Printable Sales Tax Chart

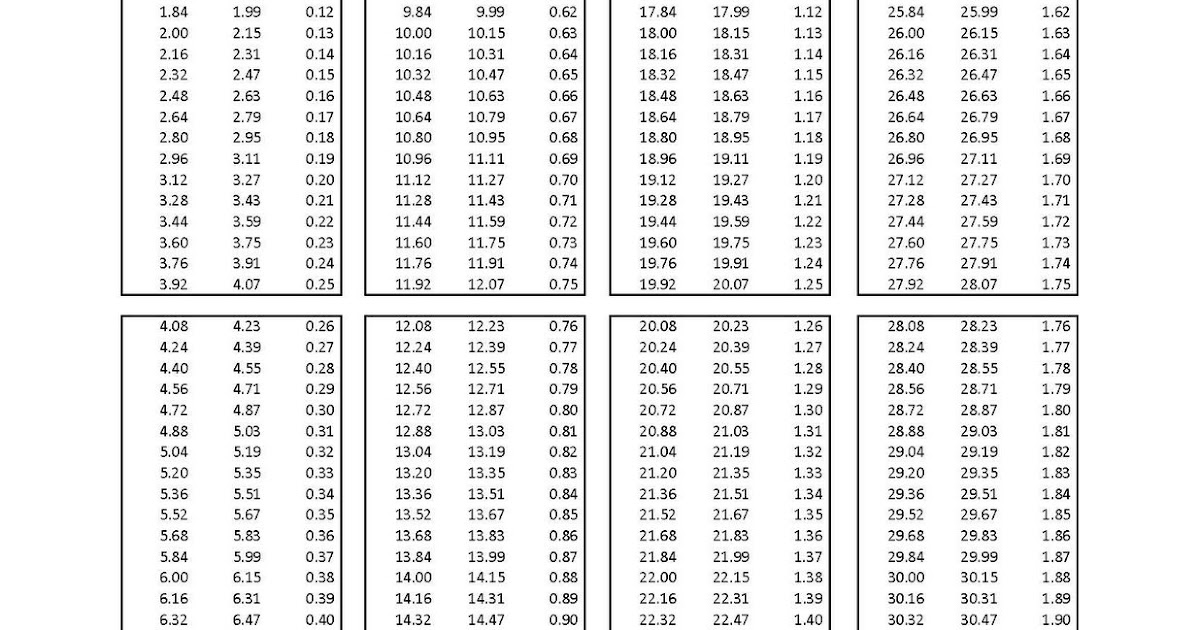

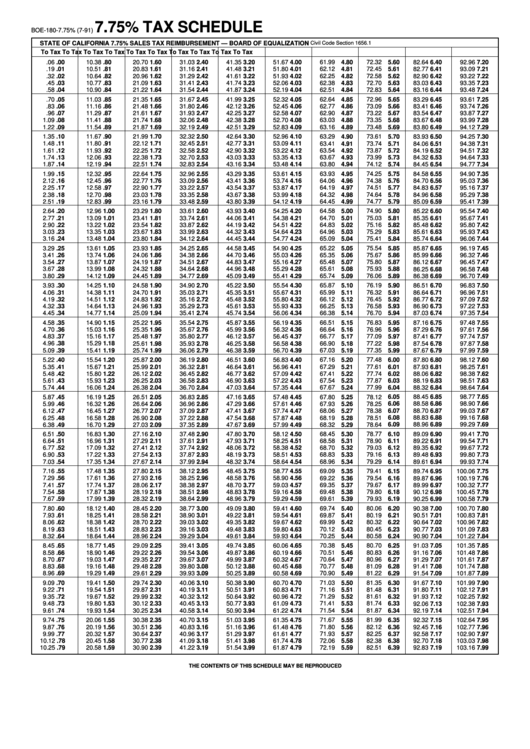

Printable sales tax chart - Min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax 0.00 0.09 $0.00 9.34 9.52 $0.50 18.78. Sales taxes are generally collected on all sales of tangible goods. In most areas of california, local jurisdictions have added district taxes that increase the tax owed by a seller. 7.5% sales and use tax chart that is free to print and use. 6.75% sales and use tax. Rate charts for sales tax. Retail sales tax rate charts. Combining local tax (2.75%) and state tax (7%) = total (9.75%) tennessee department of revenue. Those district tax rates range from 0.10% to. Pdf sorted alphabetically by city.

States have a statewide sales tax which is collected on most consumer purchases made within state borders. Comptroller.texas.gov/taxhelp/ for more information, visit our website: 51 rows this sales tax table (also known as a sales tax chart or sales tax. The charts are in pdf format. County and transit sales and use tax rates for cities and towns.

sales tax chart 8.25 Google Search Sales tax, Market day ideas

The statewide tax rate is 7.25%. Comptroller.texas.gov/taxhelp/ for more information, visit our website: County and transit sales and use tax rates for cities and towns.

MA Sales Tax 6.25 Tables MA 6.25 SALES TAX TABLES 8109>

States have a statewide sales tax which is collected on most consumer purchases made within state borders. The statewide tax rate is 7.25%. Retail sales tax rate charts.

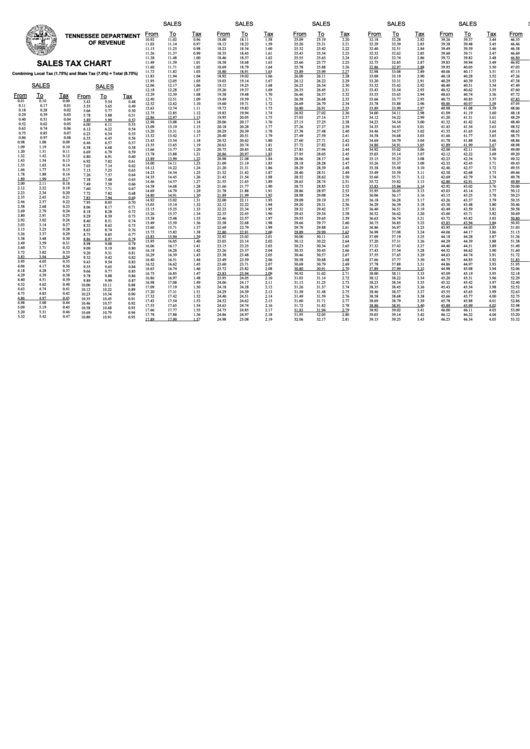

Sales And Use Tax Chart 8.75 Tennessee Department Of Revenue

The statewide tax rate is 7.25%. County and transit sales and use tax rates for cities and towns. The charts are in pdf format.

REV227 PA Sales and Use Tax Credit Chart Free Download

The charts are in pdf format. 51 rows this sales tax table (also known as a sales tax chart or sales tax. 6.75% sales and use tax.

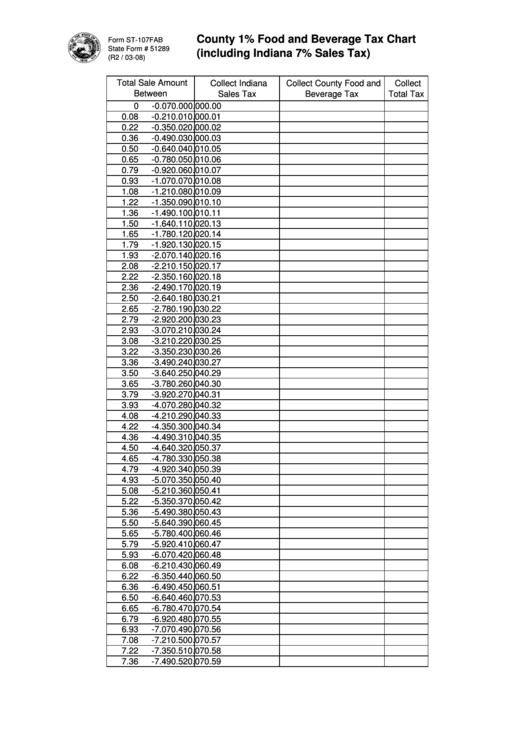

Form St107fab County 1 Food And Beverage Tax Chart (Including

Combining local tax (2.75%) and state tax (7%) = total (9.75%) tennessee department of revenue. 48.77 48.87 4.76 48.88 48.97. Min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax 0.00 0.09 $0.00 9.34 9.52 $0.50 18.78.

State Sales Tax Table Bing images

You can view these graphs in the printable. Pdf sorted alphabetically by city. The charts are in pdf format.

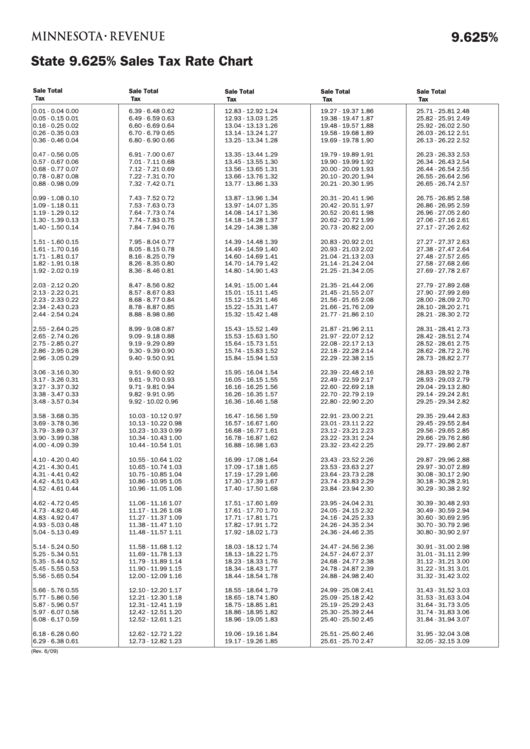

State 9.625 Sales Tax Rate Chart State Of Minnesota printable pdf

States have a statewide sales tax which is collected on most consumer purchases made within state borders. Min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax 0.00 0.09 $0.00 9.34 9.52 $0.50 18.78. Retail sales tax rate charts.

Sales Tax Spreadsheet Printable Spreadshee Sales Tax Spreadsheet

Sales taxes are generally collected on all sales of tangible goods. Retail sales tax rate charts. The statewide tax rate is 7.25%.

14 Tax Charts free to download in PDF

Retail sales tax rate charts. The charts are in pdf format. Rate charts for sales tax.

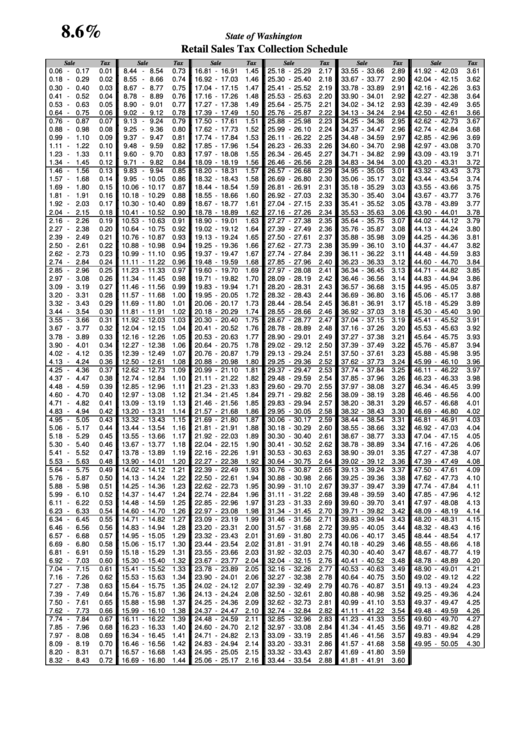

Retail Sales Tax Collection Schedule Information Sheet State Of

Rate charts for sales tax. You can view these graphs in the printable. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax.

Min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax min max tax 0.00 0.09 $0.00 9.34 9.52 $0.50 18.78. Pdf sorted alphabetically by city. Comptroller.texas.gov/taxhelp/ for more information, visit our website: You can view these graphs in the printable. The statewide tax rate is 7.25%. Retail sales tax rate charts. The charts are in pdf format. 48.77 48.87 4.76 48.88 48.97. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax. 51 rows this sales tax table (also known as a sales tax chart or sales tax.

Sales taxes are generally collected on all sales of tangible goods. In most areas of california, local jurisdictions have added district taxes that increase the tax owed by a seller. 7.5% sales and use tax chart that is free to print and use. County and transit sales and use tax rates for cities and towns. States have a statewide sales tax which is collected on most consumer purchases made within state borders. Rate charts for sales tax. 6.75% sales and use tax. Combining local tax (2.75%) and state tax (7%) = total (9.75%) tennessee department of revenue. Those district tax rates range from 0.10% to.