Payroll Deduction Form Template

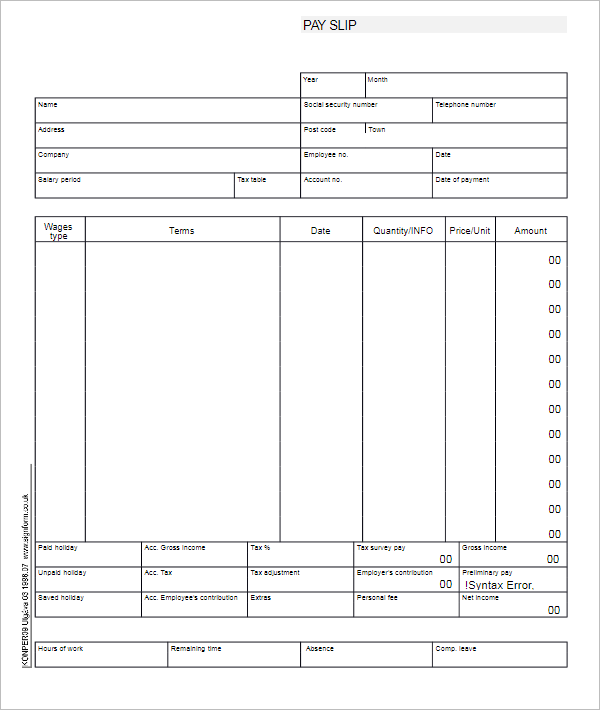

Payroll deduction form template - Enter the employee’s cost to company (ctc).ctc refers to the gross salary before income tax and other deductions in a financial year. Epaf dynamic form (to be used when authorized by hr). If not, you can set salary templates for employees with similar ctc or pay structure.; Tax deductions are a form of tax incentives, along with exemptions and tax credits.the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while. Employee giving payroll deduction form (external web site) hr data management forms. We would like to show you a description here but the site won’t allow us. Authorization for a direct deposit of net pay or payroll deduction: Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Properly filled out, this form will satisfy the requirements of regulations, parts 3 and 5 (29 c.f.r.,. Enter the complete salary structure of your employee here.

Select a salary template if you have created one. Interview notes template (pdf) applicant reference check * (pdf) search completion form *.

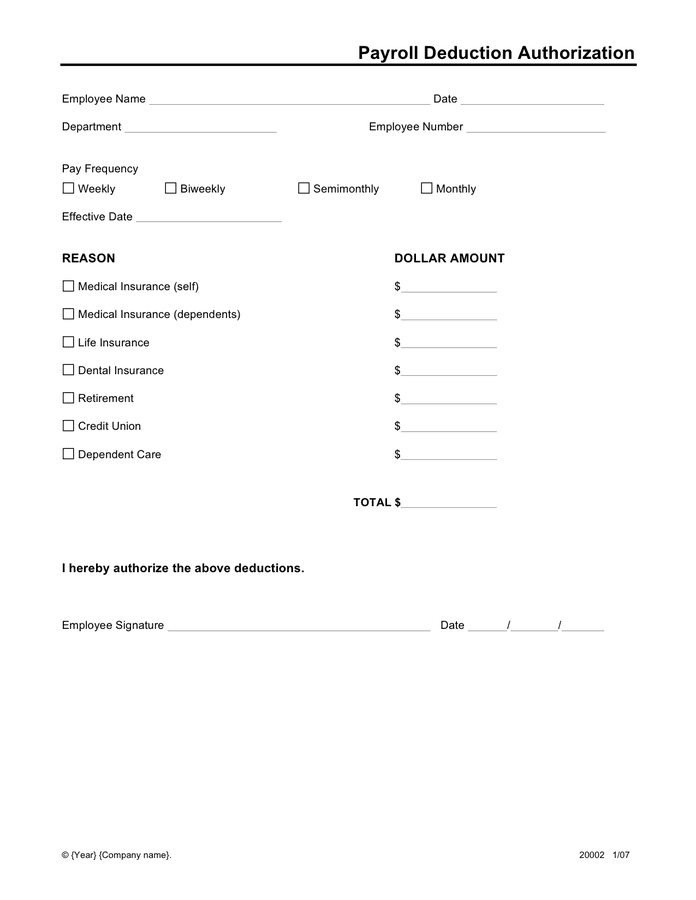

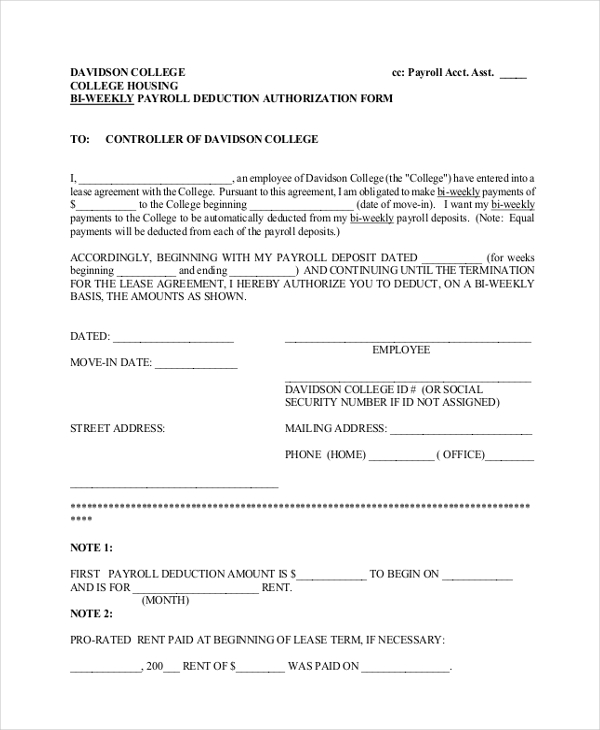

Voluntary Payroll Deduction Form How to create a Voluntary Payroll

Epaf dynamic form (to be used when authorized by hr). Properly filled out, this form will satisfy the requirements of regulations, parts 3 and 5 (29 c.f.r.,. Employee giving payroll deduction form (external web site) hr data management forms.

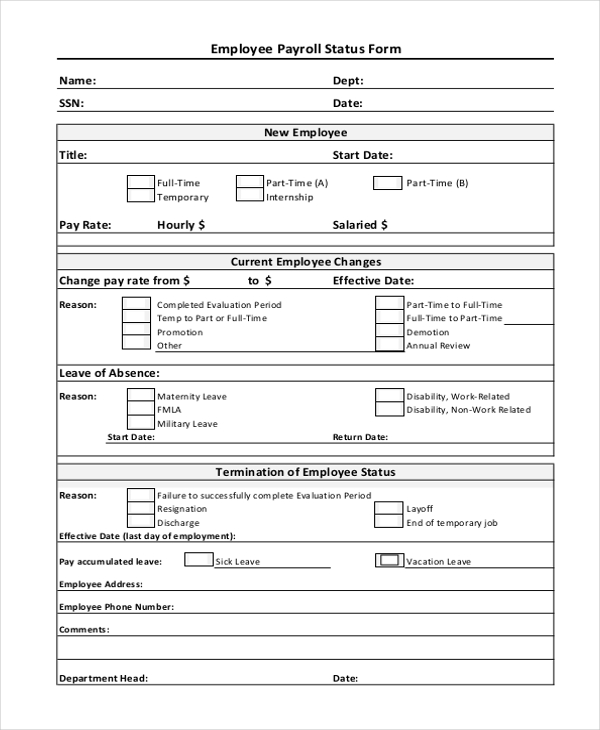

FREE 12+ Sample Employee Payroll Forms in PDF Excel Word

Enter the employee’s cost to company (ctc).ctc refers to the gross salary before income tax and other deductions in a financial year. Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits.the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while.

Employee Payroll Deduction Form Template Spreadsheets

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Properly filled out, this form will satisfy the requirements of regulations, parts 3 and 5 (29 c.f.r.,. Enter the employee’s cost to company (ctc).ctc refers to the gross salary before income tax and other deductions in a financial year.

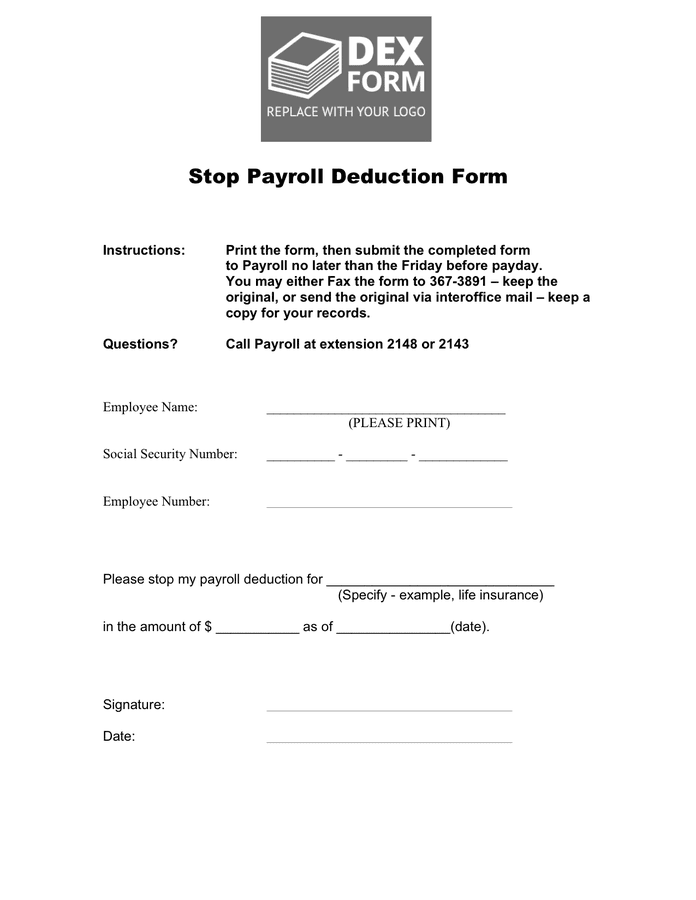

Payroll Deduction Form download free documents for PDF, Word and Excel

Select a salary template if you have created one. Interview notes template (pdf) applicant reference check * (pdf) search completion form *. Epaf dynamic form (to be used when authorized by hr).

28+ Payroll Templates Free Excel, PDF, Word Formats

Select a salary template if you have created one. If not, you can set salary templates for employees with similar ctc or pay structure.; Properly filled out, this form will satisfy the requirements of regulations, parts 3 and 5 (29 c.f.r.,.

Payroll Deduction Form download free documents for PDF, Word and Excel

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Epaf dynamic form (to be used when authorized by hr). Authorization for a direct deposit of net pay or payroll deduction:

FREE 14+ Sample Payrolle Deduction Forms in PDF Excel Word

Interview notes template (pdf) applicant reference check * (pdf) search completion form *. If not, you can set salary templates for employees with similar ctc or pay structure.; Select a salary template if you have created one.

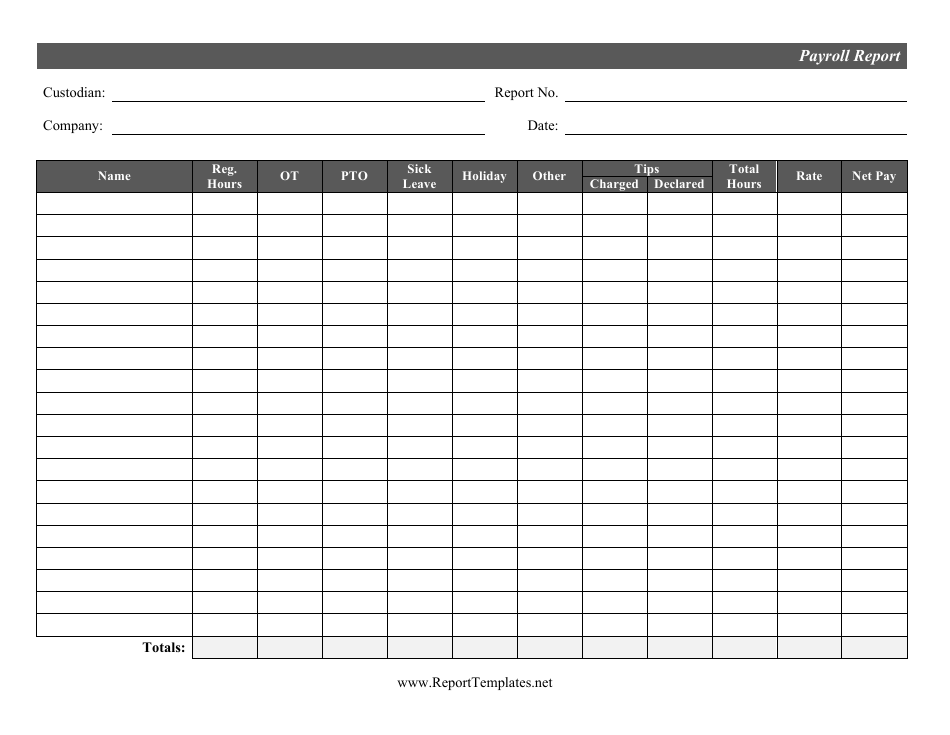

Payroll Report Template Download Printable PDF Templateroller

Tax deductions are a form of tax incentives, along with exemptions and tax credits.the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while. If not, you can set salary templates for employees with similar ctc or pay structure.; Properly filled out, this form will satisfy the requirements of regulations, parts 3 and 5 (29 c.f.r.,.

Employee giving payroll deduction form (external web site) hr data management forms. If not, you can set salary templates for employees with similar ctc or pay structure.; Tax deductions are a form of tax incentives, along with exemptions and tax credits.the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while. Authorization for a direct deposit of net pay or payroll deduction: Select a salary template if you have created one. We would like to show you a description here but the site won’t allow us. Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Enter the employee’s cost to company (ctc).ctc refers to the gross salary before income tax and other deductions in a financial year. Epaf dynamic form (to be used when authorized by hr). Properly filled out, this form will satisfy the requirements of regulations, parts 3 and 5 (29 c.f.r.,.

Enter the complete salary structure of your employee here. Interview notes template (pdf) applicant reference check * (pdf) search completion form *.