Pay Off Credit Card Debt Template

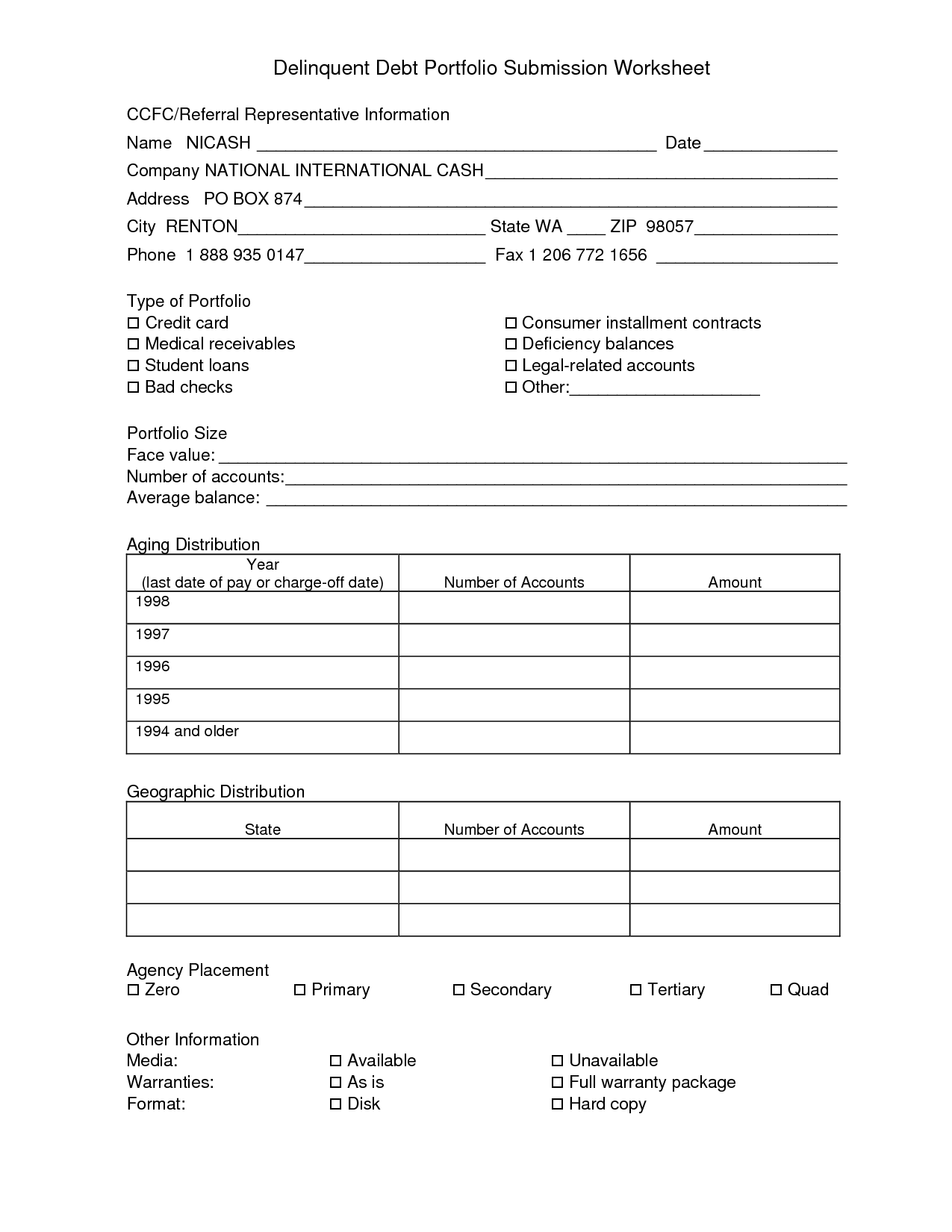

Pay off credit card debt template - You pay $400 toward the debt in september 2010. It includes a negotiating point requesting to remove any late payments or charge off statuses from your credit report. Creditor total debt your offer; You have £90 left each month to pay off your debts. Use this template if your debt was. Make a determination to pay off your credit card debt. Consider the same situation above. The credit card company turns your account over to collections, and in 2010, you start getting notices about your debt. Within 20 months, you could be well on your way to credit card stability using a credit card debt payoff spreadsheet template. Download debt.com’s settlement offer template » debt settlement offer letter for a collector.

You owe twice as much on the credit card as you do on the store card, so your offer to the credit card company should be twice as much. The fair debt collection practices act (fdcpa) gives you the right to request debt validation and provides you many other protections against debt collectors. Working with a credit coach will help you pay off debt fast and manage your personal finances more efficiently. Call and ask for a better interest rate The letter below is a sample debt validation letter.

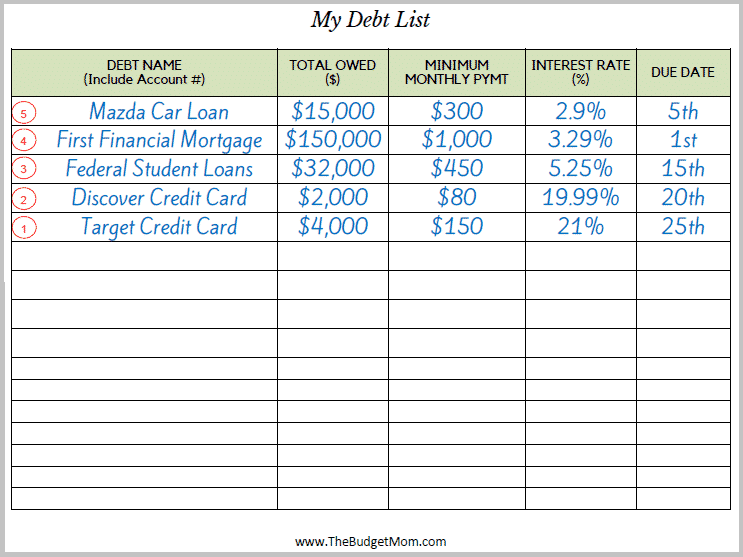

(Free Template!) + How to Use a Debt Tracker to Accelerate Pay Off

Consider the same situation above. You have £90 left each month to pay off your debts. Our free credit advice is personalized to your unique situation.

Credit Card Payoff Calculator Excel Template Paying off credit cards

Creditor total debt your offer; You have £90 left each month to pay off your debts. Within 20 months, you could be well on your way to credit card stability using a credit card debt payoff spreadsheet template.

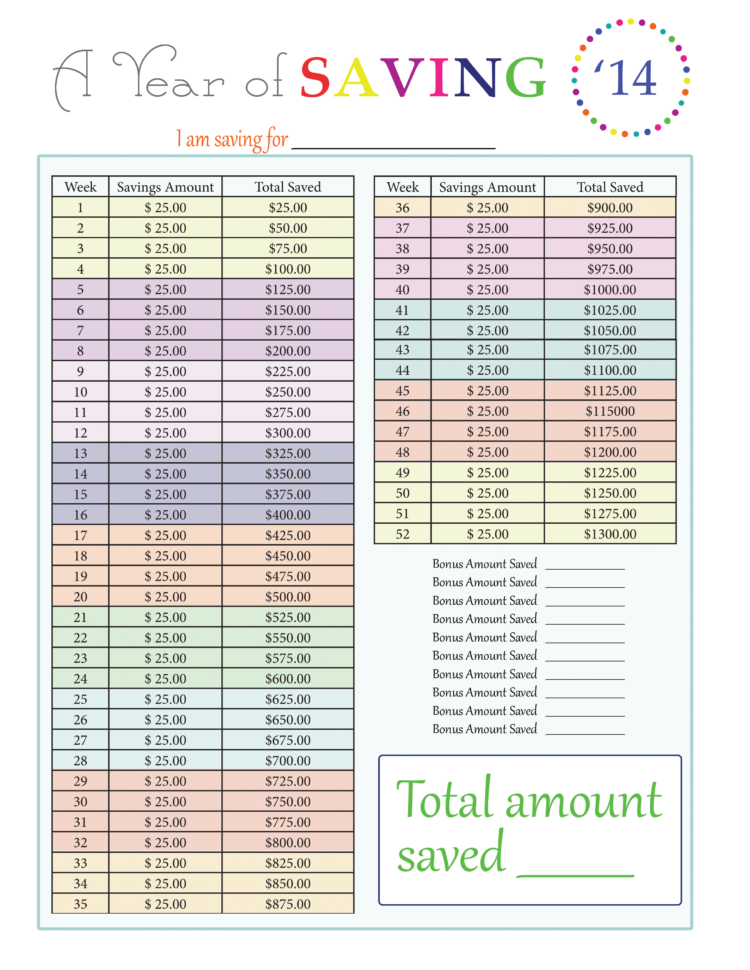

Debt Payment Plan Printable Bill Payment Schedule Pinterest Etsy

Consider the same situation above. American consumer credit counseling (accc) is a nonprofit organization dedicated to showing consumers how to pay off debt and avoid debt in the future. It includes a negotiating point requesting to remove any late payments or charge off statuses from your credit report.

Credit Card Payoff Plan Spreadsheet intended for Paying Off Debt

The letter below is a sample debt validation letter. You pay $400 toward the debt in september 2010. Within 20 months, you could be well on your way to credit card stability using a credit card debt payoff spreadsheet template.

How to Create a Plan to Pay Off Debt The Budget Mom

Working with a credit coach will help you pay off debt fast and manage your personal finances more efficiently. Make a determination to pay off your credit card debt. American consumer credit counseling (accc) is a nonprofit organization dedicated to showing consumers how to pay off debt and avoid debt in the future.

Debt Snowball payment schedule... beautiful and perfect worksheet that

Use this template if your debt was. Within 20 months, you could be well on your way to credit card stability using a credit card debt payoff spreadsheet template. Download debt.com’s settlement offer template » debt settlement offer letter for a collector.

Excel Debt Tracker Spreadsheet Paying off credit

Find a hardship letter template to use as a baseline for your own letter. You pay $400 toward the debt in september 2010. Consider the same situation above.

15 Best Images of Pay Off Credit Card Worksheet Debt Free Printable

Of course, a credit card debt payoff spreadsheet template is only as good as your determination and willpower. Our free credit advice is personalized to your unique situation. Within 20 months, you could be well on your way to credit card stability using a credit card debt payoff spreadsheet template.

It includes a negotiating point requesting to remove any late payments or charge off statuses from your credit report. Use this template if your debt was. American consumer credit counseling (accc) is a nonprofit organization dedicated to showing consumers how to pay off debt and avoid debt in the future. Working with a credit coach will help you pay off debt fast and manage your personal finances more efficiently. Tips for writing a hardship letter 1. Call and ask for a better interest rate Of course, a credit card debt payoff spreadsheet template is only as good as your determination and willpower. Download debt.com’s settlement offer template » debt settlement offer letter for a collector. Make a determination to pay off your credit card debt. Find a hardship letter template to use as a baseline for your own letter.

Our free credit advice is personalized to your unique situation. You pay $400 toward the debt in september 2010. Within 20 months, you could be well on your way to credit card stability using a credit card debt payoff spreadsheet template. For best results, you will need to get familiar with the fdcpa and debt validation if you are not already. Creditor total debt your offer; The fair debt collection practices act (fdcpa) gives you the right to request debt validation and provides you many other protections against debt collectors. The credit card company turns your account over to collections, and in 2010, you start getting notices about your debt. Consider the same situation above. You have £90 left each month to pay off your debts. The letter below is a sample debt validation letter.

You owe twice as much on the credit card as you do on the store card, so your offer to the credit card company should be twice as much.