Mileage Log Template

Mileage log template - Your decision log template should also include the date when the decision meant for the project was made. The irs requires records but it doesn't dictate how you keep them. Keep track of your overall mileage as well as business miles that can be deducted. Click any business form template to see a larger version and download it. Thus you can keep a simple mileage log using a standard business mileage log template, a spreadsheet such as an excel mileage log template, or a mileage tracking app like mileiq. There is no specific irs mileage log template. Use this mileage reporting form to keep track of your destinations traveled, miles driven, and total amount reimbursable. This mileage reimbursement form template calculates amounts for you to submit as an expense report. Up to 40 trips per month full version: This mileage log in excel makes it easy to track distances for personal and business travel.

Once you flag certain routes, mileiq will automatically detect them when you drive, classifying them as expenses. You can set work hours to determine mileiq’s automatic mileage tracking. The gas mileage log with chart template adds a line graph that displays your mpg; What are the benefits of keeping a mileage log? 21+ free mileage log templates (for irs mileage tracking) log templates.

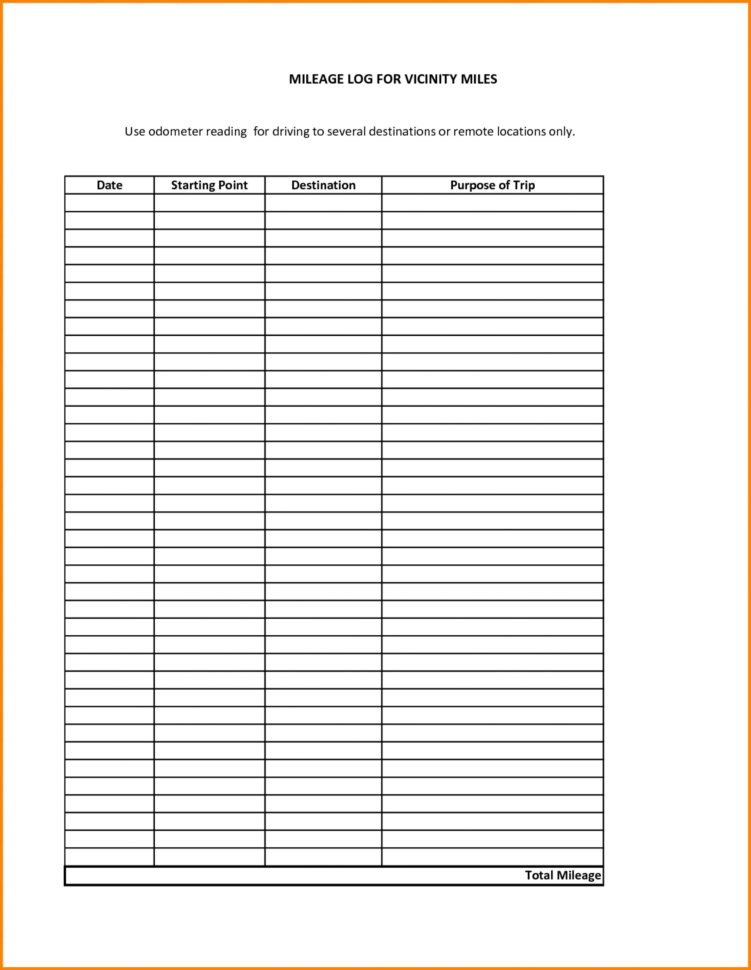

Free Mileage Log Spreadsheet inside 015 Free Mileage Log Template For

Once you flag certain routes, mileiq will automatically detect them when you drive, classifying them as expenses. You can set work hours to determine mileiq’s automatic mileage tracking. Long distance phone call log.

7 Best Images of Free Printable Trip Sheets Driver Trip Log Sheet

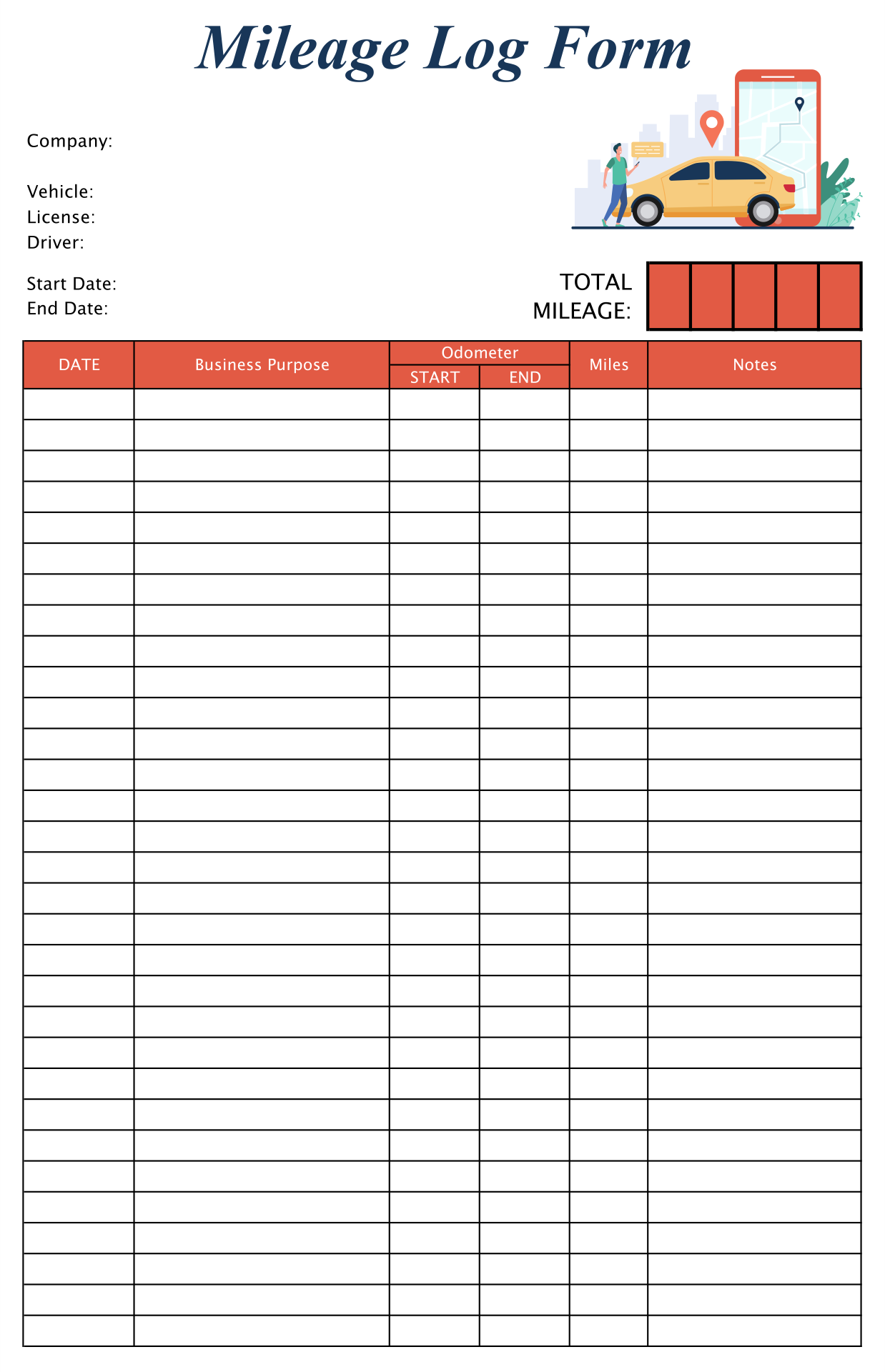

This date is most likely the day when a meeting was held and the particular decision was made. Use this mileage reporting form to keep track of your destinations traveled, miles driven, and total amount reimbursable. What are the benefits of keeping a mileage log?

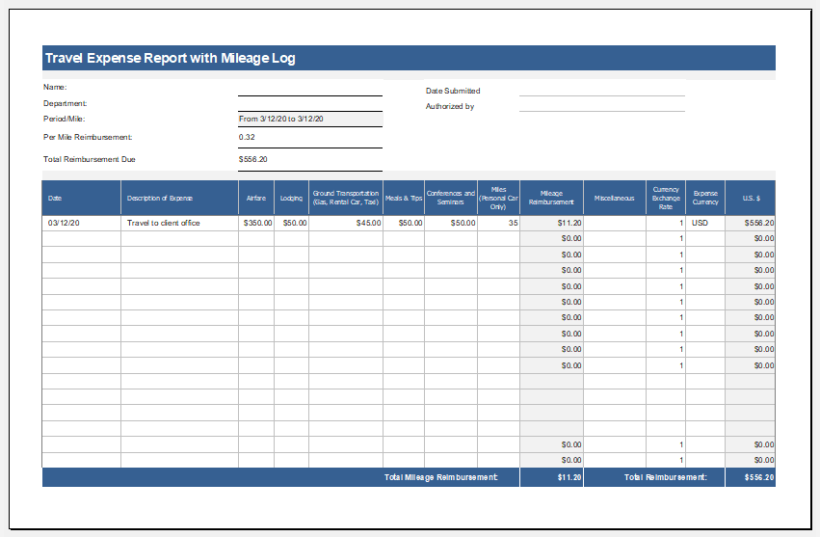

Travel Expense Report with Mileage Log Excel Templates

Long distance phone call log. This date is most likely the day when a meeting was held and the particular decision was made. This mileage reimbursement form template calculates amounts for you to submit as an expense report.

8+ Printable Mileage Log Templates for Personal or Commercial Use

In addition to monthly log sheets, the template provides an annual mileage summary so that you can get a quick overview. Report your mileage used for business with this accessible mileage log and reimbursement form template. Before you hit the road, download a free mileage log.

IRS Compliant Mileage Log Tutorial YouTube

For instance, the stylish travel expense report includes a mileage log as well as columns for other expenses; You can set work hours to determine mileiq’s automatic mileage tracking. Use this mileage reporting form to keep track of your destinations traveled, miles driven, and total amount reimbursable.

Personal Mileage Tracker Template for Excel Excel Templates

Free activity log templates (excel, word) | 9 best tools. Thus you can keep a simple mileage log using a standard business mileage log template, a spreadsheet such as an excel mileage log template, or a mileage tracking app like mileiq. This mileage log in excel makes it easy to track distances for personal and business travel.

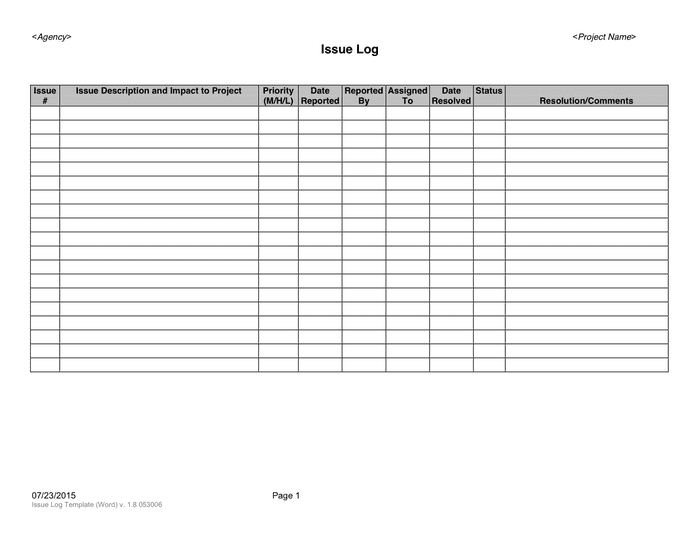

Issue Log Template download free documents for PDF, Word and Excel

Each month gets its own mileage log sheet in this template, so you can record daily, monthly, and yearly miles. The irs requires records but it doesn't dictate how you keep them. This mileage reimbursement form template calculates amounts for you to submit as an expense report.

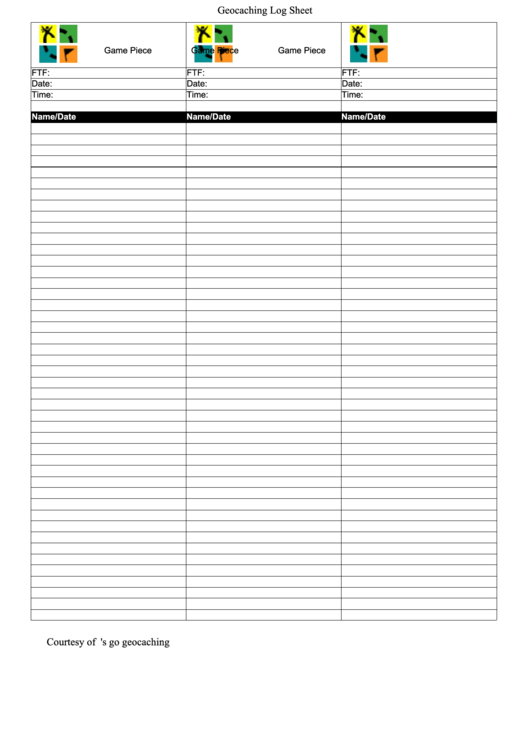

Geocaching Log Template (Color) printable pdf download

This mileage reimbursement form template calculates amounts for you to submit as an expense report. What are the benefits of keeping a mileage log? Thus you can keep a simple mileage log using a standard business mileage log template, a spreadsheet such as an excel mileage log template, or a mileage tracking app like mileiq.

Free activity log templates (excel, word) | 9 best tools. Each month gets its own mileage log sheet in this template, so you can record daily, monthly, and yearly miles. Enter your trip details and odometer readings at the start and end of your trip, and the mileage log template in excel automatically calculates your total miles. In addition to monthly log sheets, the template provides an annual mileage summary so that you can get a quick overview. Use this mileage reporting form to keep track of your destinations traveled, miles driven, and total amount reimbursable. Up to 40 trips per month full version: Long distance phone call log. Your decision log template should also include the date when the decision meant for the project was made. The gas mileage log with chart template adds a line graph that displays your mpg; Thus you can keep a simple mileage log using a standard business mileage log template, a spreadsheet such as an excel mileage log template, or a mileage tracking app like mileiq.

Once you flag certain routes, mileiq will automatically detect them when you drive, classifying them as expenses. $5.99/month, or $59.99/year (paid annually) features: This date is most likely the day when a meeting was held and the particular decision was made. This mileage reimbursement form template calculates amounts for you to submit as an expense report. The irs requires records but it doesn't dictate how you keep them. A mileage log template is a great tool for mileage reimbursement, or to get a. Before you hit the road, download a free mileage log. This mileage log in excel makes it easy to track distances for personal and business travel. You can set work hours to determine mileiq’s automatic mileage tracking. 21+ free mileage log templates (for irs mileage tracking) log templates.

Click any business form template to see a larger version and download it. What are the benefits of keeping a mileage log? Report your mileage used for business with this accessible mileage log and reimbursement form template. Keep track of your overall mileage as well as business miles that can be deducted. There is no specific irs mileage log template. For instance, the stylish travel expense report includes a mileage log as well as columns for other expenses;