Late Fee Policy Template

Late fee policy template - Set up a payment plan. Late fees can be a set amount or a percentage of the invoice total. The late fee discussed may be imposed in one of two ways. When setting your late fee, you can choose to charge a flat rate or adjust for how long your client waits to complete their payment. Each state has its own laws regarding how much you can charge. This will only sour your relationship. For instance, you may be given a citation, a penalty fee, or a new financial obligation. A client can’t be ambushed with late fees after an invoice is overdue. In case, there is any delay in payment of bill amount to the supplier, then you should write an apology letter (in advance, if possible) wherein you have to explain the cause of delay and seek his forgiveness for the delay so caused and give commitments to make a payment on a certain day. 10 days, you get a late fee;

With a flat rate, your client would pay the same fee whether they pay a day or a week after the due date. If there is a fee, it is typically between $5 and $15.how to avoid this fee: Late fees must be discussed with a client at the outset of a project. Some credit card companies will charge you a fee if you lose your card and need a new one, though many will send you a new physical card for free. If the lender will only charge the borrower the late fee amount once when it is late, then select the “occurence” checkbox however, if the late fee will be imposed on a daily basis.

Cancellation Policy Template 8+ Free Documents Download in PDF

This will only sour your relationship. If the lender will only charge the borrower the late fee amount once when it is late, then select the “occurence” checkbox however, if the late fee will be imposed on a daily basis. In a limited civil case (a civil case involving an amount that is $25,000 or less):

Pin on Cancellation Policies

In case, there is any delay in payment of bill amount to the supplier, then you should write an apology letter (in advance, if possible) wherein you have to explain the cause of delay and seek his forgiveness for the delay so caused and give commitments to make a payment on a certain day. The late fee discussed may be imposed in one of two ways. (18) late fee by occurrence or by day.

Forms

Late fees can be a set amount or a percentage of the invoice total. If the lender will only charge the borrower the late fee amount once when it is late, then select the “occurence” checkbox however, if the late fee will be imposed on a daily basis. When setting your late fee, you can choose to charge a flat rate or adjust for how long your client waits to complete their payment.

Bill Tracker to Organize Your Finances Free Printable

But with the latter method, you could charge an extra fee for each day that the payment is late. When setting your late fee, you can choose to charge a flat rate or adjust for how long your client waits to complete their payment. The late fee discussed may be imposed in one of two ways.

8 Late Payment Letter Template SampleTemplatess SampleTemplatess

If there is a fee, it is typically between $5 and $15.how to avoid this fee: If you have a fee waiver from the superior court for the case you are appealing and that fee waiver has not ended (fee waivers automatically end 60 days after the judgment), your fees are already waived. 10 days, you get a late fee;

Late Fee Letter Example

Late fees can be a set amount or a percentage of the invoice total. For instance, you may be given a citation, a penalty fee, or a new financial obligation. Each state has its own laws regarding how much you can charge.

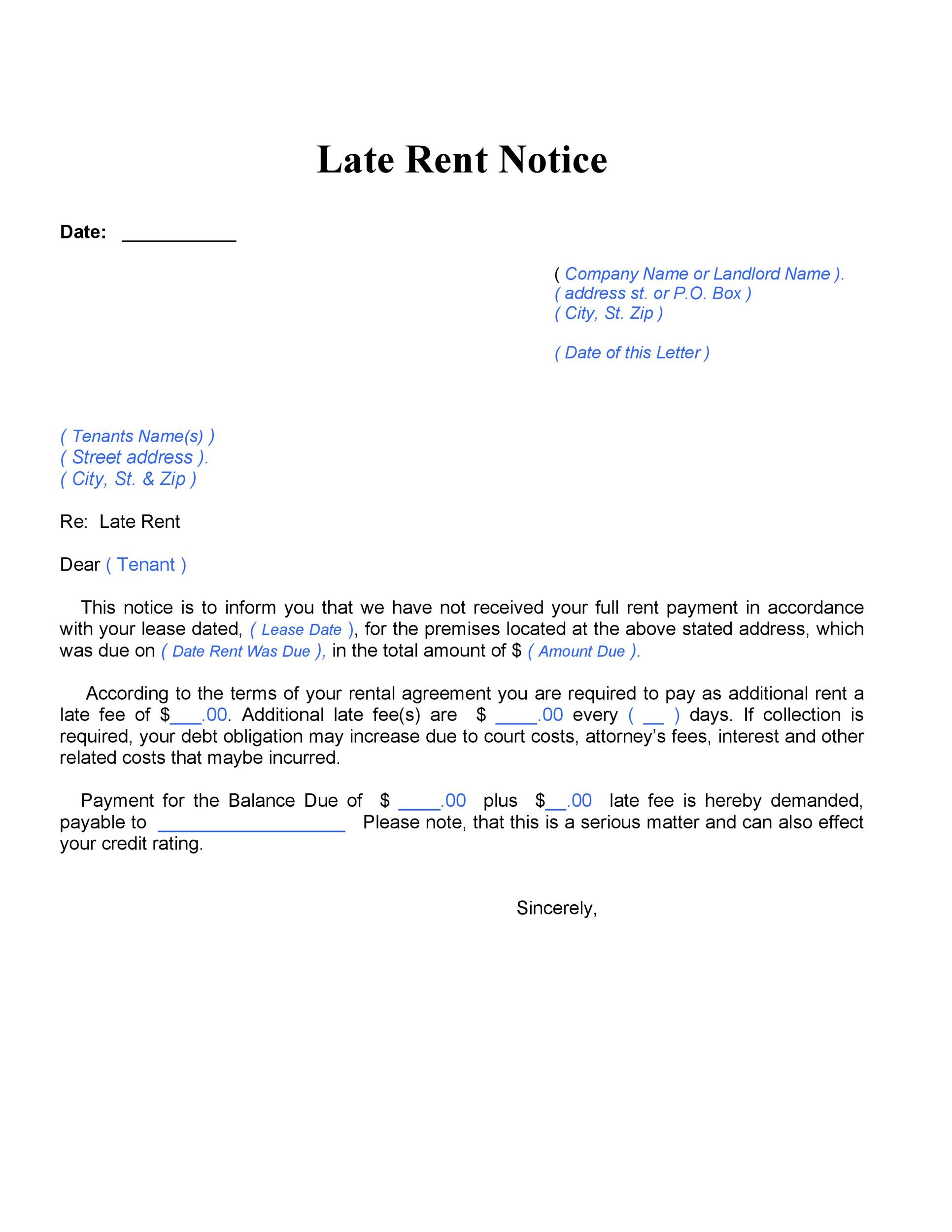

Late Rent Notice Create a Free Notice to Pay Rent or Quit Form

If there is a fee, it is typically between $5 and $15.how to avoid this fee: (18) late fee by occurrence or by day. 20 days, you lose service, giordano suggested.

BOARDING CONTRACT.pdf DocHub

If you have a fee waiver from the superior court for the case you are appealing and that fee waiver has not ended (fee waivers automatically end 60 days after the judgment), your fees are already waived. Late fees can be a set amount or a percentage of the invoice total. 20 days, you lose service, giordano suggested.

20 days, you lose service, giordano suggested. 10 days, you get a late fee; This will only sour your relationship. When setting your late fee, you can choose to charge a flat rate or adjust for how long your client waits to complete their payment. For instance, you may be given a citation, a penalty fee, or a new financial obligation. (18) late fee by occurrence or by day. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Just include a copy of the fee waiver with the notice of. If you have a fee waiver from the superior court for the case you are appealing and that fee waiver has not ended (fee waivers automatically end 60 days after the judgment), your fees are already waived. If you feel that such is undeserved, or if you feel that it would unfairly affect you, then […]

If the lender will only charge the borrower the late fee amount once when it is late, then select the “occurence” checkbox however, if the late fee will be imposed on a daily basis. If there is a fee, it is typically between $5 and $15.how to avoid this fee: Set up a payment plan. A client can’t be ambushed with late fees after an invoice is overdue. For instance, if you don’t pay within five days, you get a warning; Some credit card companies will charge you a fee if you lose your card and need a new one, though many will send you a new physical card for free. The late fee discussed may be imposed in one of two ways. Late fees can be a set amount or a percentage of the invoice total. Late fees must be discussed with a client at the outset of a project. In case, there is any delay in payment of bill amount to the supplier, then you should write an apology letter (in advance, if possible) wherein you have to explain the cause of delay and seek his forgiveness for the delay so caused and give commitments to make a payment on a certain day.

Unsecured promissory note template customize. In a limited civil case (a civil case involving an amount that is $25,000 or less): But with the latter method, you could charge an extra fee for each day that the payment is late. With a flat rate, your client would pay the same fee whether they pay a day or a week after the due date. Each state has its own laws regarding how much you can charge.