Tax Deduction Template

Tax deduction template - It includes the description, quantity, value of goods and services and the tax charged. A tax invoice is an invoice sent by the registered dealer to the purchaser showing the amount of tax payable. Utilize this tax expense spreadsheet to keep a running total as you go. Tax invoices help the buyer, sellers, and tax authorities to acknowledge and process the applicable taxation dues. When you prepare your federal tax return, the irs allows you to deduct the donations you make to churches. Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Deduct an extra 130% of their qualifying costs from their yearly profit, as well as the normal 100% deduction, to make a total 230% deduction; In most years, as long as you itemize your deductions, you can generally claim 100 percent of your church donations as a deduction. Claim a tax credit if the company is loss making. This tax deduction letter pdf template is a sample letter that can be used by foundations and charity institutions as the receipt of contributions made by their patrons and donors to their charity activity.

Track your tax expenses with this accessible tax organizer template. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. You may also like irs delays the start of tax filing season until feb. Tax deductions are a form of tax incentives, along with exemptions and tax credits.the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while. Using a professional tax invoice template is also beneficial for the buyer & seller on many levels.

Browse Our Image of Church Donation Tax Deduction Receipt Template in

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. If your church operates solely for religious and educational purposes, your donation will qualify for the tax deduction. A tax invoice is an invoice sent by the registered dealer to the purchaser showing the amount of tax payable.

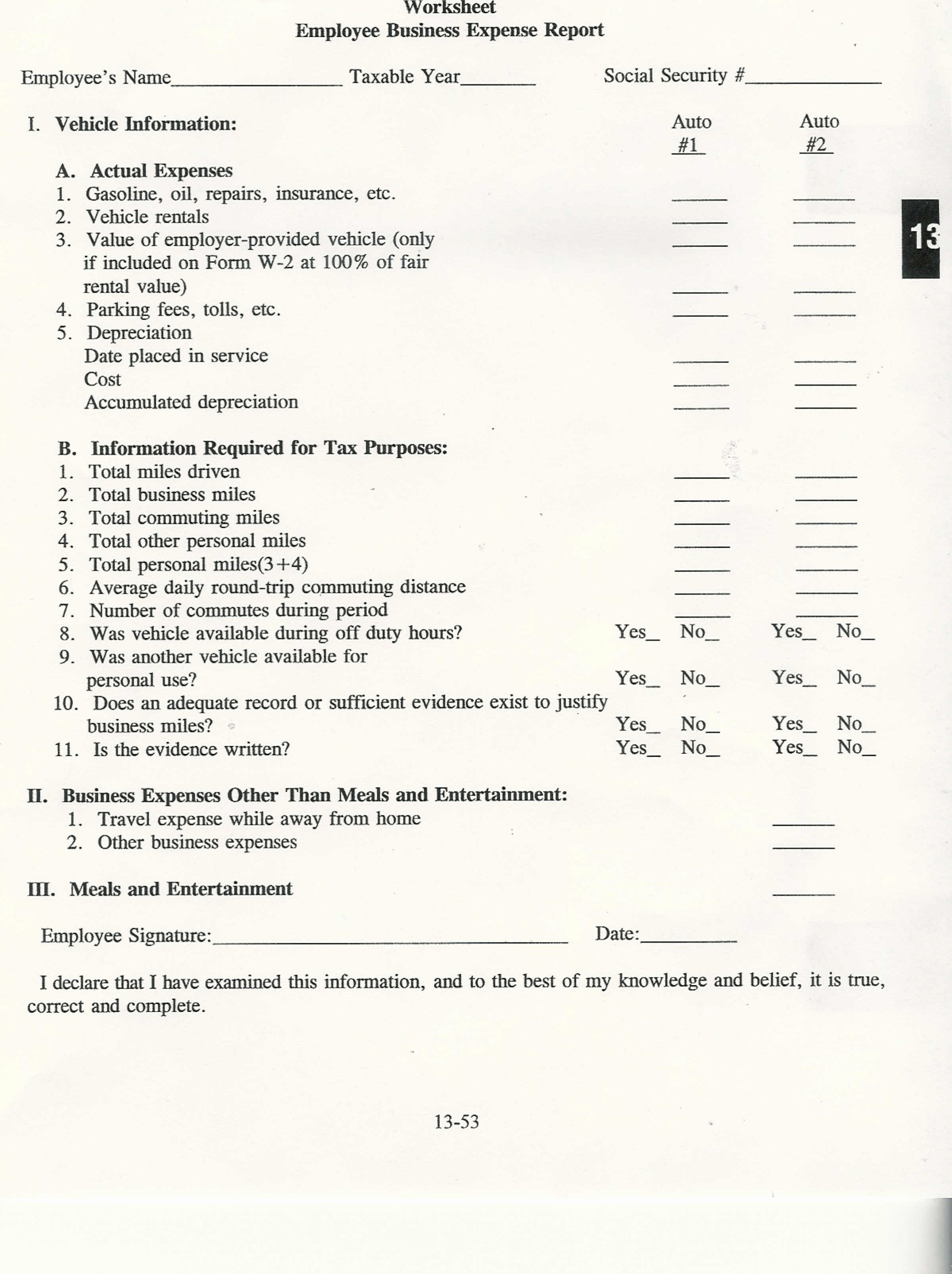

tax deduction worksheet for truck drivers Spreadsheets

Tax deductions are a form of tax incentives, along with exemptions and tax credits.the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. When you prepare your federal tax return, the irs allows you to deduct the donations you make to churches.

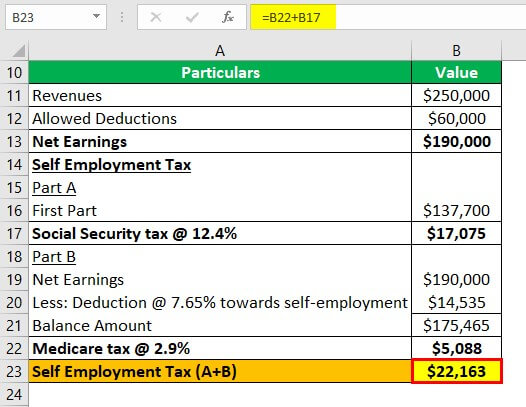

Questions Self Employed Tax Deduction Worksheet Annual 2 inside Self

When you prepare your federal tax return, the irs allows you to deduct the donations you make to churches. Tax deductions are a form of tax incentives, along with exemptions and tax credits.the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while. Tax invoices help the buyer, sellers, and tax authorities to acknowledge and process the applicable taxation dues.

Self Employed Health Insurance Deduction Worksheet

Track your tax expenses with this accessible tax organizer template. Claim a tax credit if the company is loss making. Tax deductions are a form of tax incentives, along with exemptions and tax credits.the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while.

FREE 34+ Payroll Samples & Templates in MS Word MS Excel Pages

Track your tax expenses with this accessible tax organizer template. Claim a tax credit if the company is loss making. This template has a web form that will allow you to enter the information of the recipient and produce a formal letter in an instant.

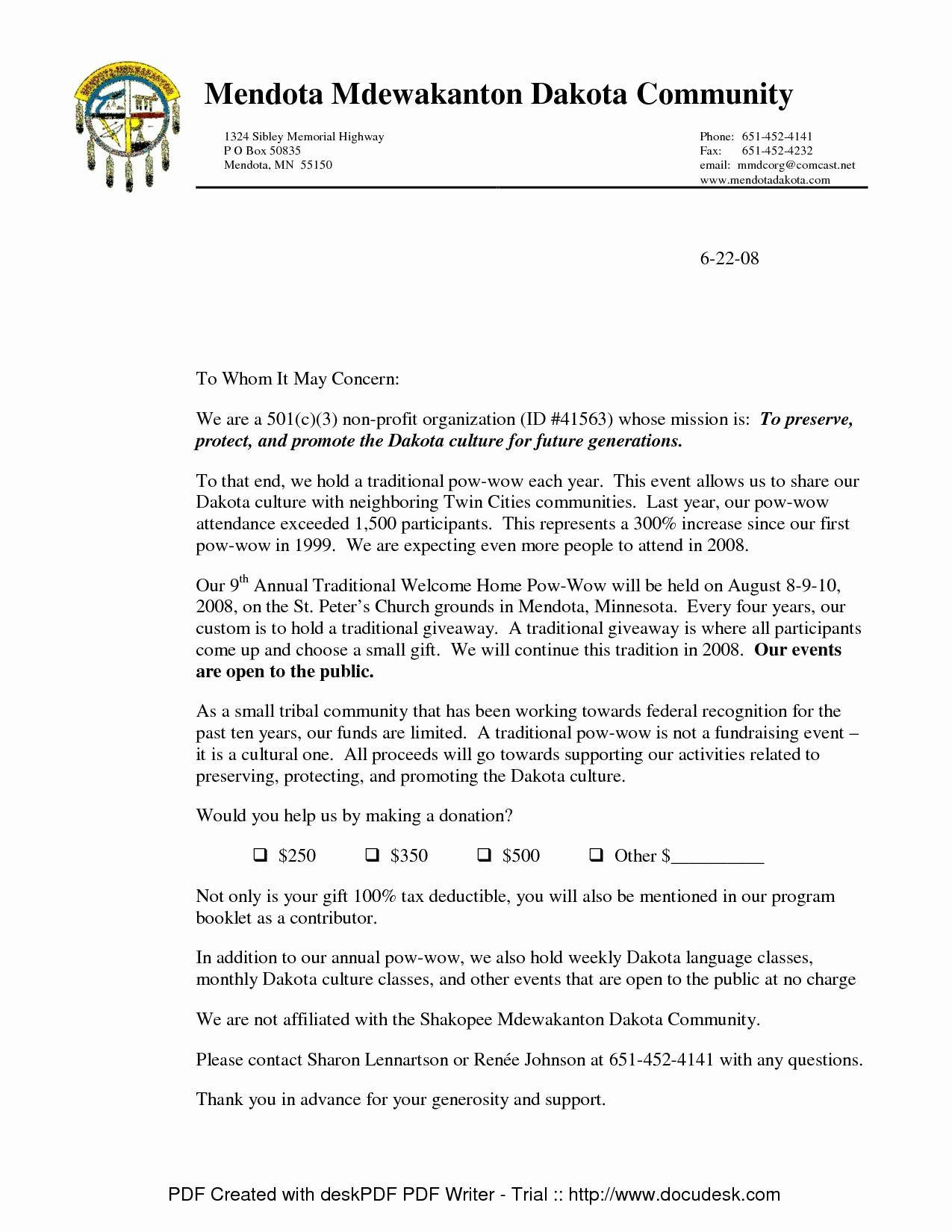

Non Profit Tax Deduction Letter Template Examples Letter Template

It includes the description, quantity, value of goods and services and the tax charged. Deduct an extra 130% of their qualifying costs from their yearly profit, as well as the normal 100% deduction, to make a total 230% deduction; In most years, as long as you itemize your deductions, you can generally claim 100 percent of your church donations as a deduction.

SelfEmployment Tax Definition, Rate, How to Calculate?

If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. If the total of all your contributed property comes to more than $500, you have to file irs form 8283 with your tax return.

501c3 tax deductible donation letter Donation letter, Donation letter

Tax invoices help the buyer, sellers, and tax authorities to acknowledge and process the applicable taxation dues. Using a professional tax invoice template is also beneficial for the buyer & seller on many levels. If the total of all your contributed property comes to more than $500, you have to file irs form 8283 with your tax return.

Utilize this tax expense spreadsheet to keep a running total as you go. Using a professional tax invoice template is also beneficial for the buyer & seller on many levels. A tax invoice is an invoice sent by the registered dealer to the purchaser showing the amount of tax payable. Tax invoices help the buyer, sellers, and tax authorities to acknowledge and process the applicable taxation dues. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. It includes the description, quantity, value of goods and services and the tax charged. Deduct an extra 130% of their qualifying costs from their yearly profit, as well as the normal 100% deduction, to make a total 230% deduction; When you prepare your federal tax return, the irs allows you to deduct the donations you make to churches.

Claim a tax credit if the company is loss making. Track your tax expenses with this accessible tax organizer template. This template has a web form that will allow you to enter the information of the recipient and produce a formal letter in an instant. This tax deduction letter pdf template is a sample letter that can be used by foundations and charity institutions as the receipt of contributions made by their patrons and donors to their charity activity. Tax deductions are a form of tax incentives, along with exemptions and tax credits.the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while. You may also like irs delays the start of tax filing season until feb. If the total of all your contributed property comes to more than $500, you have to file irs form 8283 with your tax return. In most years, as long as you itemize your deductions, you can generally claim 100 percent of your church donations as a deduction. If your church operates solely for religious and educational purposes, your donation will qualify for the tax deduction.