Money Gift Letter Template

Money gift letter template - The day that you make a gift in excess of £325,000 that would be as a chargeable lifetime transfer with inheritance tax paid upfront at half the usual rate of 40%, so 20% of £175,000 is payable in inheritance tax on day one. Both the person owed the debt, and the person owing the debt, should be identified. Finish your letter by thanking your recipient for considering a gift, and signing it. If the dispute surrounds a charge. You should include certain fundamental information in a demand for payment letter. If you then died within 7 years the balance 20% would be payable as well. Don’t assume they know what you’re looking for. The person who gave you the money must write and sign the gift letter as well as provide their personal information. Here's a sample gift letter you can use to prove that the money is truly meant as an outright gift, with no expectation of repayment. Giving money away if you need care?

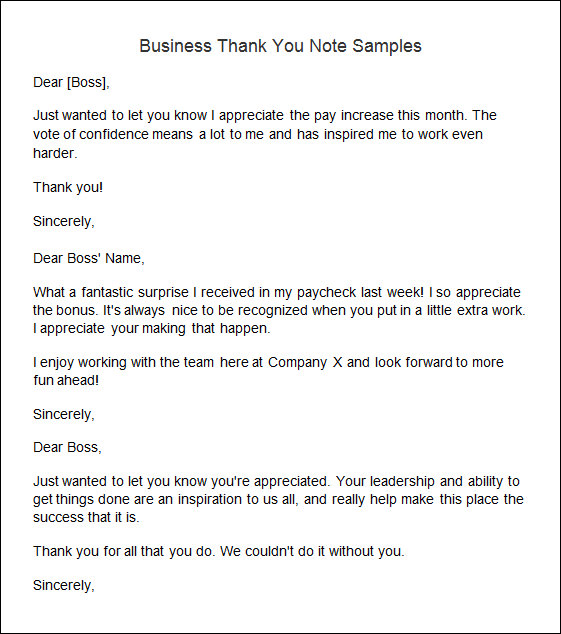

Such information is detailed below: Or date debt was improperly charged: Ignore the temptation to sign from your organization. We here at [your organization] are so proud of our recent work to [provide a few details about your past initiatives], and we’d like to thank you for being a part of our community. However, our mission to [short description of your organization’s mission] is a 24/7 undertaking!

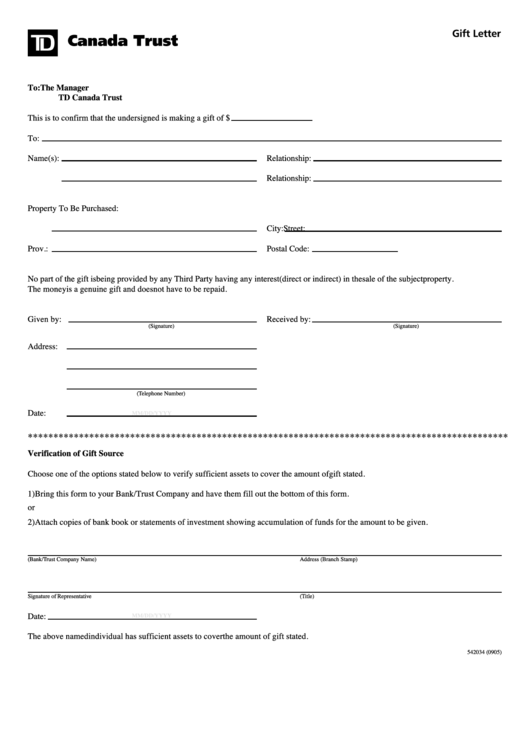

Gift Money Letter Template printable pdf download

Don’t assume they know what you’re looking for. The solution is to ask for a gift letter to accompany any large financial gift you use for your down payment. You should include certain fundamental information in a demand for payment letter.

Money Envelope Template printable pdf download

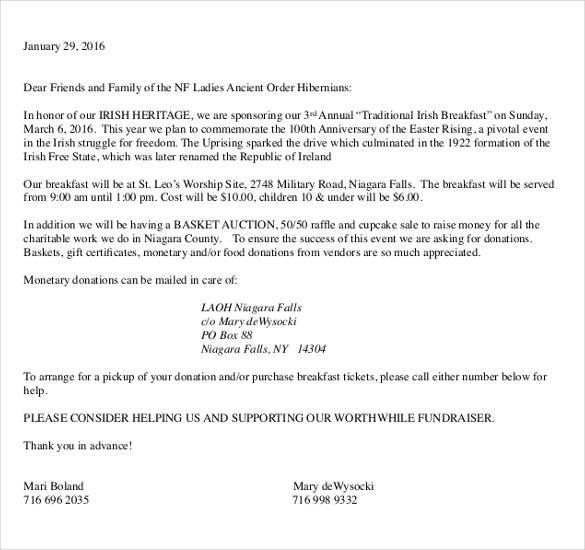

If the dispute surrounds a charge. We need your help to. Ignore the temptation to sign from your organization.

Hardship Letter Template 17 Financial, Mortgage, Lettering

Or date debt was improperly charged: You should include certain fundamental information in a demand for payment letter. Don’t assume they know what you’re looking for.

FREE 9+ Sample Thank You Note Templates in MS Word PDF

We need your help to. The day that you make a gift in excess of £325,000 that would be as a chargeable lifetime transfer with inheritance tax paid upfront at half the usual rate of 40%, so 20% of £175,000 is payable in inheritance tax on day one. However, our mission to [short description of your organization’s mission] is a 24/7 undertaking!

Green Money Chore Bucks Template printable pdf download

Or date debt was improperly charged: If you then died within 7 years the balance 20% would be payable as well. Ignore the temptation to sign from your organization.

Letter Of Agreement Template Free Lovely Free Printable Letter Of

Or date debt was improperly charged: Here's a sample gift letter you can use to prove that the money is truly meant as an outright gift, with no expectation of repayment. Ignore the temptation to sign from your organization.

29+ Donation Letter Templates PDF, DOC Free & Premium Templates

If you then died within 7 years the balance 20% would be payable as well. However, our mission to [short description of your organization’s mission] is a 24/7 undertaking! The day that you make a gift in excess of £325,000 that would be as a chargeable lifetime transfer with inheritance tax paid upfront at half the usual rate of 40%, so 20% of £175,000 is payable in inheritance tax on day one.

Gift Voucher Templates for MS Word Editable Word & Excel Templates

You should include certain fundamental information in a demand for payment letter. Or date debt was improperly charged: The person who gave you the money must write and sign the gift letter as well as provide their personal information.

Ignore the temptation to sign from your organization. Don’t assume they know what you’re looking for. Before finalizing the letter, check with your lender to make sure that it includes all information required, such as evidence of the donor's ability to provide these gift funds. Giving money away if you need care? The solution is to ask for a gift letter to accompany any large financial gift you use for your down payment. If the dispute surrounds a charge. A gift letter is a statement that ensures your lender the money that came into your account is a gift and not a loan. Or date debt was improperly charged: We here at [your organization] are so proud of our recent work to [provide a few details about your past initiatives], and we’d like to thank you for being a part of our community. You should include certain fundamental information in a demand for payment letter.

Here's a sample gift letter you can use to prove that the money is truly meant as an outright gift, with no expectation of repayment. The day that you make a gift in excess of £325,000 that would be as a chargeable lifetime transfer with inheritance tax paid upfront at half the usual rate of 40%, so 20% of £175,000 is payable in inheritance tax on day one. Such information is detailed below: However, our mission to [short description of your organization’s mission] is a 24/7 undertaking! Both the person owed the debt, and the person owing the debt, should be identified. If you then died within 7 years the balance 20% would be payable as well. We need your help to. The person who gave you the money must write and sign the gift letter as well as provide their personal information. Finish your letter by thanking your recipient for considering a gift, and signing it.