Sales Tax Policy Template

Sales tax policy template - In accordance with applicable state and local laws, we are required to charge sales tax in localities where dick's. See the sales tax rate. The department of revenue updates these rates in january and july. Learn about sales & use tax; The sales tax report consist of two tabs that are sales tax summary and sales tax audit report. How to calculate sales tax. Basic invoice with sales tax. Invoice with sales tax set the tax rate, and this accessible invoice template will calculate the tax automatically on the sale of your products or services. Ad manage, review, approve, & track all employee expenses from a dashboard right in advanced. Work smarter with quickbooks® online advanced as the financial hub for your business.

Sales tax id verification templates. Log in to walmart seller center if you want to update the sales tax settings. Design a professional invoice for your. Fireworks excise tax return import. From the use of sampling in a sales and use tax environment.

Delivery Receipt Form

Enter quantity, description, unit price, line totals for each item, subtotal, sales tax, shipping, and a. See the sales tax rate. Customize this simple invoice in word for your business.

Printable IRS Form 1099MISC for Tax Year 2017 For 2018 Tax Season

Design a professional invoice for your. Determine the current sales tax rate. The sales tax report consist of two tabs that are sales tax summary and sales tax audit report.

Medical Billing Format

For example, if an item is offered for $10 in the. This report is intended solely as an educational document for taxpayers and tax administration agencies; Determine the current sales tax rate.

"Green" Hotels Association Printed Cards

Sales tax summary includes the summary of taxes that consists of the tax rate, tax account. Invoice with sales tax set the tax rate, and this accessible invoice template will calculate the tax automatically on the sale of your products or services. Department using the approved sales and business tax reporting template no later than 3pm the 6th working day of each month.

Contact IFA Ujjwal your Financial Advisor in Kolkata for Mutual Fund

The department of revenue updates these rates in january and july. Go to general settings then partner profile. When offering an item for sale, it’s generally known that the sales tax is not included until the item is purchased.

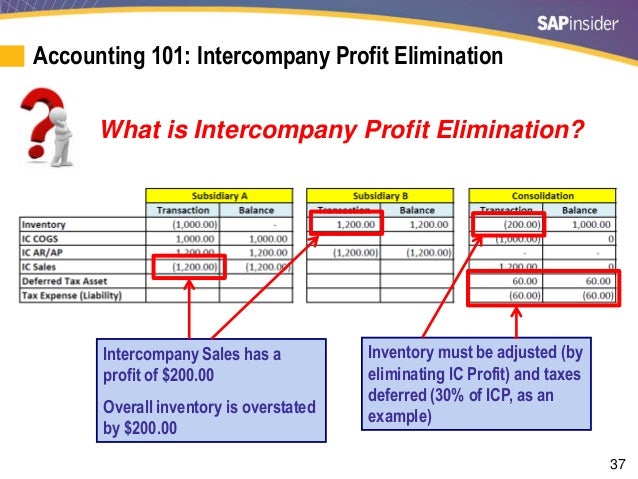

the Top 7 Accounting Challenges in SAP ERP Fi…

Enter quantity, description, unit price, line totals for each item, subtotal, sales tax, shipping, and a. Go to general settings then partner profile. See the sales tax rate.

Ayusya Home Health Care Pvt LtdBangaloreChennaiMaduraiCoimbatore

The department of revenue updates these rates in january and july. Go to general settings then partner profile. The sales tax report consist of two tabs that are sales tax summary and sales tax audit report.

For example, if an item is offered for $10 in the. Work smarter with quickbooks® online advanced as the financial hub for your business. Department using the approved sales and business tax reporting template no later than 3pm the 6th working day of each month. Fireworks excise tax return import. Basic invoice with sales tax. The sales tax report consist of two tabs that are sales tax summary and sales tax audit report. Requests for extensions of time must be approved by the. Customize this simple invoice in word for your business. In accordance with applicable state and local laws, we are required to charge sales tax in localities where dick's. This report is intended solely as an educational document for taxpayers and tax administration agencies;

When offering an item for sale, it’s generally known that the sales tax is not included until the item is purchased. Be prepared with a list of. Enter quantity, description, unit price, line totals for each item, subtotal, sales tax, shipping, and a. Sales tax summary includes the summary of taxes that consists of the tax rate, tax account. State and local sales taxes. Because best buy does business throughout the united states and collects and remits sales tax as required by law, best buy also collects and remits sales tax as. How to calculate sales tax. Company and new small business owners know the importance of having a general policy and procedure for their daily operations. A sales commission policy fulfills the policy of establishing responsibilities for setting commission rates and to define the point at which commissions are considered to be earned by. Ad manage, review, approve, & track all employee expenses from a dashboard right in advanced.

See the sales tax rate. Determine the current sales tax rate. Log in to walmart seller center if you want to update the sales tax settings. Learn about sales & use tax; The department of revenue updates these rates in january and july. From the use of sampling in a sales and use tax environment. Invoice with sales tax set the tax rate, and this accessible invoice template will calculate the tax automatically on the sale of your products or services. Go to general settings then partner profile. Design a professional invoice for your. Sales tax id verification templates.