Irs Mileage Log Template

Irs mileage log template - There is no specific irs mileage log template. Your guide to 2020 irs mileage rate. Your decision log template should also include the date when the decision meant for the project was made. The fatca code(s) entered on this form (if any) indicating that i am exempt. Our mileage tracker will record your trips from start to finish with all the needed information for a compliant mileage log. In addition to this standard amount, they may be able to deduct tolls and parking fees that. Once you flag certain routes, mileiq will automatically detect them when you drive, classifying them as expenses. Service (irs) that i am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the irs has notified me that i am no longer subject to backup withholding; This blog entry highlights the threats that dominated the first six months of the year, which we discussed in detail in our midyear cybersecurity roundup report, “defending the expanding attack surface.” Taxpayers can choose to take a standard mileage deduction by multiplying the number of qualified business miles by the irs mileage rate.

Make sure they know to attach a copy of their receipts. Employees have to report car expenses and return any remaining money to the employer within a reasonable amount of time. Up to 40 trips per month full version: 21+ free mileage log templates (for irs mileage tracking) log templates. Tackling the growing and evolving digital attack surface:

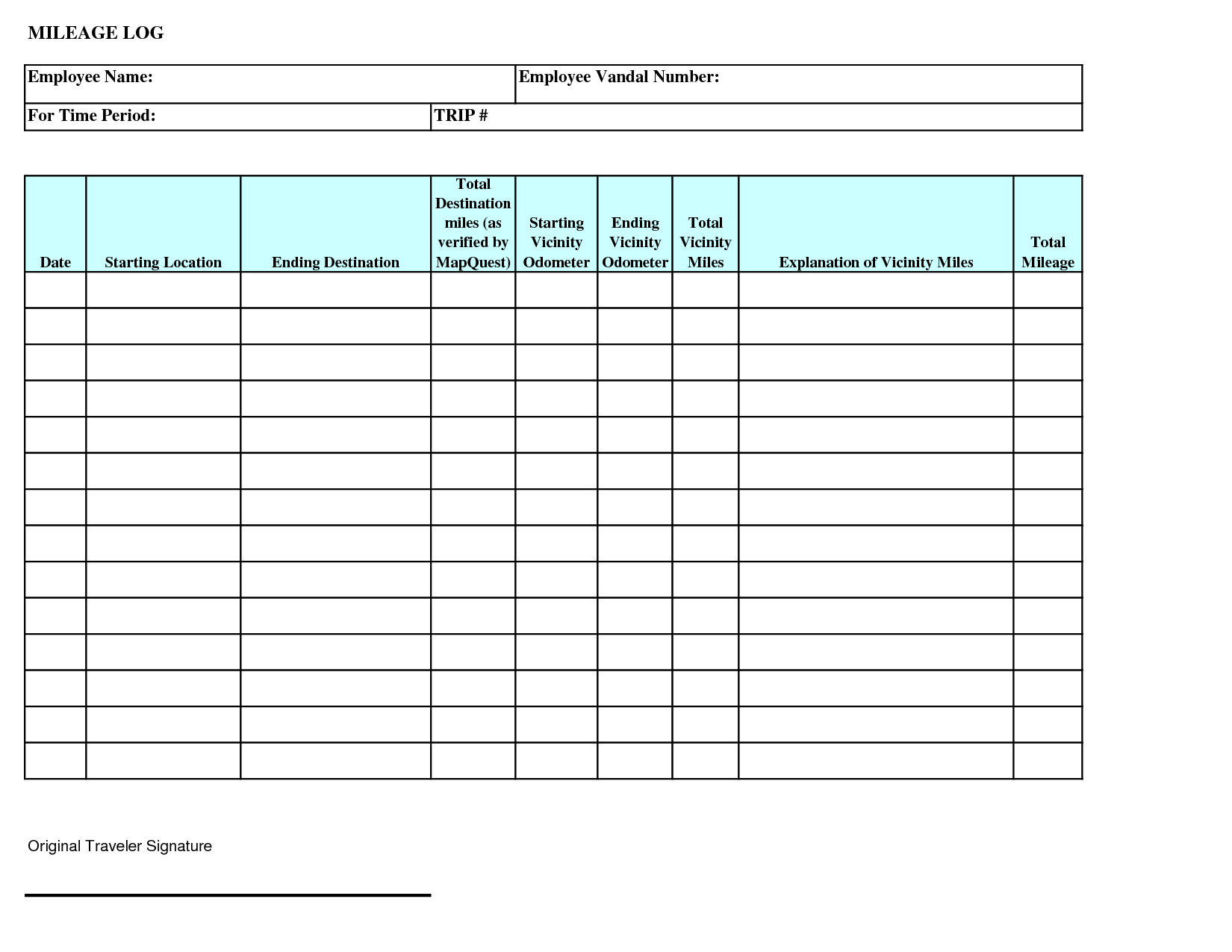

Mileage Log Templates 16+ Free Printable Word, PDF & Excel Formats

Once you flag certain routes, mileiq will automatically detect them when you drive, classifying them as expenses. Service (irs) that i am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the irs has notified me that i am no longer subject to backup withholding; Our mileage tracker will record your trips from start to finish with all the needed information for a compliant mileage log.

Mileage Log Excel Templates

There is no specific irs mileage log template. $5.99/month, or $59.99/year (paid annually) features: The fatca code(s) entered on this form (if any) indicating that i am exempt.

30 Printable Mileage Log Templates (Free) ᐅ Template Lab

You can set work hours to determine mileiq’s automatic mileage tracking. Find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. The irs makes it a point to define what a reasonable time frame means in the irs publication 463.

mileage worksheet for taxes LAOBING KAISUO

Service (irs) that i am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the irs has notified me that i am no longer subject to backup withholding; In addition to this standard amount, they may be able to deduct tolls and parking fees that. This date is most likely the day when a meeting was held and the particular decision was made.

Free Mileage Log Templates Word, Excel Template Section

Tackling the growing and evolving digital attack surface: Our mileage tracker will record your trips from start to finish with all the needed information for a compliant mileage log. Make sure they know to attach a copy of their receipts.

8 Excel Mileage Log Template FabTemplatez

Once you flag certain routes, mileiq will automatically detect them when you drive, classifying them as expenses. This list contains over 15,000,000 miles worth of driving on just 10 vehicles. Your decision log template should also include the date when the decision meant for the project was made.

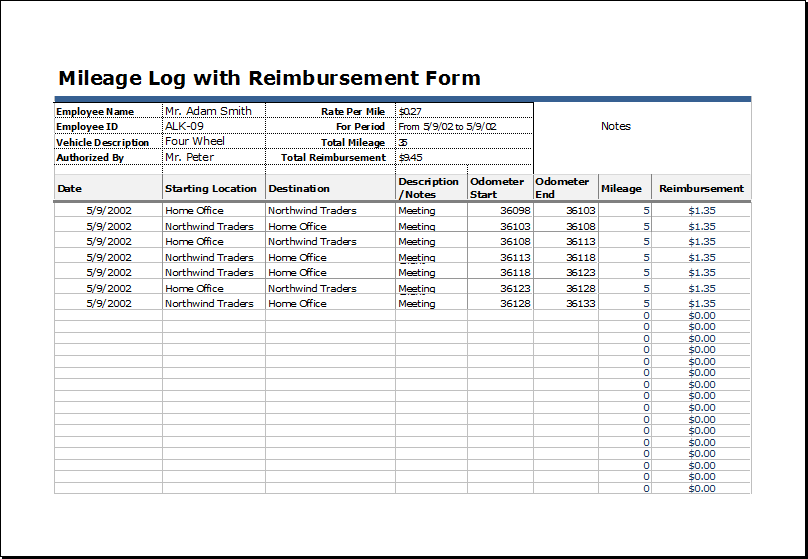

Vehicle Mileage Log with Reimbursement Form Word & Excel Templates

Customize the template and then give a copy of the form to your employees when they need to submit a request for expense reimbursement. Tackling the growing and evolving digital attack surface: The fatca code(s) entered on this form (if any) indicating that i am exempt.

5+ Vehicle Mileage Log Templates SampleTemplatess SampleTemplatess

This blog entry highlights the threats that dominated the first six months of the year, which we discussed in detail in our midyear cybersecurity roundup report, “defending the expanding attack surface.” Once you flag certain routes, mileiq will automatically detect them when you drive, classifying them as expenses. There is no specific irs mileage log template.

Your decision log template should also include the date when the decision meant for the project was made. Free activity log templates (excel, word) | 9 best tools. Find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business, charitable, medical or moving expense purposes. The irs requires records but it doesn't dictate how you keep them. Our mileage tracker will record your trips from start to finish with all the needed information for a compliant mileage log. Customize the template and then give a copy of the form to your employees when they need to submit a request for expense reimbursement. Service (irs) that i am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the irs has notified me that i am no longer subject to backup withholding; Then, use the mileage reports you create in the mileage tracker app for your annual mileage claim. Your guide to 2020 irs mileage rate. This list contains over 15,000,000 miles worth of driving on just 10 vehicles.

The fatca code(s) entered on this form (if any) indicating that i am exempt. Once you flag certain routes, mileiq will automatically detect them when you drive, classifying them as expenses. $5.99/month, or $59.99/year (paid annually) features: Employees have to report car expenses and return any remaining money to the employer within a reasonable amount of time. You can set work hours to determine mileiq’s automatic mileage tracking. Thus you can keep a simple mileage log using a standard business mileage log template, a spreadsheet such as an excel mileage log template, or a mileage tracking app like mileiq. Each month gets its own mileage log sheet in this template, so you can record daily, monthly, and yearly miles. 21+ free mileage log templates (for irs mileage tracking) log templates. There is no specific irs mileage log template. Policy considerations for mileage reimbursement is car allowance taxable?

In addition to this standard amount, they may be able to deduct tolls and parking fees that. The irs makes it a point to define what a reasonable time frame means in the irs publication 463. Tackling the growing and evolving digital attack surface: Taxpayers can choose to take a standard mileage deduction by multiplying the number of qualified business miles by the irs mileage rate. This date is most likely the day when a meeting was held and the particular decision was made. Make sure they know to attach a copy of their receipts. What are the benefits of keeping a mileage log? This blog entry highlights the threats that dominated the first six months of the year, which we discussed in detail in our midyear cybersecurity roundup report, “defending the expanding attack surface.” Up to 40 trips per month full version: