Irs Response Letter Template

Irs response letter template - Your address your city, state, zip code (your email address, if sending via email) date. Simply request a replacement letter from the irs. Here’s a sample letter of explanation. Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person), not an entity. Or (b) description of the property donated (the nonprofit should not attempt to assign the cash value of. This individual or entity, which the irs will call the “responsible party,” controls, manages, or directs the applicant entity and the disposition of its funds and assets. You can use it as a template when you write your own letter. Irs guidance suggests that gift acknowledgments should contain: Just enter a notice code, like cp2000, or letter number, we’ll tell you exactly what the irs needs or each case. Office releases annual report on the insurance industry and request for information on potential federal insurance response to catastrophic cyber incidents.

Are you unsure how to use it for your situation? After you finish writing the letter, edit for typos or grammatical errors. Either (a) amount donated (if cash or cash equivalents); Send the letter in a timely manner to keep your mortgage application on track. October 7, 2022 treasury targets north korean fuel procurement network.

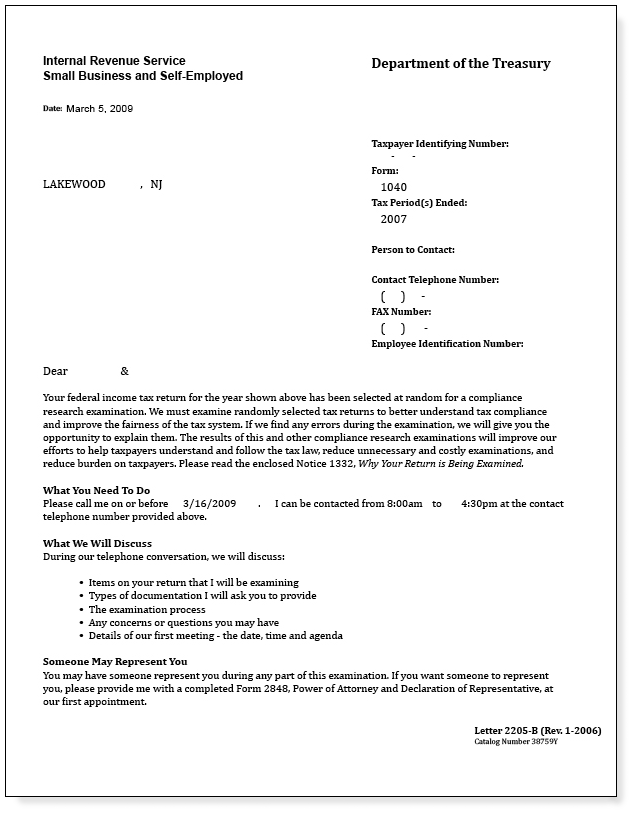

IRS Response Letter Template Federal Government Of The United States

After you finish writing the letter, edit for typos or grammatical errors. You can use it as a template when you write your own letter. Here’s a sample letter of explanation.

10 Letter to Irs Template Examples Letter Templates

After you finish writing the letter, edit for typos or grammatical errors. Use this sample complaint letter (.txt file) the next time you need to file a complaint. Office releases annual report on the insurance industry and request for information on potential federal insurance response to catastrophic cyber incidents.

Just enter a notice code, like cp2000, or letter number, we’ll tell you exactly what the irs needs or each case. Irs guidance suggests that gift acknowledgments should contain: After you finish writing the letter, edit for typos or grammatical errors.

IRS Audit Letter CP22A Sample 1

Lightening fast transcript delivery and analysis; After you finish writing the letter, edit for typos or grammatical errors. An irs representative will first confirm your identity and from there, work with you to get you your replacement letter.

Irs Audit Letter Sample Free Printable Documents

Call their business and specialty tax line. Or (b) description of the property donated (the nonprofit should not attempt to assign the cash value of. Name of contact person (if available)

Irs Audit Notice Free Printable Documents

This individual or entity, which the irs will call the “responsible party,” controls, manages, or directs the applicant entity and the disposition of its funds and assets. You can use it as a template when you write your own letter. An irs representative will first confirm your identity and from there, work with you to get you your replacement letter.

Letter Of Resignation Notice Period RETELQ

Simply request a replacement letter from the irs. Or (b) description of the property donated (the nonprofit should not attempt to assign the cash value of. Check out an example letter that used this format.

IRS Notice CP22A Understanding IRS Notice CP22A IRS Data Processing

October 7, 2022 treasury targets north korean fuel procurement network. Check out an example letter that used this format. Lightening fast transcript delivery and analysis;

October 7, 2022 treasury targets north korean fuel procurement network. After you finish writing the letter, edit for typos or grammatical errors. Name of contact person (if available) Send the letter in a timely manner to keep your mortgage application on track. Check out an example letter that used this format. Or (b) description of the property donated (the nonprofit should not attempt to assign the cash value of. An irs representative will first confirm your identity and from there, work with you to get you your replacement letter. Use this sample complaint letter (.txt file) the next time you need to file a complaint. Irs guidance suggests that gift acknowledgments should contain: Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person), not an entity.

Are you unsure how to use it for your situation? Either (a) amount donated (if cash or cash equivalents); This individual or entity, which the irs will call the “responsible party,” controls, manages, or directs the applicant entity and the disposition of its funds and assets. Simultaneous login of 3 users for the price of 2; You can use it as a template when you write your own letter. Lightening fast transcript delivery and analysis; Office releases annual report on the insurance industry and request for information on potential federal insurance response to catastrophic cyber incidents. Here’s a sample letter of explanation. Your address your city, state, zip code (your email address, if sending via email) date. Simply request a replacement letter from the irs.

Just enter a notice code, like cp2000, or letter number, we’ll tell you exactly what the irs needs or each case. Request a replacement letter this is also an easy method. Call their business and specialty tax line.