Promissory Note Template Georgia

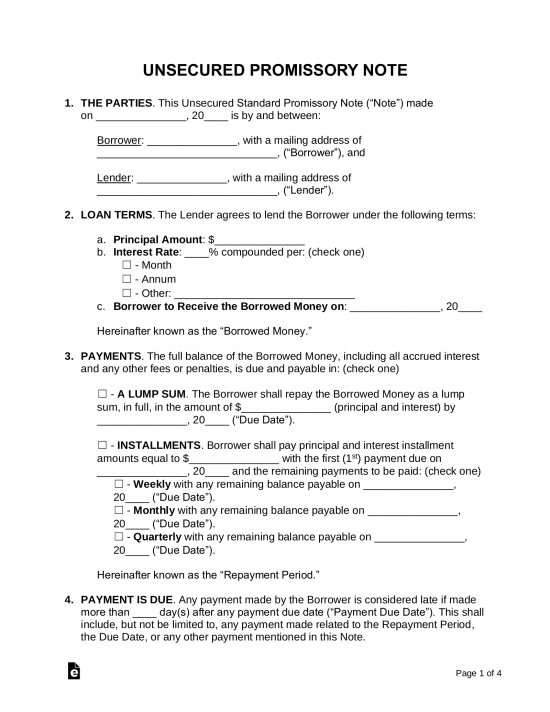

Promissory note template georgia - An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full. Unlike a secured promissory note, the lender is taking into account the borrower’s credibility without receiving anything in return if they shall default on their payments. For written contracts, the maximum 16% on loans below $3,000, 5% per month on loans between $3,000 and $250,000, and no limit on loans above $250,000. The default is 7% if no written contract is established. A promissory note is a promise to pay back money owed within a specific timeframe.

Free Promissory Note Templates Word PDF eForms

An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full. For written contracts, the maximum 16% on loans below $3,000, 5% per month on loans between $3,000 and $250,000, and no limit on loans above $250,000. The default is 7% if no written contract is established.

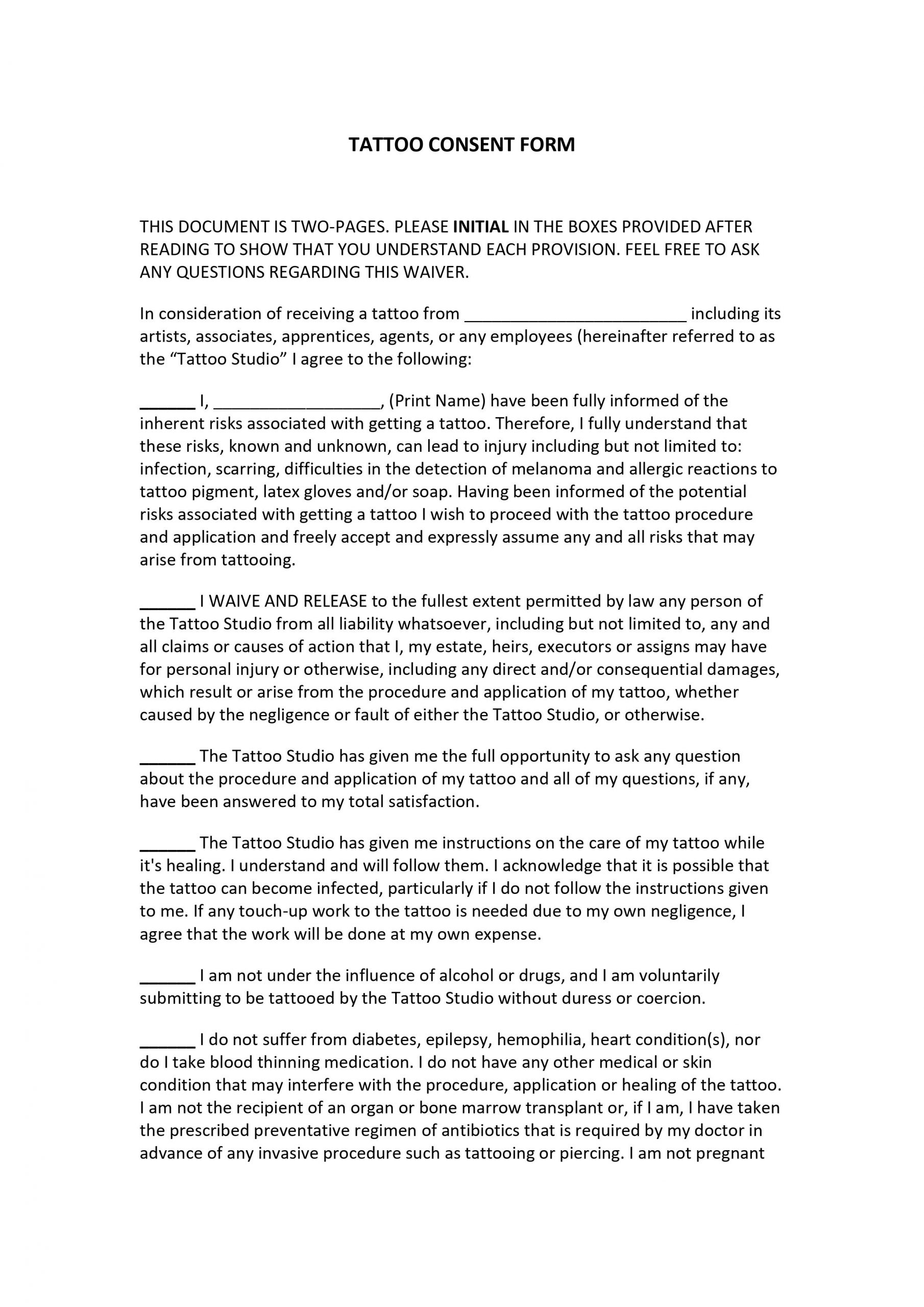

FREE Tattoo Consent Form

The default is 7% if no written contract is established. For written contracts, the maximum 16% on loans below $3,000, 5% per month on loans between $3,000 and $250,000, and no limit on loans above $250,000. An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full.

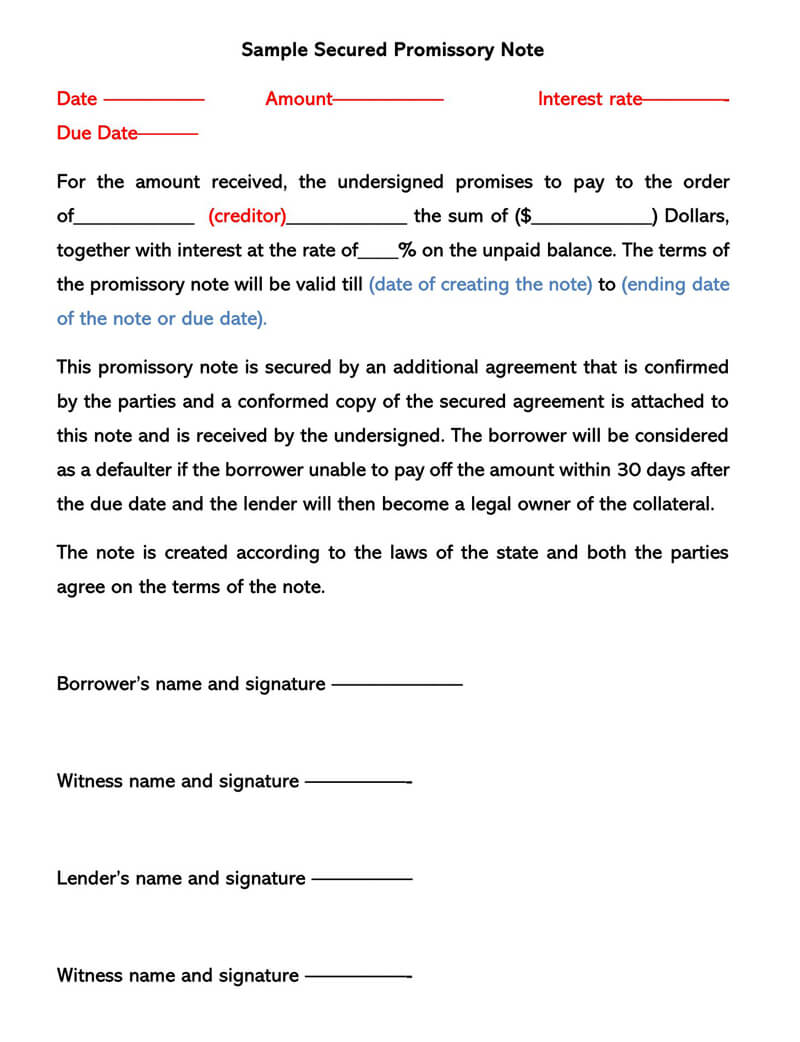

Free Secured Promissory Note Templates (by State) Basic Terms & Guide

Unlike a secured promissory note, the lender is taking into account the borrower’s credibility without receiving anything in return if they shall default on their payments. The default is 7% if no written contract is established. For written contracts, the maximum 16% on loans below $3,000, 5% per month on loans between $3,000 and $250,000, and no limit on loans above $250,000.

North Carolina 10Day Notice to Quit Form NonPayment of Rent eForms

Unlike a secured promissory note, the lender is taking into account the borrower’s credibility without receiving anything in return if they shall default on their payments. The default is 7% if no written contract is established. An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full.

Free Living Will Template Of Free Blank Living Will forms

A promissory note is a promise to pay back money owed within a specific timeframe. Unlike a secured promissory note, the lender is taking into account the borrower’s credibility without receiving anything in return if they shall default on their payments. For written contracts, the maximum 16% on loans below $3,000, 5% per month on loans between $3,000 and $250,000, and no limit on loans above $250,000.

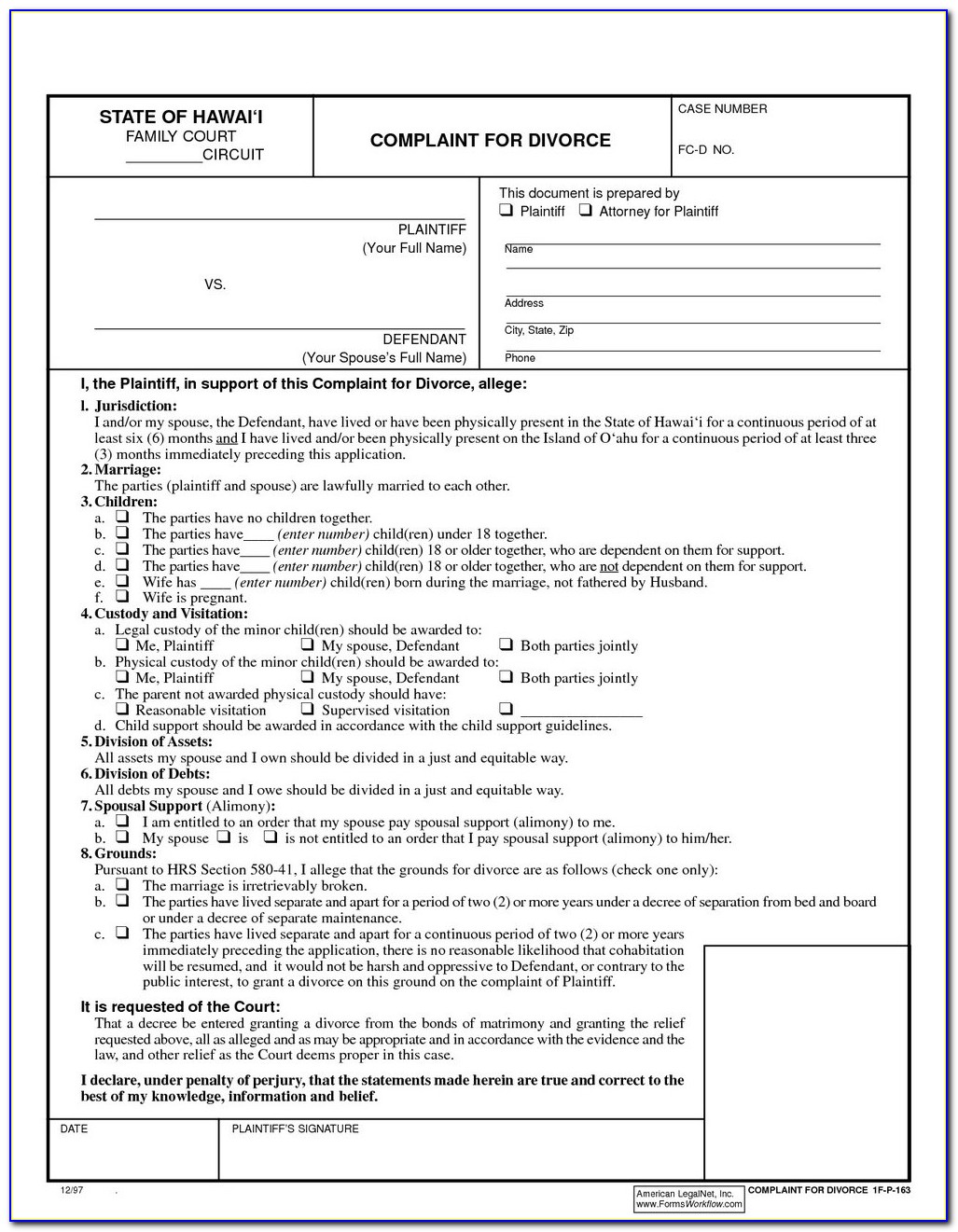

Arkansas Divorce Forms Pdf Form Resume Examples XnDEXynkWl

An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full. A promissory note is a promise to pay back money owed within a specific timeframe. For written contracts, the maximum 16% on loans below $3,000, 5% per month on loans between $3,000 and $250,000, and no limit on loans above $250,000.

Corporate Resolution Template Pdf Template 1 Resume Examples

Unlike a secured promissory note, the lender is taking into account the borrower’s credibility without receiving anything in return if they shall default on their payments. An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full. A promissory note is a promise to pay back money owed within a specific timeframe.

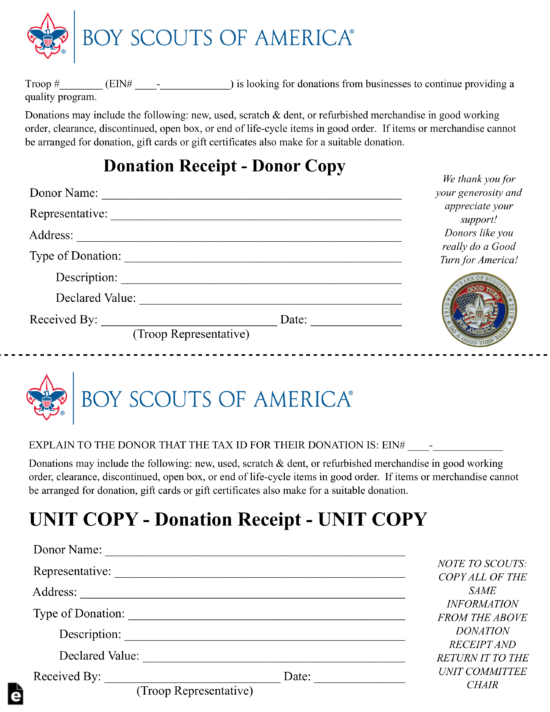

Free Boy Scouts of America Donation Receipt Template PDF eForms

Unlike a secured promissory note, the lender is taking into account the borrower’s credibility without receiving anything in return if they shall default on their payments. The default is 7% if no written contract is established. An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full.

An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full. For written contracts, the maximum 16% on loans below $3,000, 5% per month on loans between $3,000 and $250,000, and no limit on loans above $250,000. The default is 7% if no written contract is established. Unlike a secured promissory note, the lender is taking into account the borrower’s credibility without receiving anything in return if they shall default on their payments. A promissory note is a promise to pay back money owed within a specific timeframe.