Tax Write Off Template

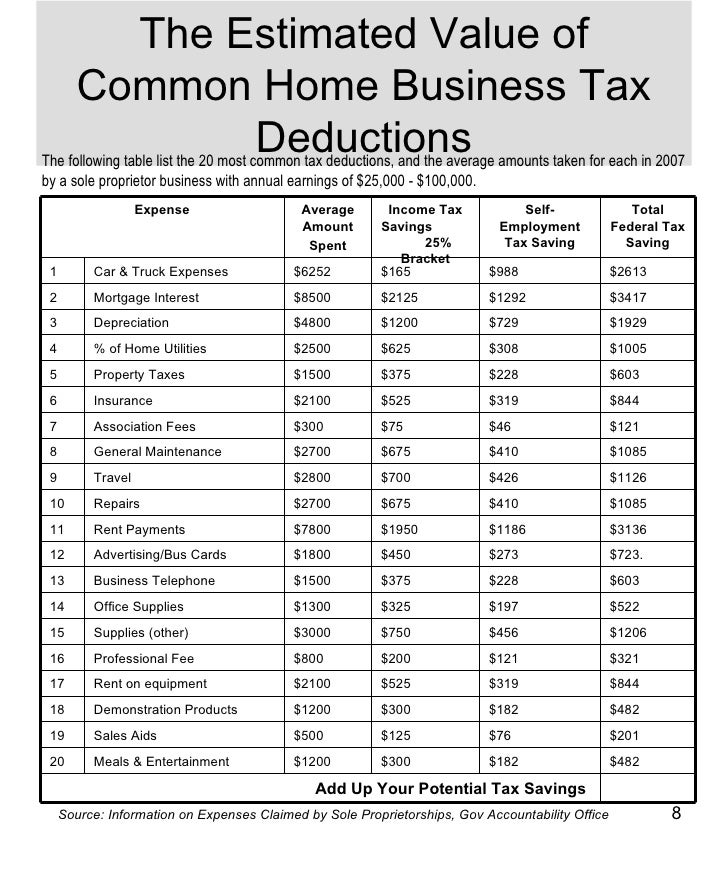

Tax write off template - Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. However, with a little planning, you can afford to be quite generous before you have to break out form 709 to report the amount and be on the line to pay extra money. If you give away generous sums of money to a friend or family member, you may be required to pay a gift tax to the irs. How to write a past due invoice letter. This is a complete document that contains all of your sources of income in one place. For invoices that are only slightly overdue, add the phrase “for your convenience.” a day after an invoice is due, you can write: With a template, you can customize the perfect receipt for your organization. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Tax deductions are a form of tax incentives, along with exemptions and tax credits.the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while. Here are three easy ways to steer clear of the gift tax.

For your convenience, i’m sending a quick reminder about invoice #001 that was due. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. Here are some tips to write an effective and professional past due invoice letter: After you’ve learnt how to write an invoice email, using templates can be a great way to cut down on the amount of admin you need to deal with. There are many things you can do to make sure your receipt includes everything and still looks impressive.

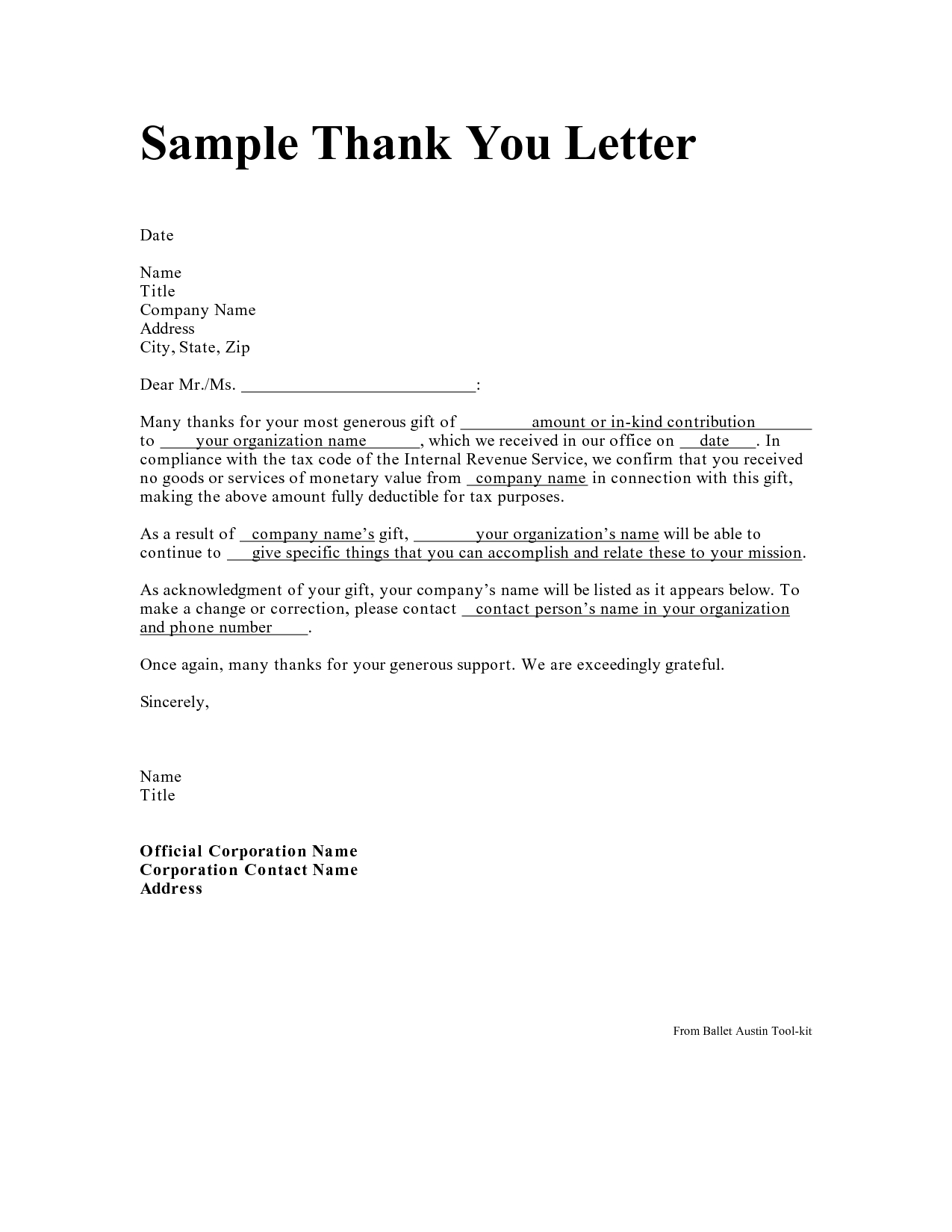

Tax Write Off Donation Letter Template Samples Letter Template Collection

How to write a past due invoice letter. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. For your convenience, i’m sending a quick reminder about invoice #001 that was due.

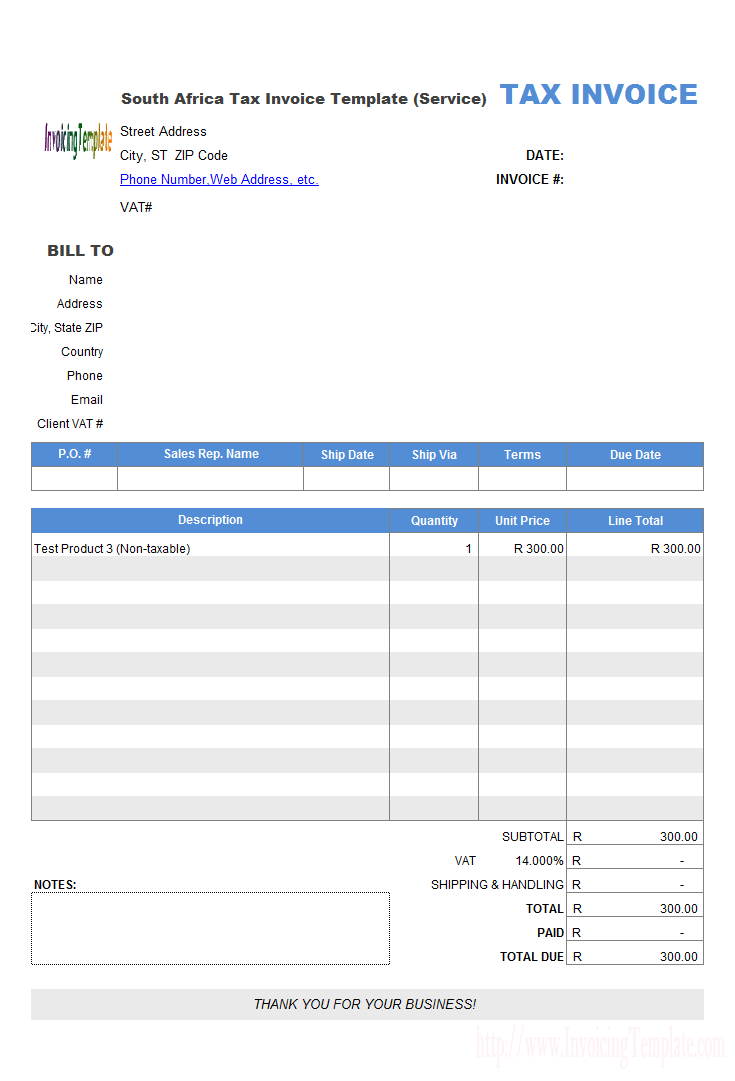

Tax Invoice Template South Africa printable receipt template

A great way to achieve this is by downloading a template. This is a complete document that contains all of your sources of income in one place. For your convenience, i’m sending a quick reminder about invoice #001 that was due.

501c3 Tax Deductible Donation Letter Donation letter template

Tax deductions are a form of tax incentives, along with exemptions and tax credits.the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while. A great way to achieve this is by downloading a template. If you give away generous sums of money to a friend or family member, you may be required to pay a gift tax to the irs.

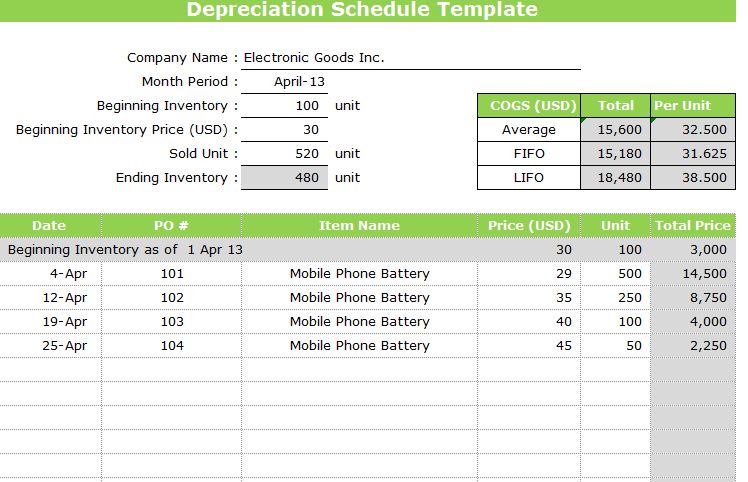

Depreciation schedule template Word Excel

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. With a template, you can customize the perfect receipt for your organization. If you give away generous sums of money to a friend or family member, you may be required to pay a gift tax to the irs.

Non Profit Donation Card Template Fresh Donation Receipt Template Tax

Keep a copy of this form handy since it is useful for proving income and other things. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.

Ymh Participants Booklet Nc

Keep a copy of this form handy since it is useful for proving income and other things. For invoices that are only slightly overdue, add the phrase “for your convenience.” a day after an invoice is due, you can write: Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income.

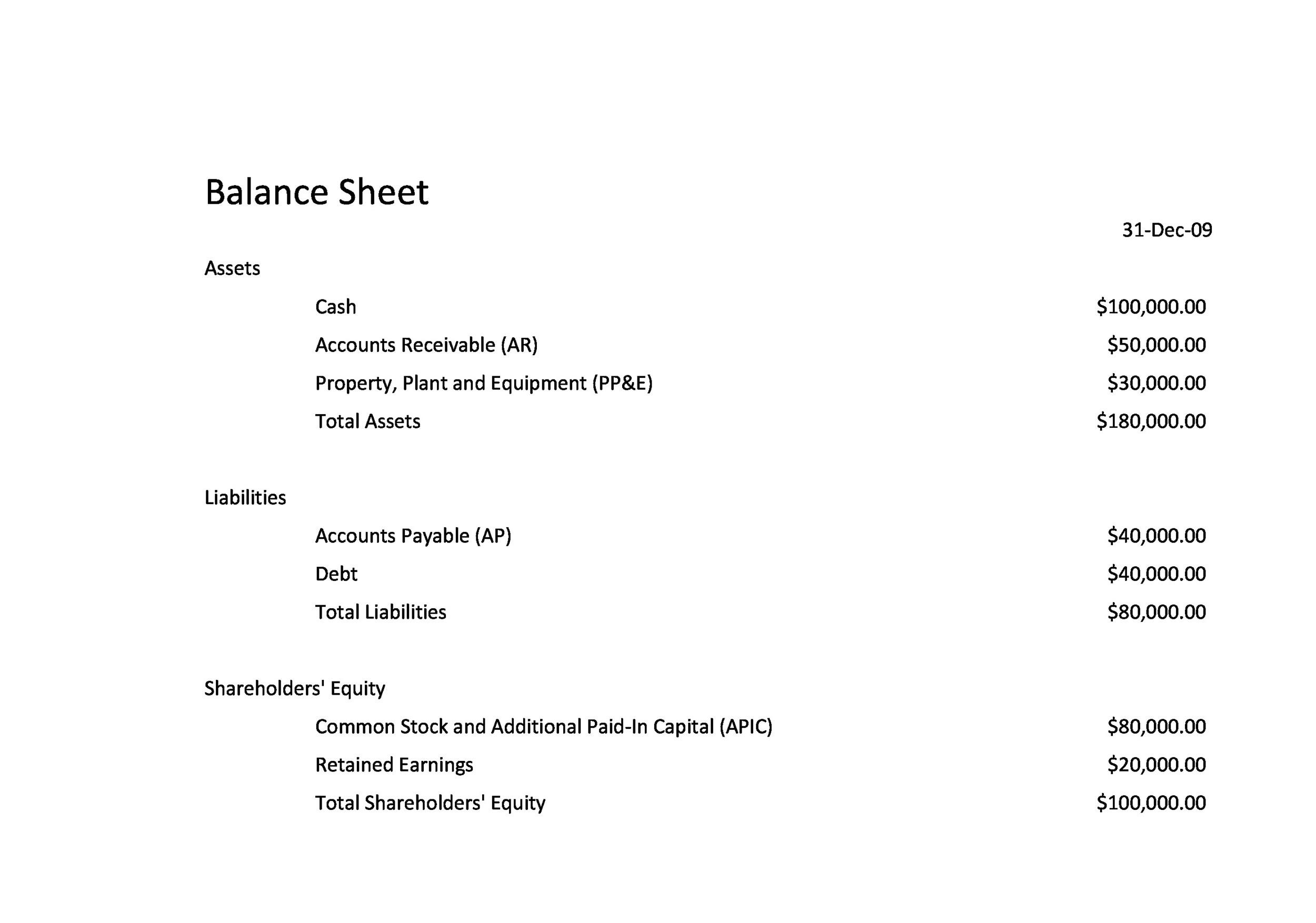

38 Free Balance Sheet Templates & Examples Template Lab

For your convenience, i’m sending a quick reminder about invoice #001 that was due. With a template, you can customize the perfect receipt for your organization. For invoices that are only slightly overdue, add the phrase “for your convenience.” a day after an invoice is due, you can write:

There are many things you can do to make sure your receipt includes everything and still looks impressive. After you’ve learnt how to write an invoice email, using templates can be a great way to cut down on the amount of admin you need to deal with. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations.

For your convenience, i’m sending a quick reminder about invoice #001 that was due. For invoices that are only slightly overdue, add the phrase “for your convenience.” a day after an invoice is due, you can write: Tax deductions are a form of tax incentives, along with exemptions and tax credits.the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while. Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Keep a copy of this form handy since it is useful for proving income and other things. With a template, you can customize the perfect receipt for your organization. Here are some tips to write an effective and professional past due invoice letter: However, with a little planning, you can afford to be quite generous before you have to break out form 709 to report the amount and be on the line to pay extra money. This is a complete document that contains all of your sources of income in one place. A great way to achieve this is by downloading a template.

Here are three easy ways to steer clear of the gift tax. Here’s a simple and effective sample you can use to send a. There are many things you can do to make sure your receipt includes everything and still looks impressive. How to write a past due invoice letter. After you’ve learnt how to write an invoice email, using templates can be a great way to cut down on the amount of admin you need to deal with. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. If you give away generous sums of money to a friend or family member, you may be required to pay a gift tax to the irs. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.