Unsecured Promissory Note Template

Unsecured promissory note template - The borrower repays the loan in weekly, monthly, or yearly instalments.; If you are lending a large amount of money to someone (or to a business), then you may want to create a promissory note from a promissory note template. At the minimum, a promissory note details the principal amount, interest rates, and payment date. The borrower repays the entire loan amount at once (either by a specific date or upon notice to repay).; Lawdepot's loan agreement template allows you to choose from the following methods of repayment: This means that if the payment is not made by the borrower that the lender would have to either file in small claims court or through other legal processes. An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full. What is a promissory note template? Adobe pdf, ms word (.docx), opendocument. A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends.

Unlike a secured promissory note, the lender is taking into account the borrower’s credibility without receiving anything in return if they shall default on their payments. This note will be a legal record. A promissory note or note payable is a legally binding written declaration stating a borrower agrees to pay the lender a specific sum of money on demand or at a specified future date. When to use a promissory note?

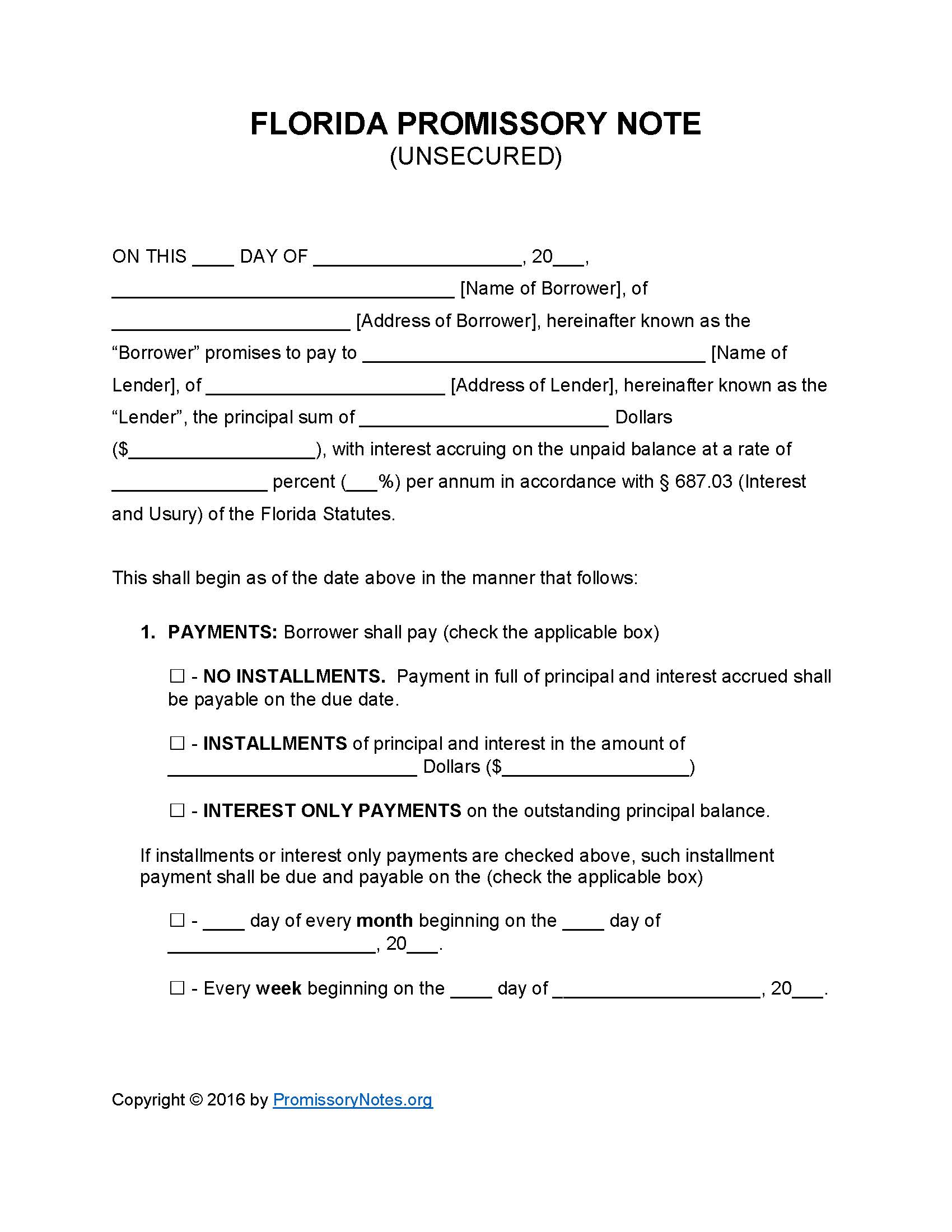

Florida Unsecured Promissory Note Template Promissory Notes

An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full. The borrower repays the entire loan amount at once (either by a specific date or upon notice to repay).; When to use a promissory note?

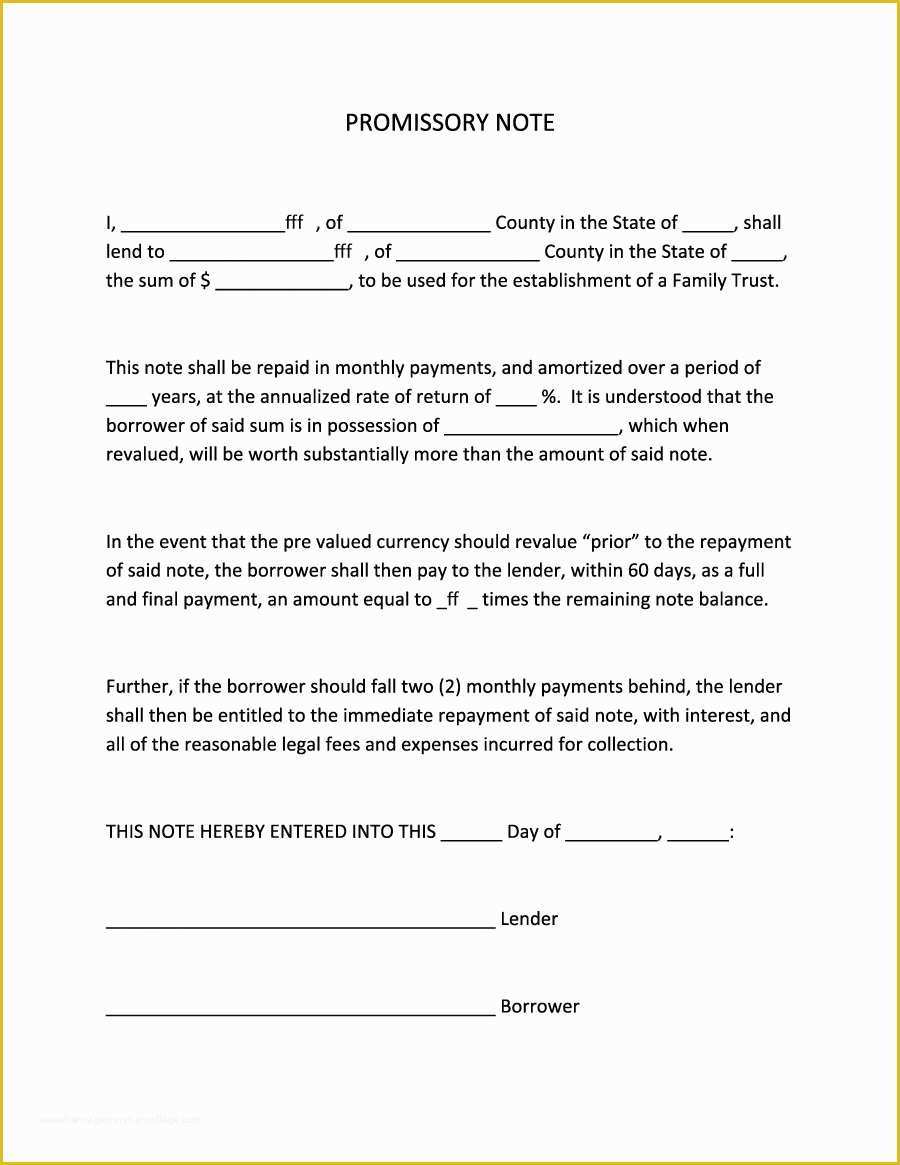

Free Promissory Note Template Illinois Of 45 Free Promissory Note

A promissory note or note payable is a legally binding written declaration stating a borrower agrees to pay the lender a specific sum of money on demand or at a specified future date. The borrower repays the loan in weekly, monthly, or yearly instalments.; What is a promissory note template?

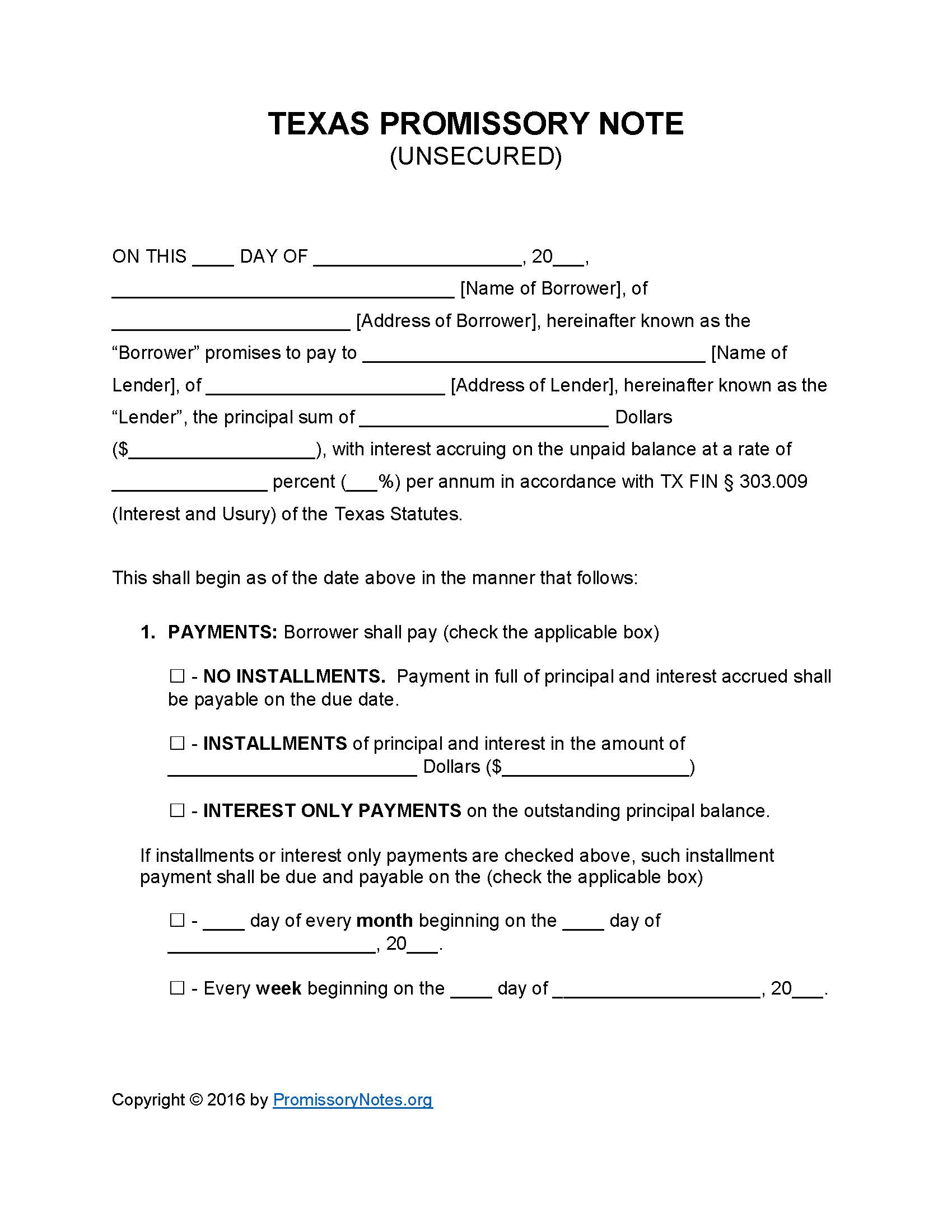

Texas Unsecured Promissory Note Template Promissory Notes

This means that if the payment is not made by the borrower that the lender would have to either file in small claims court or through other legal processes. Unlike a secured promissory note, the lender is taking into account the borrower’s credibility without receiving anything in return if they shall default on their payments. If you are lending a large amount of money to someone (or to a business), then you may want to create a promissory note from a promissory note template.

Blank Promissory Note

The borrower repays the entire loan amount at once (either by a specific date or upon notice to repay).; A promissory note or note payable is a legally binding written declaration stating a borrower agrees to pay the lender a specific sum of money on demand or at a specified future date. Lawdepot's loan agreement template allows you to choose from the following methods of repayment:

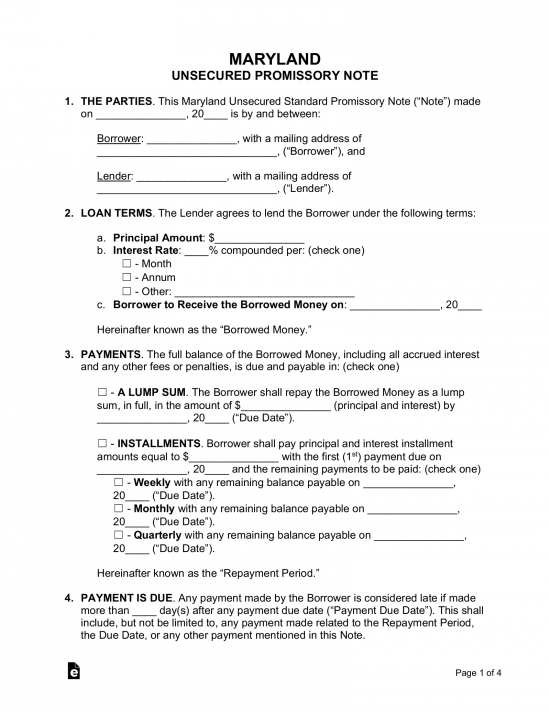

Free Maryland Unsecured Promissory Note Template Word PDF eForms

The borrower repays the entire loan amount at once (either by a specific date or upon notice to repay).; An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full. A promissory note or note payable is a legally binding written declaration stating a borrower agrees to pay the lender a specific sum of money on demand or at a specified future date.

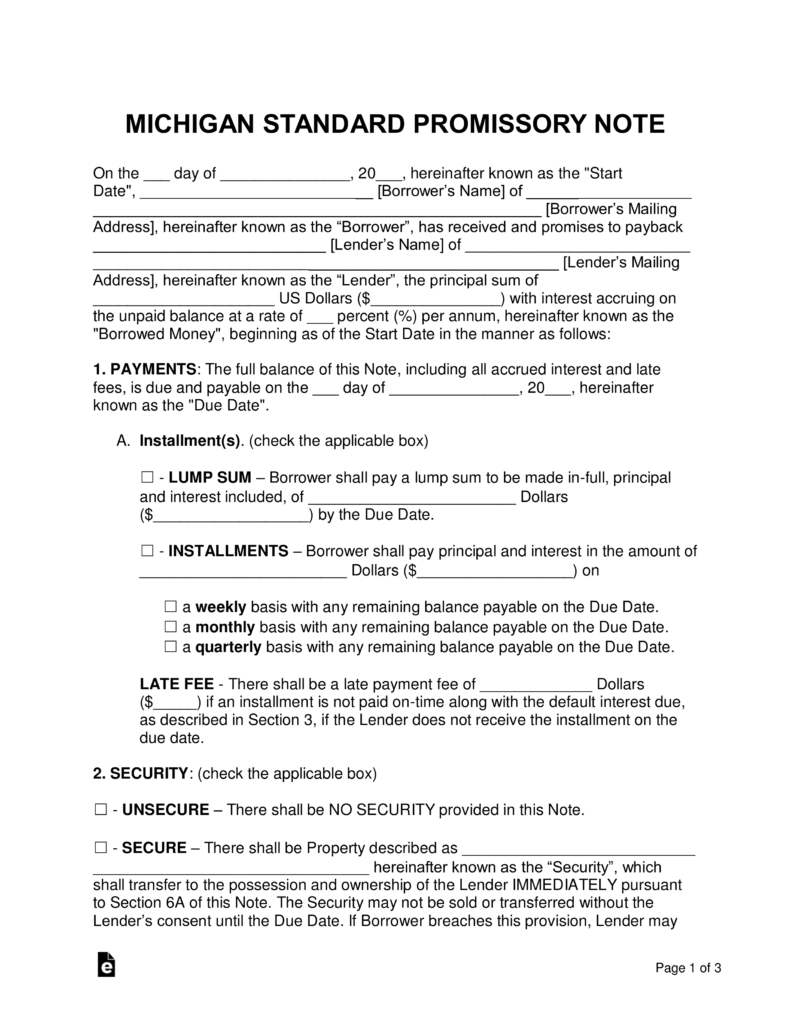

Free Michigan Promissory Note Templates Word PDF eForms

Unlike a secured promissory note, the lender is taking into account the borrower’s credibility without receiving anything in return if they shall default on their payments. If you are lending a large amount of money to someone (or to a business), then you may want to create a promissory note from a promissory note template. A promissory note or note payable is a legally binding written declaration stating a borrower agrees to pay the lender a specific sum of money on demand or at a specified future date.

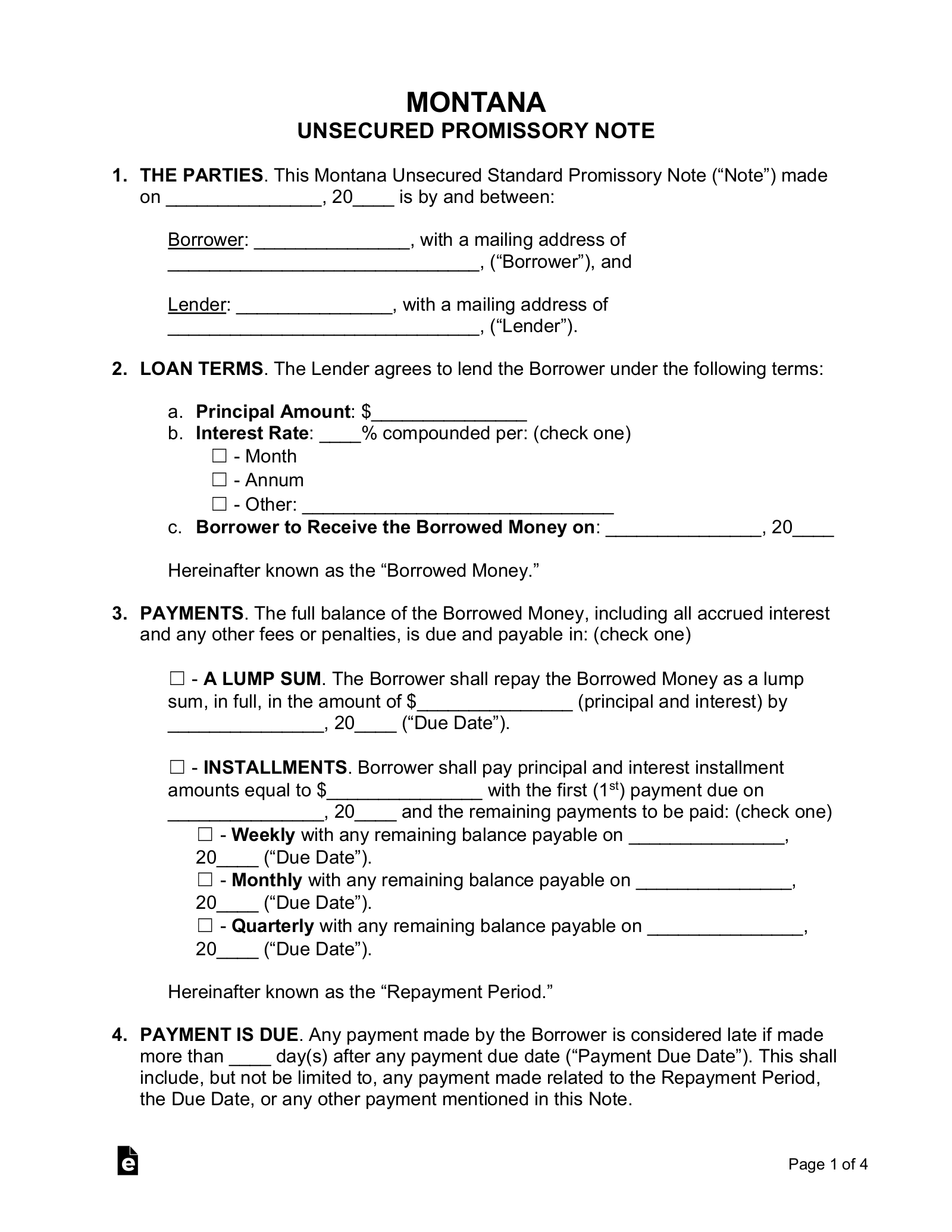

Free Montana Unsecured Promissory Note Template Word PDF eForms

A promissory note or note payable is a legally binding written declaration stating a borrower agrees to pay the lender a specific sum of money on demand or at a specified future date. The borrower repays the loan in weekly, monthly, or yearly instalments.; Lawdepot's loan agreement template allows you to choose from the following methods of repayment:

Unsecured Promissory Note Template Promissory Notes

Adobe pdf, ms word (.docx), opendocument. This means that if the payment is not made by the borrower that the lender would have to either file in small claims court or through other legal processes. What is a promissory note template?

Adobe pdf, ms word (.docx), opendocument. This means that if the payment is not made by the borrower that the lender would have to either file in small claims court or through other legal processes. A promissory note or note payable is a legally binding written declaration stating a borrower agrees to pay the lender a specific sum of money on demand or at a specified future date. An unsecured promissory note is a document that details the borrowing of money from one individual or entity to another without security if the debt is not paid in full. What is a promissory note template? Unlike a secured promissory note, the lender is taking into account the borrower’s credibility without receiving anything in return if they shall default on their payments. The borrower repays the entire loan amount at once (either by a specific date or upon notice to repay).; If you are lending a large amount of money to someone (or to a business), then you may want to create a promissory note from a promissory note template. This note will be a legal record. The borrower repays the loan in weekly, monthly, or yearly instalments.;

Lawdepot's loan agreement template allows you to choose from the following methods of repayment: When to use a promissory note? A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends. At the minimum, a promissory note details the principal amount, interest rates, and payment date.