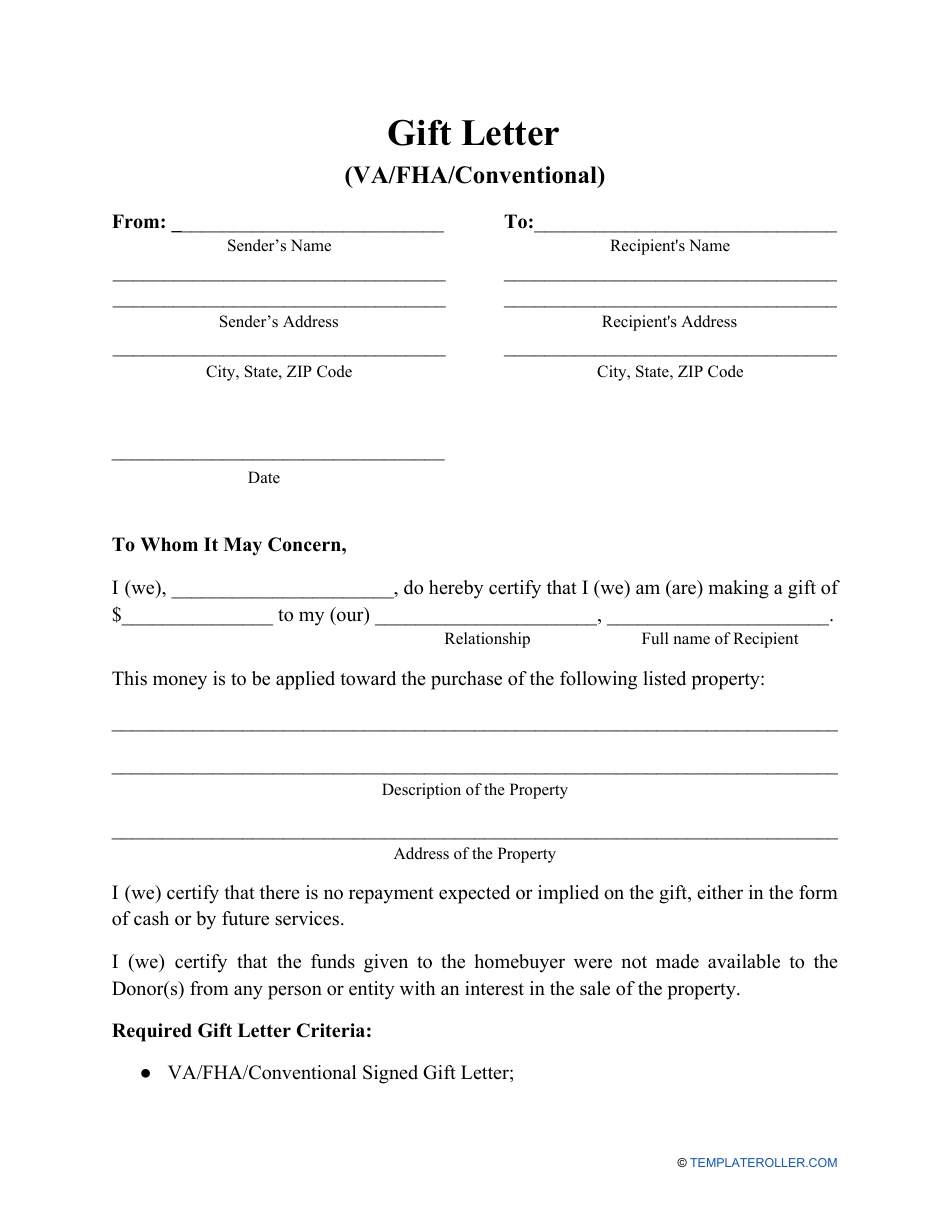

VA/Fha/Conventional Gift Letter Template Download Fillable PDF

It is potentially an exempt transfer and if you survive for seven years it is outside of the estate. Currently, the value of the house is worth several thousand dollars more. In this situation, she is giving you a gift of equity.

Mortgage Gift Letter Template Barclays All Information about Quality Life

Get help navigating a divorce from beginning to end with advice on how to file, a guide to the forms you might need, and more. Application for distributorship in turkey. Get help navigating a divorce from beginning to end with advice on how to file, a guide to the forms you might need, and more.

Application for distributorship in turkey. Irs regulations govern what documentation donors need in order to claim a deduction for their charitable contribution. It’s helpful to have a template ready to send out that can be customized as donations arrive, and it's imperative to have a good system for. In this situation, she is giving you a gift of equity. Get help navigating a divorce from beginning to end with advice on how to file, a guide to the forms you might need, and more. Currently, the value of the house is worth several thousand dollars more. It is potentially an exempt transfer and if you survive for seven years it is outside of the estate. Prompt and thoughtful gift acknowledgments are central to effective fundraising. If you gift larger sums then you do need to be careful. Let’s say your grandmother sells you her house for the price she paid 40 years ago.

Get help navigating a divorce from beginning to end with advice on how to file, a guide to the forms you might need, and more. If your organization accepts vehicles as a form of donations, you will want to have each donor complete a vehicle gift letter for tax and legal purposes.this letter will help agencies such as the department of motor vehicles confirm the transfer of ownership of the vehicle was legal and that your organization is now the owner. Dear sir/madam, i am writing this letter to notify you that my company advo limited is willing to gain distributorship of your products in turkey. In the gift of equity.