Template To Remove Old Address From Credit Report

Template to remove old address from credit report - Ensure that the information on all of your credit reports is correct and up to date. 1) identification information, 2) public record information, 3) credit and debt accounts, and 4) inquiries into the report. Get a free copy of your credit report every 12 months from each credit reporting company. Review each sections of your report looking for errors, unfamiliar accounts and inquiries by companies that you do not recognize. Credit reports generally have four sections: Federal law allows you to: Make sure this fits by entering your model number.; Review your whole lexisnexis credit report.

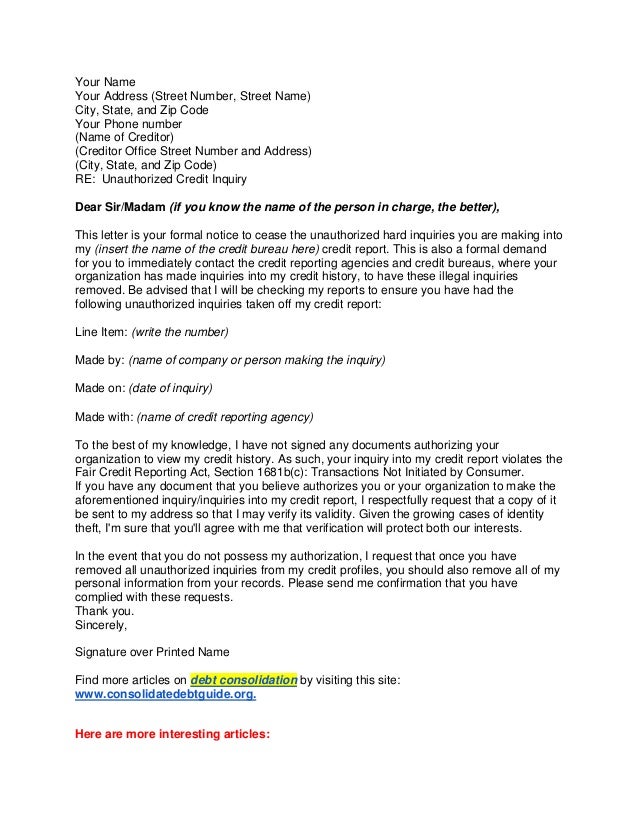

Sample letters to remove inquiries

Credit reports generally have four sections: 1) identification information, 2) public record information, 3) credit and debt accounts, and 4) inquiries into the report. Review your whole lexisnexis credit report.

Make sure this fits by entering your model number.; Review each sections of your report looking for errors, unfamiliar accounts and inquiries by companies that you do not recognize. Federal law allows you to:

Review your whole lexisnexis credit report. Get a free copy of your credit report every 12 months from each credit reporting company. Ensure that the information on all of your credit reports is correct and up to date.

Ensure that the information on all of your credit reports is correct and up to date. Federal law allows you to: Credit reports generally have four sections:

Get a free copy of your credit report every 12 months from each credit reporting company. Make sure this fits by entering your model number.; Review each sections of your report looking for errors, unfamiliar accounts and inquiries by companies that you do not recognize.

Review each sections of your report looking for errors, unfamiliar accounts and inquiries by companies that you do not recognize. 1) identification information, 2) public record information, 3) credit and debt accounts, and 4) inquiries into the report. Federal law allows you to:

Ensure that the information on all of your credit reports is correct and up to date. 1) identification information, 2) public record information, 3) credit and debt accounts, and 4) inquiries into the report. Credit reports generally have four sections:

Make sure this fits by entering your model number.; Ensure that the information on all of your credit reports is correct and up to date. Review your whole lexisnexis credit report.

Make sure this fits by entering your model number.; Federal law allows you to: Get a free copy of your credit report every 12 months from each credit reporting company. Review each sections of your report looking for errors, unfamiliar accounts and inquiries by companies that you do not recognize. Ensure that the information on all of your credit reports is correct and up to date. 1) identification information, 2) public record information, 3) credit and debt accounts, and 4) inquiries into the report. Review your whole lexisnexis credit report. Credit reports generally have four sections: