Wacc Excel Template

Wacc excel template - Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs. List of financial model templates. Here are the steps of how to make a football field chart in excel: Set the open and low values as being the same; Preferred dividend calculation in excel (with excel template) let us now do the same example above in excel. Explore and download our free excel financial modeling templates below, designed to be flexible and help you perform various kinds of financial analysis and build financial models.use these to expand your knowledge and practice your modeling skills. Set the high and close values as being the same; Common equity, preferred stock, debt). If you’re building an unlevered discounted cash flow (dcf) model, the weighted average cost of capital (wacc) is the appropriate cost of capital to use when discounting the unlevered free cash flows. Create a table in excel with the range of values;

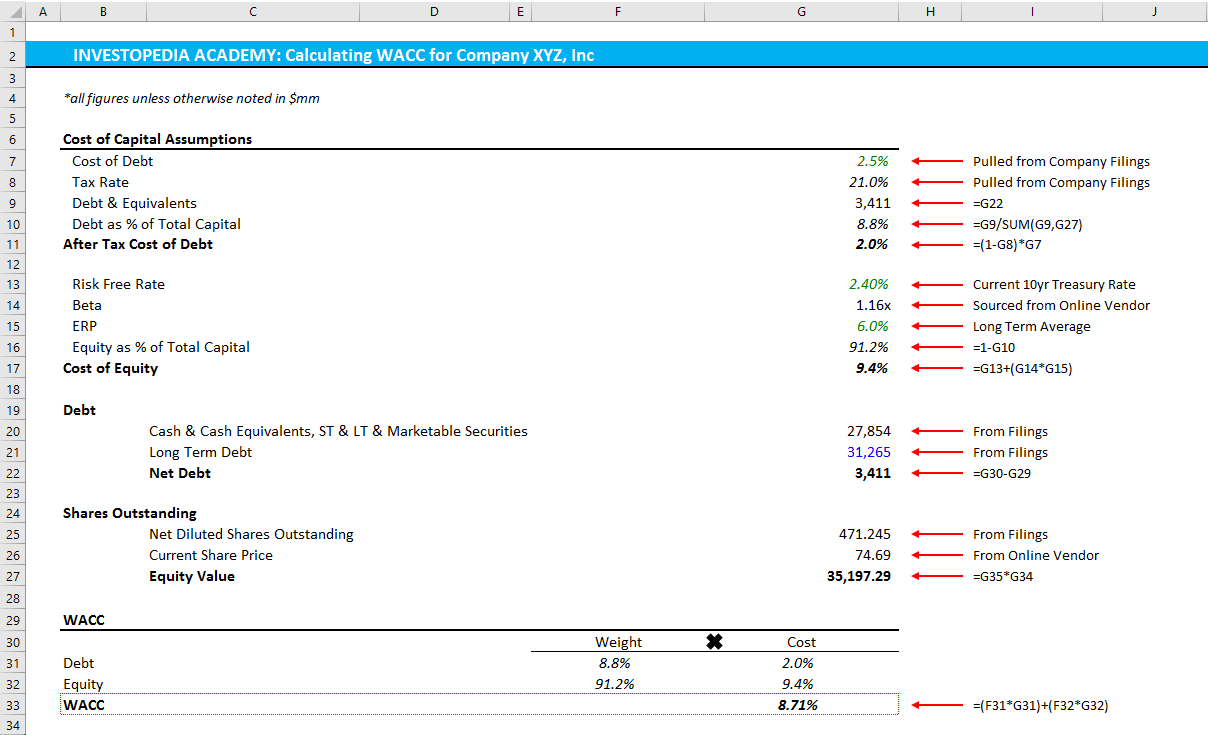

Similar to unlevered free cash flows (fcfs), the wacc represents the cost of capital to all capital providers (e.g. We have divided them based on industry (investment banking, private equity,. You can easily calculate the ratio in the template provided. You must provide the two inputs of par value, rate of dividend, and number of preferred stocks. List of free excel financial model templates.

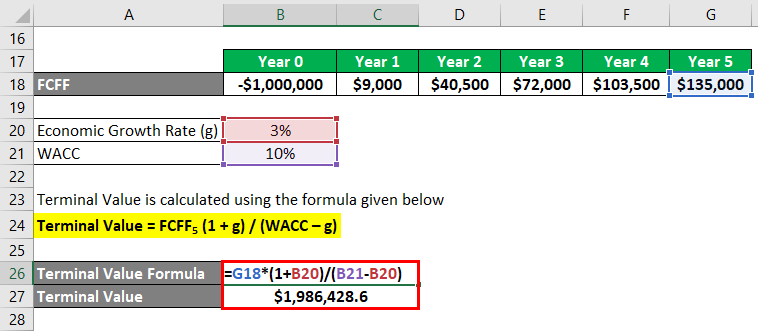

Net Present Value Formula Examples With Excel Template

You can easily calculate the ratio in the template provided. Set the open and low values as being the same; Create a table in excel with the range of values;

What is the formula for calculating weighted average cost of capital

You must provide the two inputs of par value, rate of dividend, and number of preferred stocks. Common equity, preferred stock, debt). You can easily calculate the ratio in the template provided.

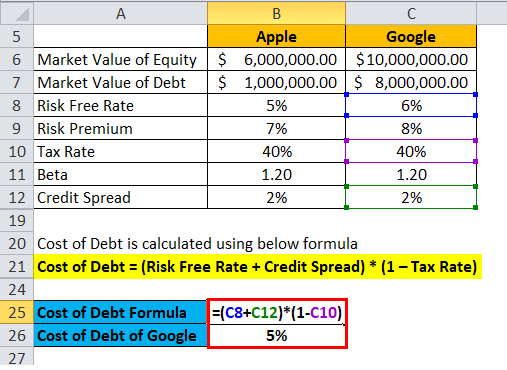

Cost of Debt Formula How to Calculate? (With Examples)

Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs. Create a table in excel with the range of values; Similar to unlevered free cash flows (fcfs), the wacc represents the cost of capital to all capital providers (e.g.

Cost of Capital Formula Calculator (Excel template)

Create a table in excel with the range of values; Here are the steps of how to make a football field chart in excel: List of financial model templates.

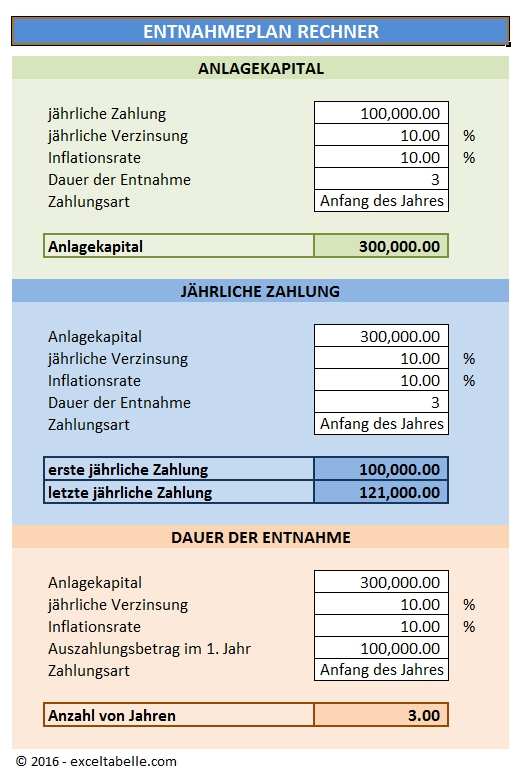

Entnahmeplan Rechner Excel

If you’re building an unlevered discounted cash flow (dcf) model, the weighted average cost of capital (wacc) is the appropriate cost of capital to use when discounting the unlevered free cash flows. Create a table in excel with the range of values; List of free excel financial model templates.

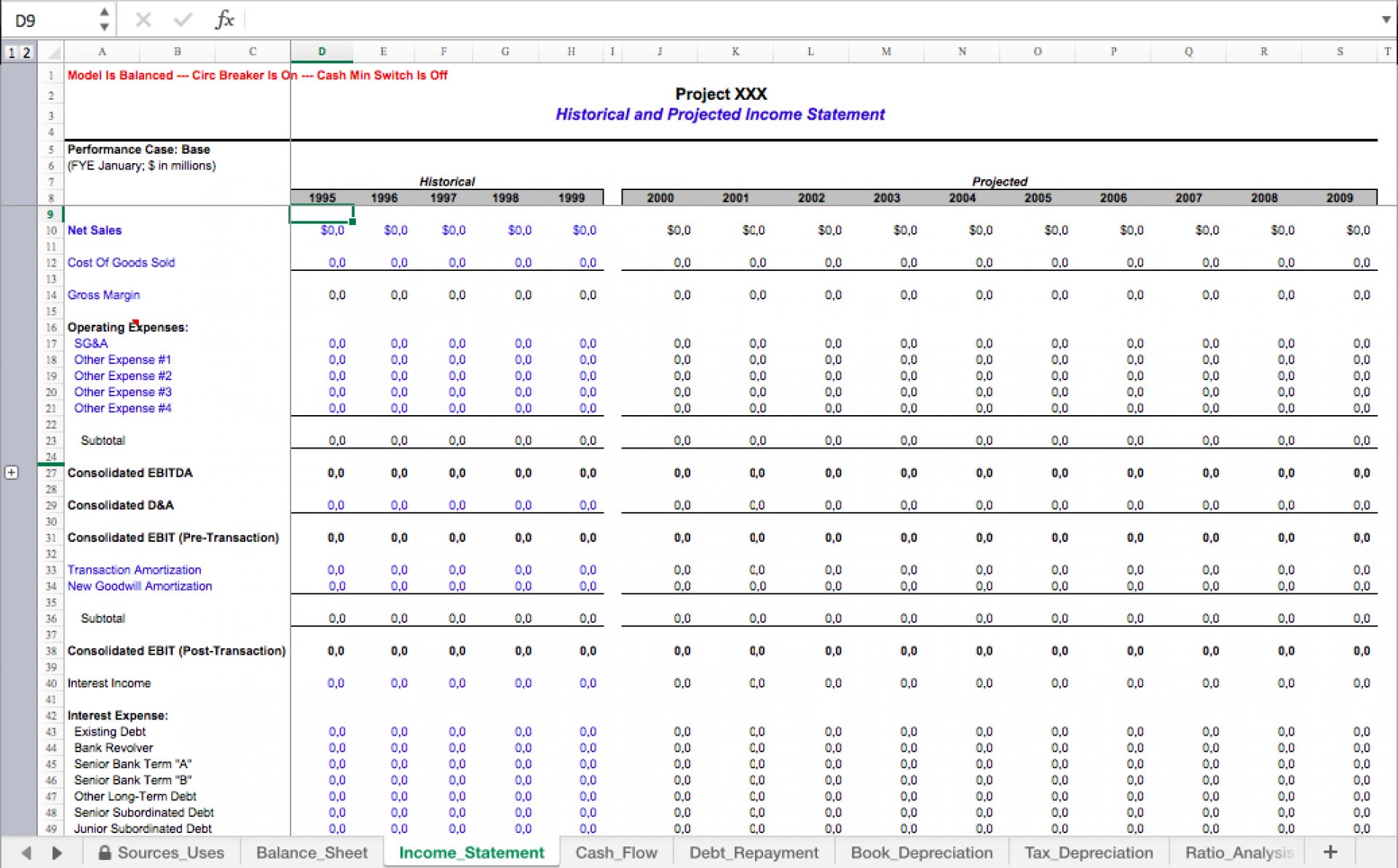

Leveraged Buyout (LBO) Model Template Excel Eloquens

Set the open and low values as being the same; Here are the steps of how to make a football field chart in excel: Create a table in excel with the range of values;

Sensitivity Analysis in Excel Template Example DCF Guide

List of free excel financial model templates. Preferred dividend calculation in excel (with excel template) let us now do the same example above in excel. Here are the steps of how to make a football field chart in excel:

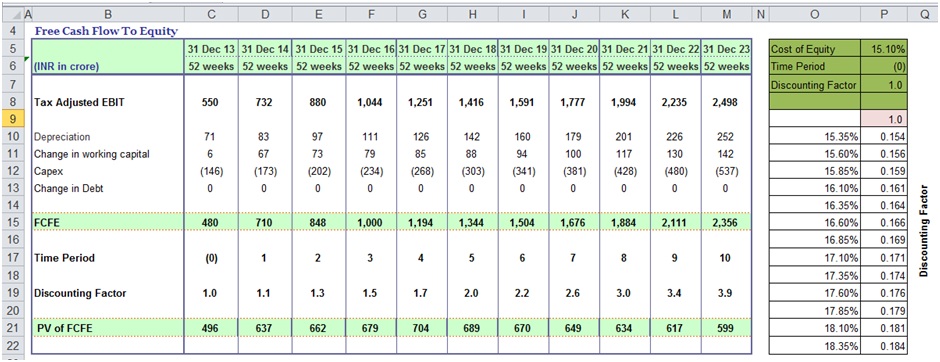

DCF Model Training 6 Steps to Building a DCF Model in Excel Wall

Preferred dividend calculation in excel (with excel template) let us now do the same example above in excel. If you’re building an unlevered discounted cash flow (dcf) model, the weighted average cost of capital (wacc) is the appropriate cost of capital to use when discounting the unlevered free cash flows. Discounting levered free cash flows.

List of financial model templates. Explore and download our free excel financial modeling templates below, designed to be flexible and help you perform various kinds of financial analysis and build financial models.use these to expand your knowledge and practice your modeling skills. Preferred dividend calculation in excel (with excel template) let us now do the same example above in excel. Discounting levered free cash flows. Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs. Create a table in excel with the range of values; If you’re building an unlevered discounted cash flow (dcf) model, the weighted average cost of capital (wacc) is the appropriate cost of capital to use when discounting the unlevered free cash flows. You can easily calculate the ratio in the template provided. Set the open and low values as being the same; You must provide the two inputs of par value, rate of dividend, and number of preferred stocks.

Similar to unlevered free cash flows (fcfs), the wacc represents the cost of capital to all capital providers (e.g. Set the high and close values as being the same; List of free excel financial model templates. Common equity, preferred stock, debt). Here are the steps of how to make a football field chart in excel: We have divided them based on industry (investment banking, private equity,.