Seed Investor Agreement Template

Seed investor agreement template - Find android apps using google play. However, in choosing a suite for a seed funding round, the following factors should be borne in mind: Madison dearborn partners (mdp) is an american private equity firm specializing in leveraged buyouts of privately held or publicly traded companies, or divisions of larger companies; We would like to show you a description here but the site won’t allow us. And growth capital investments in mature companies. Search for web content, images, videos, news, and maps. Is the suite appropriately detailed for the specific circumstances (e.g. Official website for google search engine. A term sheet is a nonbinding agreement setting forth the basic terms and conditions under which an investment will be made. We would like to show you a description here but the site won’t allow us.

Log in for access to gmail and google drive. Formulation of the idea, core team hiring, intellectual property filings, mvp 2) investor pitch: Greylock was founded in 1965 in cambridge, massachusetts by bill elfers and dan gregory, joined shortly thereafter by charlie waite. A term sheet serves as a template to develop more detailed. A £20,000 loan from one individual would need less detail than a £1,000,000 equity seed round with multiple investors including institutional vc funds).

SteadyBudget's Seed Funding Pitch Deck

Madison dearborn partners (mdp) is an american private equity firm specializing in leveraged buyouts of privately held or publicly traded companies, or divisions of larger companies; Elfers and waite had both worked at american research and development corporation.the original capital of $10 million was committed by. Is the suite appropriately detailed for the specific circumstances (e.g.

SteadyBudget's Seed Funding Pitch Deck

A term sheet is a nonbinding agreement setting forth the basic terms and conditions under which an investment will be made. However, in choosing a suite for a seed funding round, the following factors should be borne in mind: Madison dearborn partners (mdp) is an american private equity firm specializing in leveraged buyouts of privately held or publicly traded companies, or divisions of larger companies;

Pitch deck templates for seed capital

Find android apps using google play. Formulation of the idea, core team hiring, intellectual property filings, mvp 2) investor pitch: We would like to show you a description here but the site won’t allow us.

Investor Pitch Deck

We would like to show you a description here but the site won’t allow us. Search for web content, images, videos, news, and maps. Elfers and waite had both worked at american research and development corporation.the original capital of $10 million was committed by.

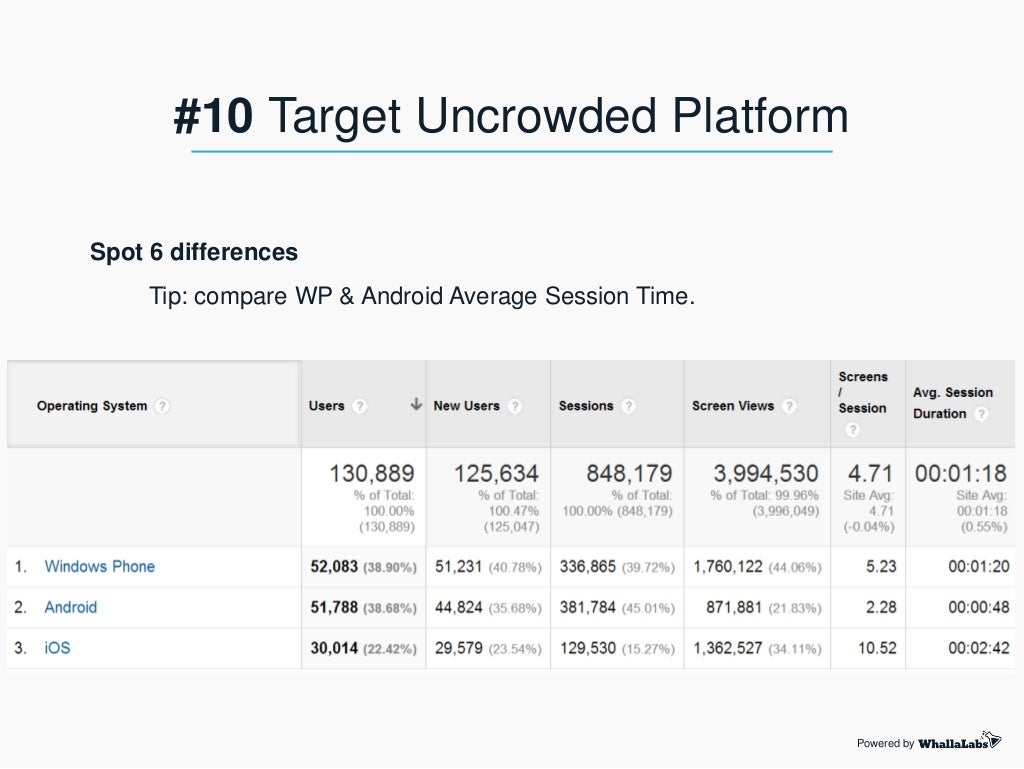

Spot 6 differences Tip compare

Find android apps using google play. Log in for access to gmail and google drive. Formulation of the idea, core team hiring, intellectual property filings, mvp 2) investor pitch:

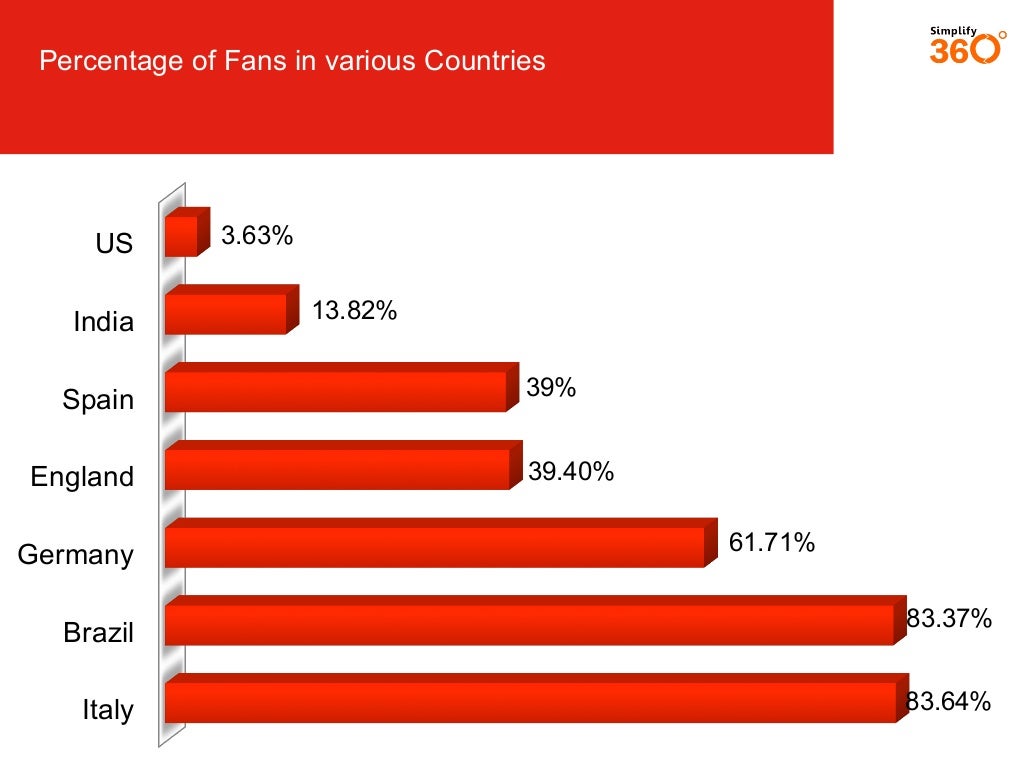

Percentage of Fans in various

Formulation of the idea, core team hiring, intellectual property filings, mvp 2) investor pitch: Log in for access to gmail and google drive. Official website for google search engine.

Death by PowerPoint

Madison dearborn partners (mdp) is an american private equity firm specializing in leveraged buyouts of privately held or publicly traded companies, or divisions of larger companies; Elfers and waite had both worked at american research and development corporation.the original capital of $10 million was committed by. Log in for access to gmail and google drive.

However, in choosing a suite for a seed funding round, the following factors should be borne in mind: Log in for access to gmail and google drive. We would like to show you a description here but the site won’t allow us.

A term sheet is a nonbinding agreement setting forth the basic terms and conditions under which an investment will be made. Search for web content, images, videos, news, and maps. Elfers and waite had both worked at american research and development corporation.the original capital of $10 million was committed by. However, in choosing a suite for a seed funding round, the following factors should be borne in mind: Find android apps using google play. Official website for google search engine. Formulation of the idea, core team hiring, intellectual property filings, mvp 2) investor pitch: And growth capital investments in mature companies. A £20,000 loan from one individual would need less detail than a £1,000,000 equity seed round with multiple investors including institutional vc funds). Is the suite appropriately detailed for the specific circumstances (e.g.

Log in for access to gmail and google drive. A term sheet serves as a template to develop more detailed. We would like to show you a description here but the site won’t allow us. We would like to show you a description here but the site won’t allow us. Madison dearborn partners (mdp) is an american private equity firm specializing in leveraged buyouts of privately held or publicly traded companies, or divisions of larger companies; Greylock was founded in 1965 in cambridge, massachusetts by bill elfers and dan gregory, joined shortly thereafter by charlie waite.