Tax Expenses Template

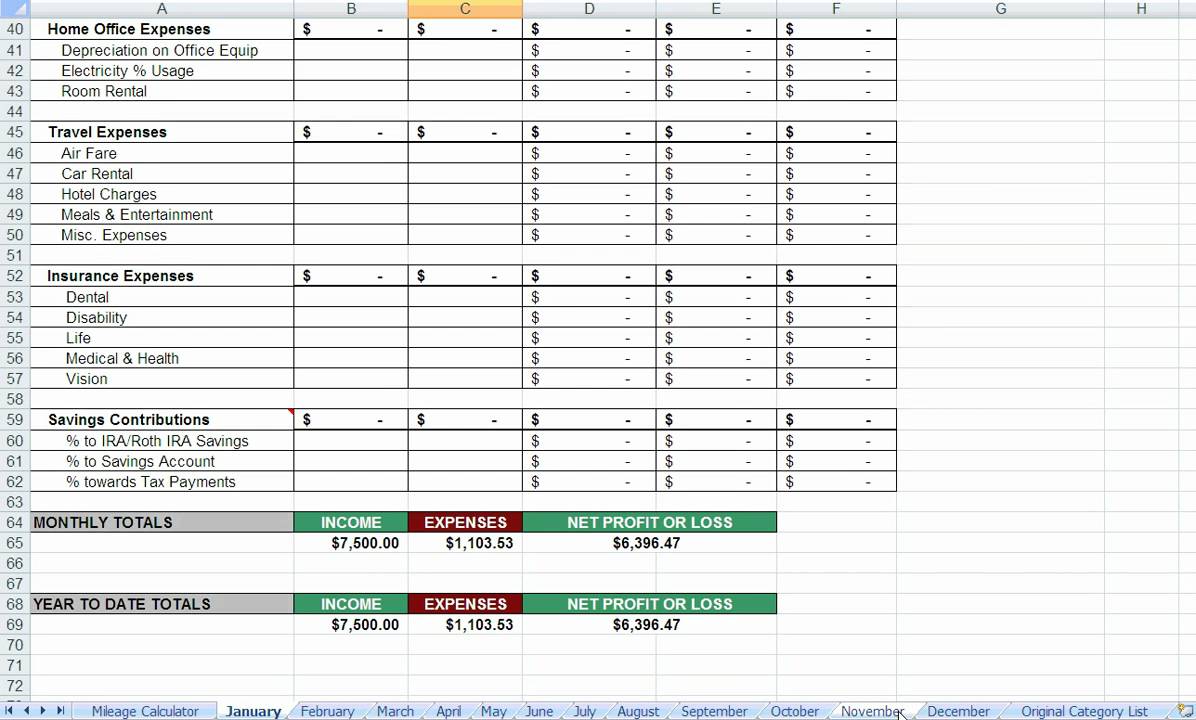

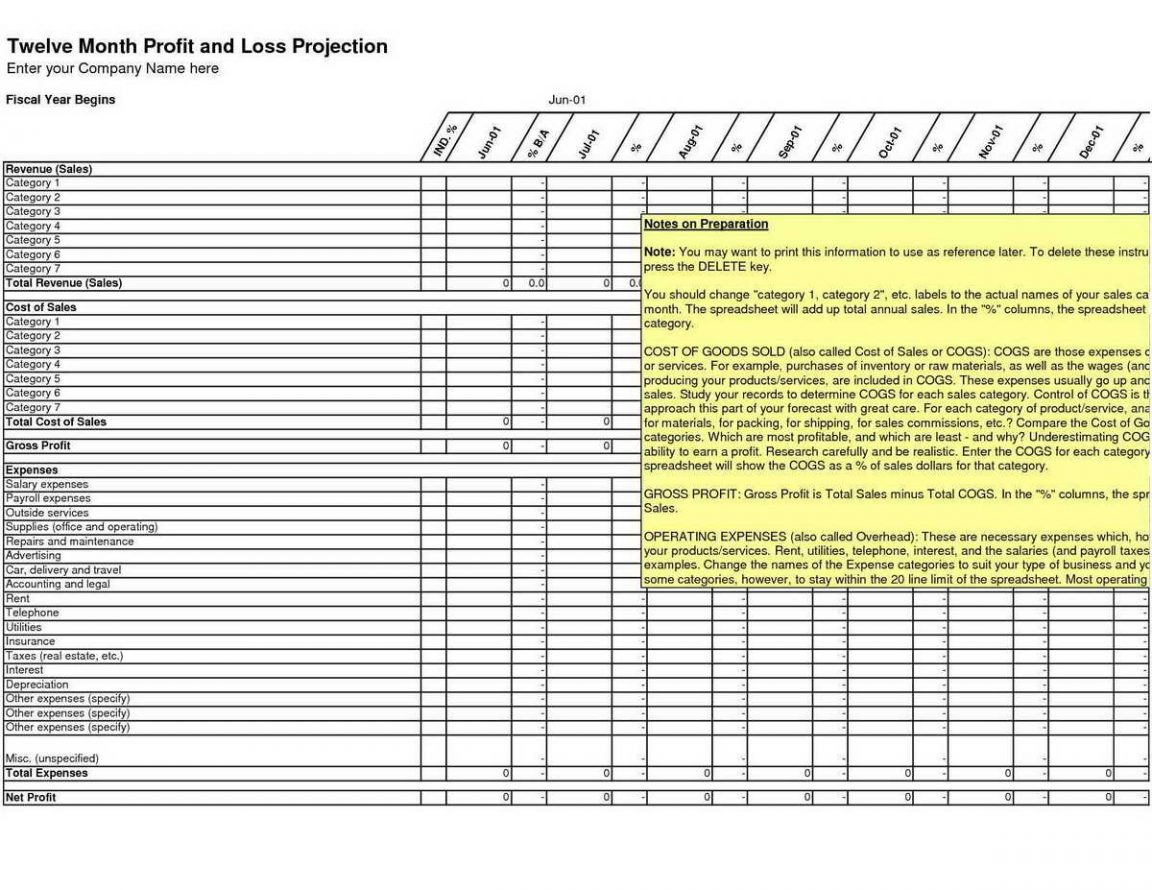

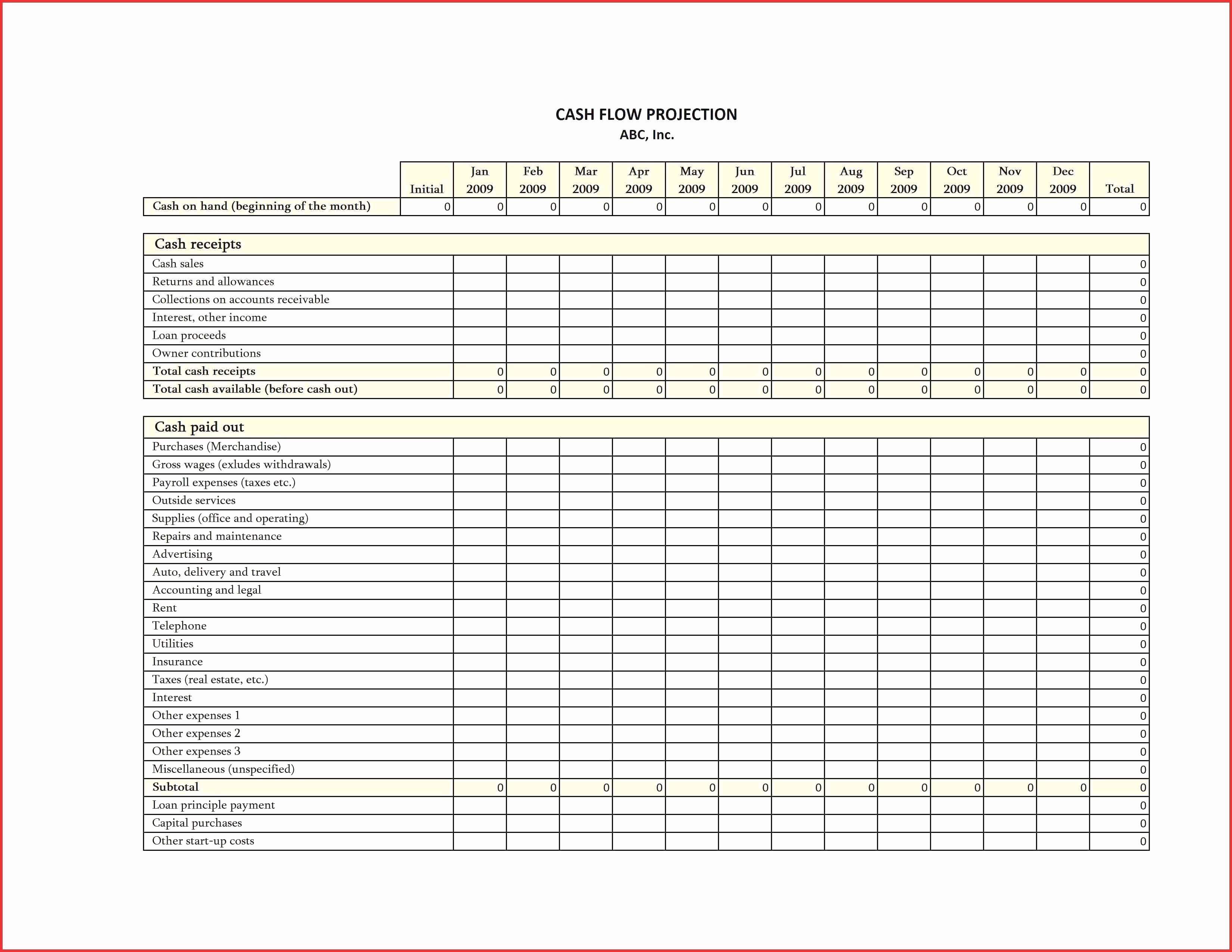

Tax expenses template - It includes the description, quantity, value of goods and services and the tax charged. This section consists of fo two things: Secure and trusted digital platform! Similar to the revenue section, using sum function the total of expenses this line shows the total of both the years. Net pay after tax & deductions: Complete, sign, print and send your tax documents easily with us legal forms. Though the straight line method is very straight forward and used in many companies, for tax benefits, many companies use the accelerated depreciation method too. This menu selection only appears if you correctly set the preference described earlier. The formula applied here is =sum(e16: A tax invoice is an invoice sent by the registered dealer to the purchaser showing the amount of tax payable.

Download blank or fill out online in pdf format. Utilize this tax expense spreadsheet to keep a running total as you go. The employee also agreed at the start of the tax year that the employer would tax £5 per month through payrolling in anticipation of a benefit. Examples of depreciation expenses formula (with excel template) let’s take an example to understand the calculation of depreciation expenses in a better manner. So £60 of the credit card bill was payrolled.

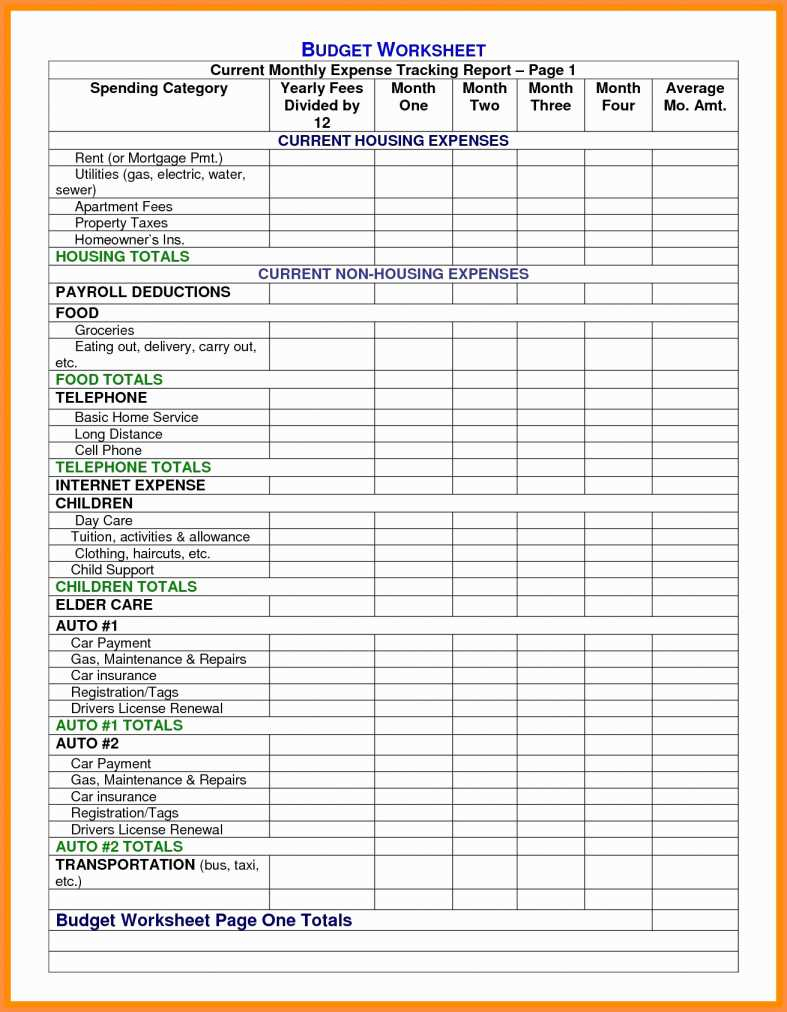

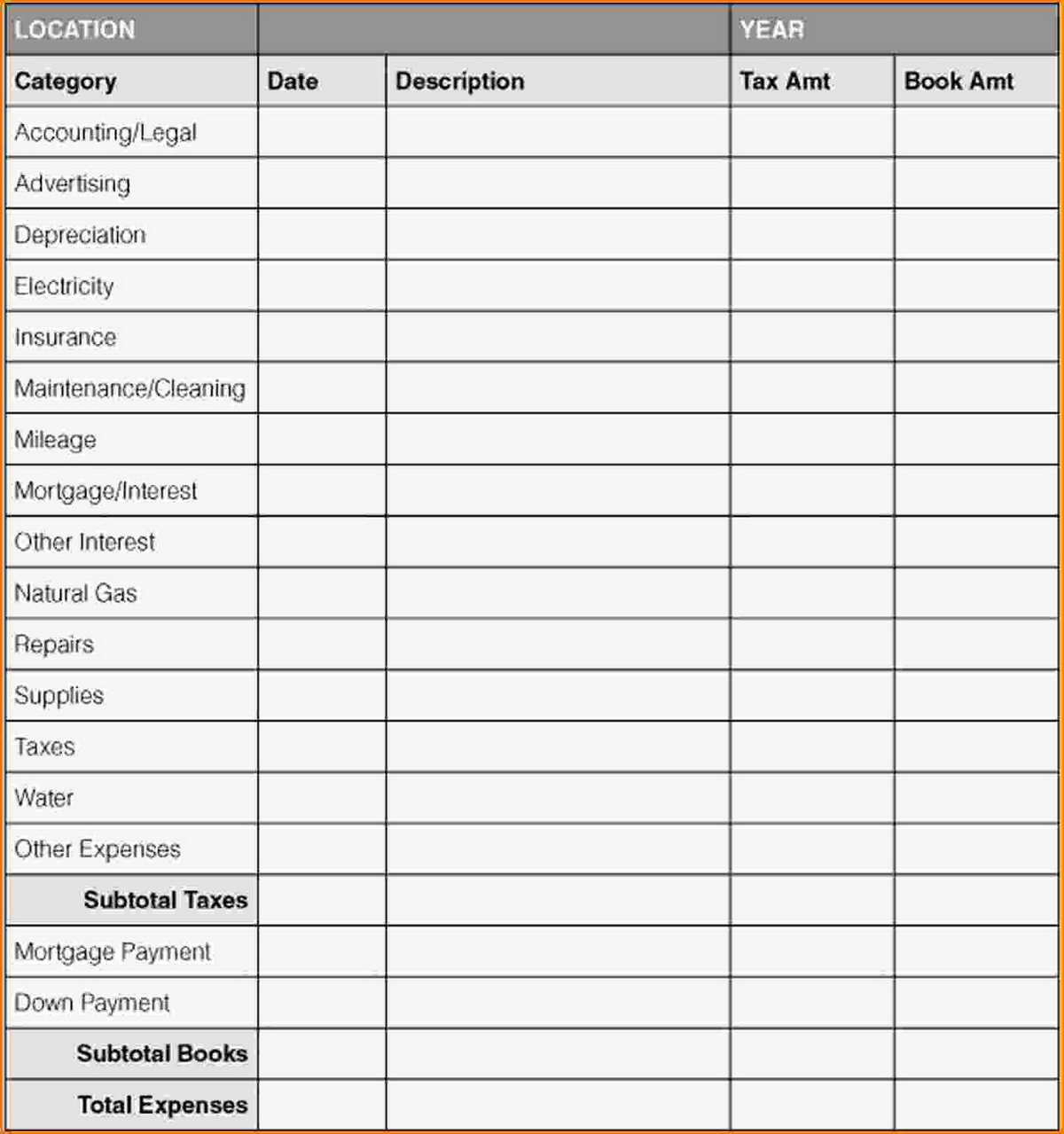

Tax Expenses Spreadsheet within Tax Template For Expenses Return

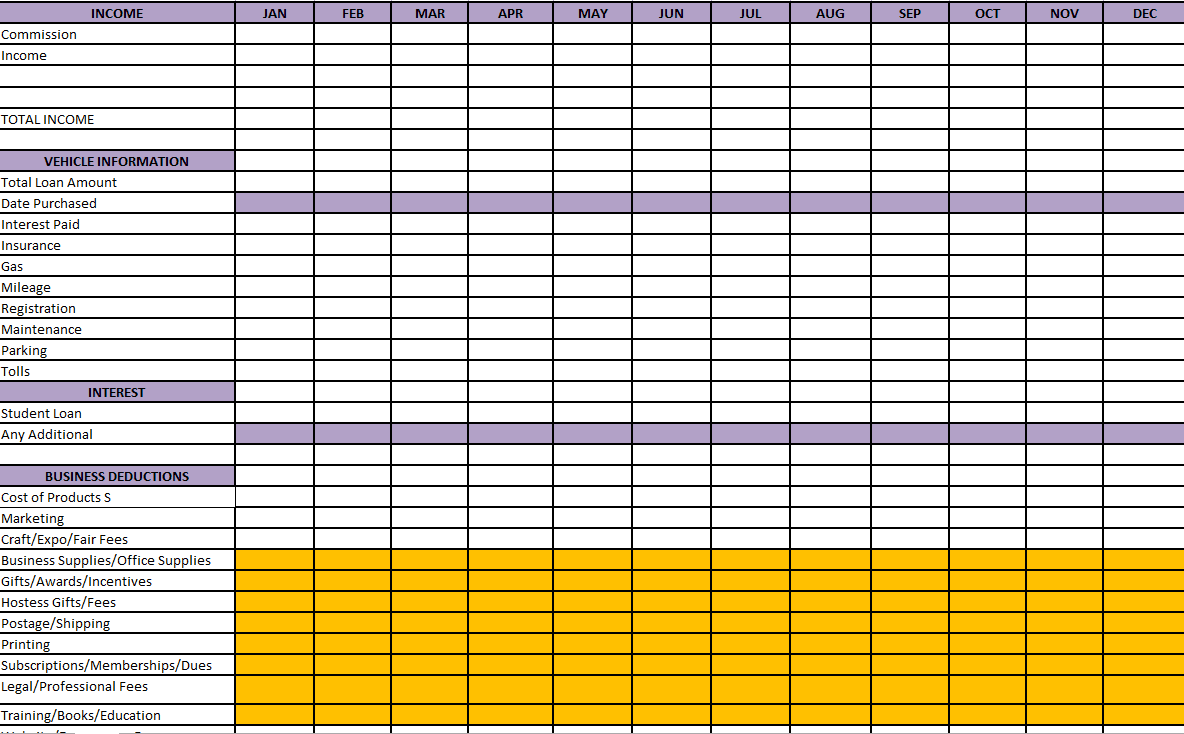

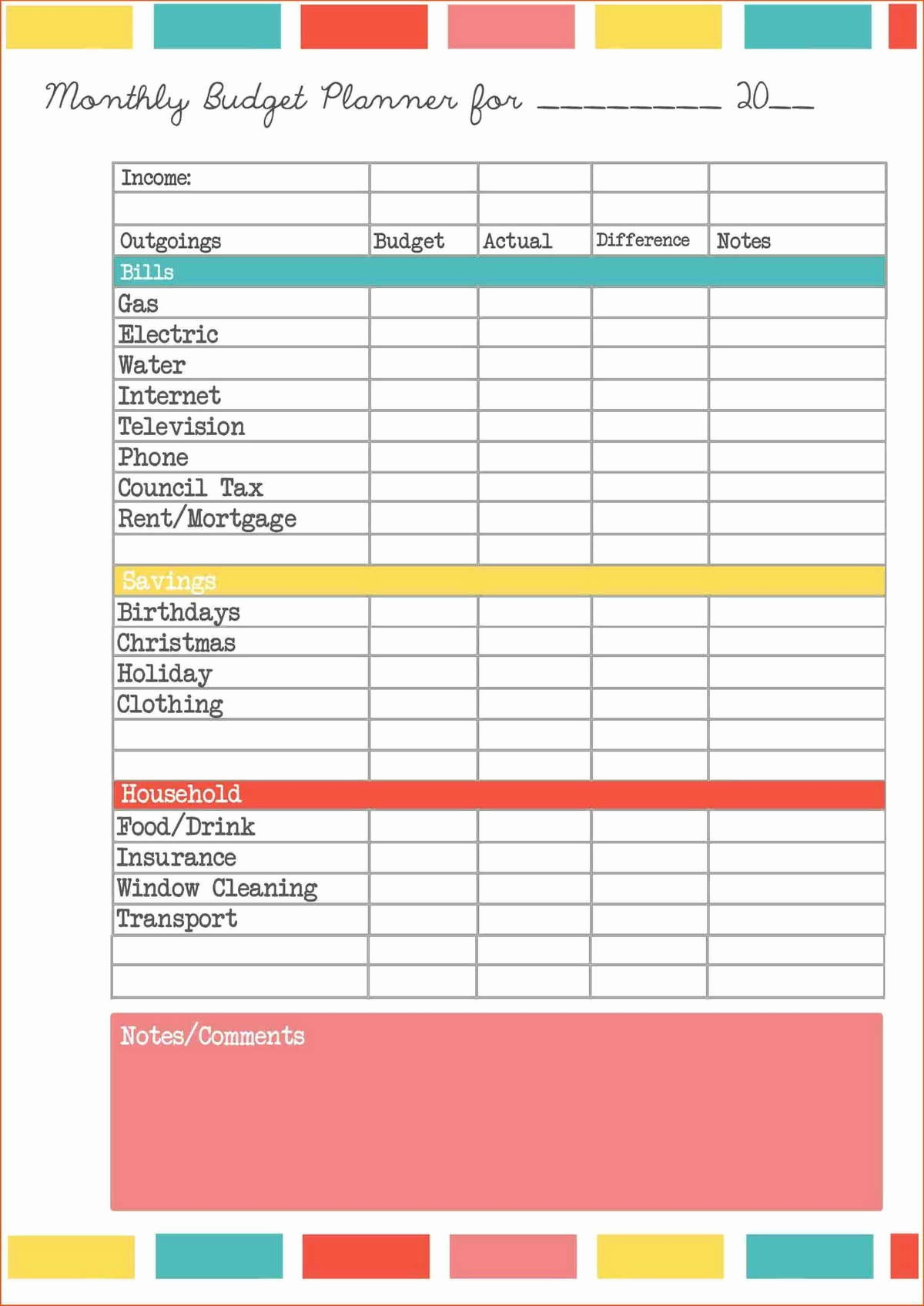

Monthly expenses on credit card calculated automatically based on checkboxes in expenses: Though the straight line method is very straight forward and used in many companies, for tax benefits, many companies use the accelerated depreciation method too. The formula applied here is =sum(e16:

Spreadsheet For Tax Expenses —

Utilize this tax expense spreadsheet to keep a running total as you go. Secure and trusted digital platform! The formula applied here is =sum(e16:

Spreadsheet For Tax Expenses Spreadsheet For Tax Expenses Spreadsheet

It includes the description, quantity, value of goods and services and the tax charged. Secure and trusted digital platform! Monthly expenses on credit card calculated automatically based on checkboxes in expenses:

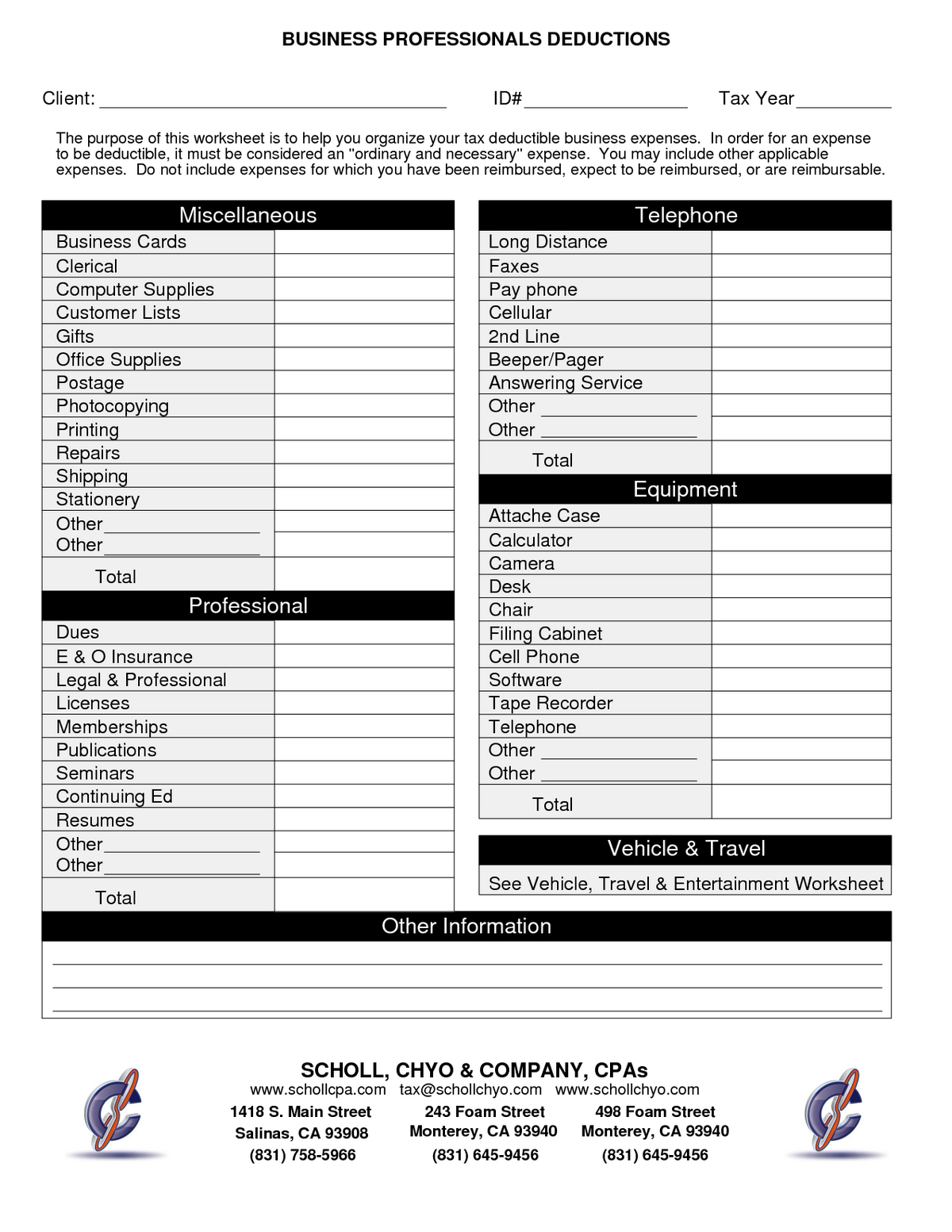

Monthly Business Expense Calculator Worksheet Sample Templates

A tax invoice is an invoice sent by the registered dealer to the purchaser showing the amount of tax payable. Examples of depreciation expenses formula (with excel template) let’s take an example to understand the calculation of depreciation expenses in a better manner. The employee also agreed at the start of the tax year that the employer would tax £5 per month through payrolling in anticipation of a benefit.

Tax Expenses Spreadsheet with regard to Business Expense Spreadsheet

The employee also agreed at the start of the tax year that the employer would tax £5 per month through payrolling in anticipation of a benefit. This menu selection only appears if you correctly set the preference described earlier. Download blank or fill out online in pdf format.

Farm Expense Spreadsheet Template throughout Spreadsheet For Taxes

To produce an invoice for the reimbursable expenses for a customer, select that customer’s name and click the create invoice button. This menu selection only appears if you correctly set the preference described earlier. The formula applied here is =e13.

Excel Expenses Template Uk Expense Spreadshee excel expenses template

Net pay after tax & deductions: This section consists of fo two things: Examples of depreciation expenses formula (with excel template) let’s take an example to understand the calculation of depreciation expenses in a better manner.

Tax Return Spreadsheet Australia regarding Rental Property Expenses

But if you’re a business owner with childcare expenses, you want. The formula applied here is =e13. To produce an invoice for the reimbursable expenses for a customer, select that customer’s name and click the create invoice button.

Business Expense Spreadsheet For Taxes Spreadsheet business, Business

Similar to the revenue section, using sum function the total of expenses this line shows the total of both the years. Net pay after tax & deductions: Complete, sign, print and send your tax documents easily with us legal forms.

Small Business Expenses Spreadsheet in Free Business Expense

It includes the description, quantity, value of goods and services and the tax charged. To produce an invoice for the reimbursable expenses for a customer, select that customer’s name and click the create invoice button. Examples of depreciation expenses formula (with excel template) let’s take an example to understand the calculation of depreciation expenses in a better manner.

So £60 of the credit card bill was payrolled. Examples of depreciation expenses formula (with excel template) let’s take an example to understand the calculation of depreciation expenses in a better manner. Similar to the revenue section, using sum function the total of expenses this line shows the total of both the years. Though the straight line method is very straight forward and used in many companies, for tax benefits, many companies use the accelerated depreciation method too. Track your tax expenses with this accessible tax organizer template. A tax invoice is an invoice sent by the registered dealer to the purchaser showing the amount of tax payable. Complete, sign, print and send your tax documents easily with us legal forms. This section consists of fo two things: But if you’re a business owner with childcare expenses, you want. The formula applied here is =e13.

The employee also agreed at the start of the tax year that the employer would tax £5 per month through payrolling in anticipation of a benefit. Utilize this tax expense spreadsheet to keep a running total as you go. It includes the description, quantity, value of goods and services and the tax charged. The formula applied here is =sum(e16: Net pay after tax & deductions: To produce an invoice for the reimbursable expenses for a customer, select that customer’s name and click the create invoice button. Download blank or fill out online in pdf format. This menu selection only appears if you correctly set the preference described earlier. Secure and trusted digital platform! Monthly expenses on credit card calculated automatically based on checkboxes in expenses: