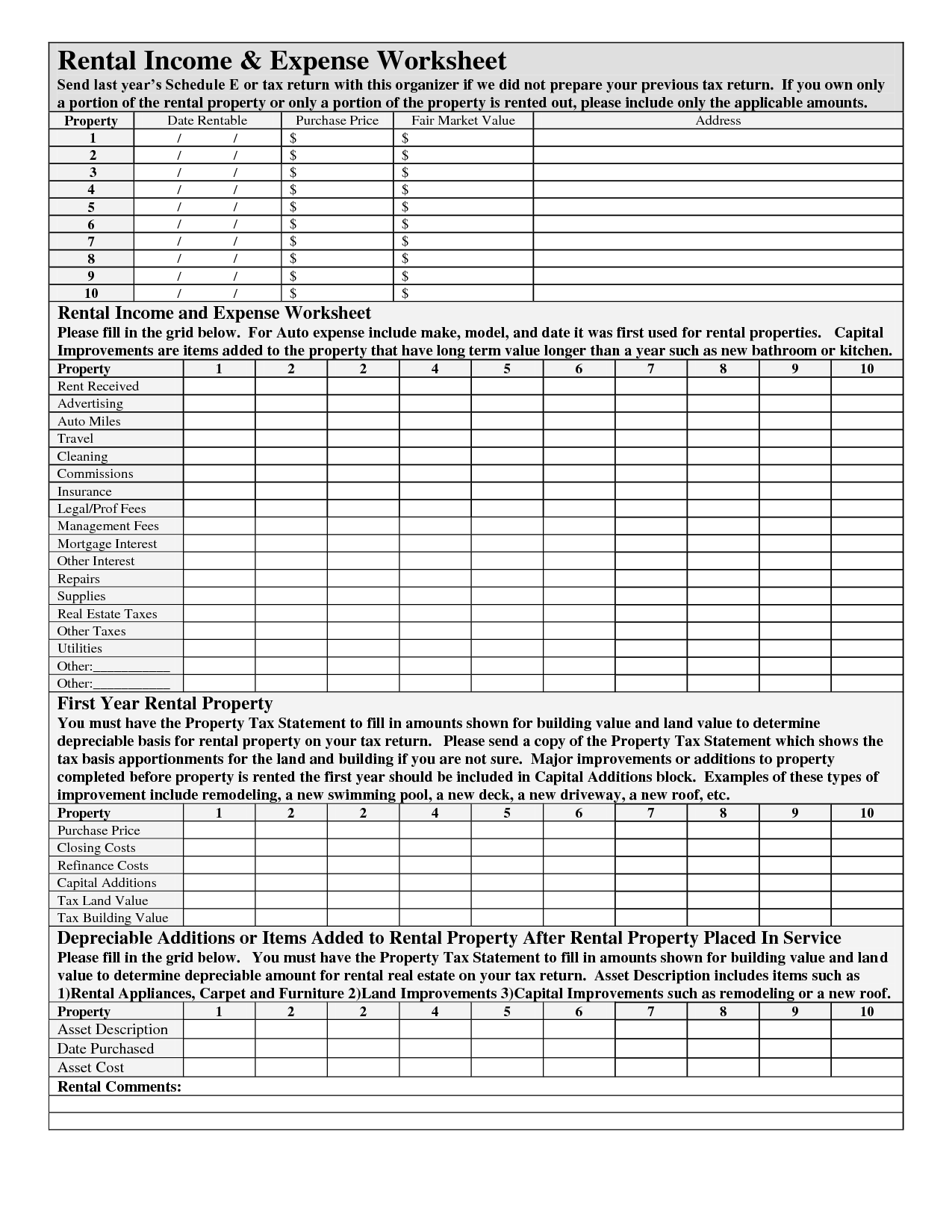

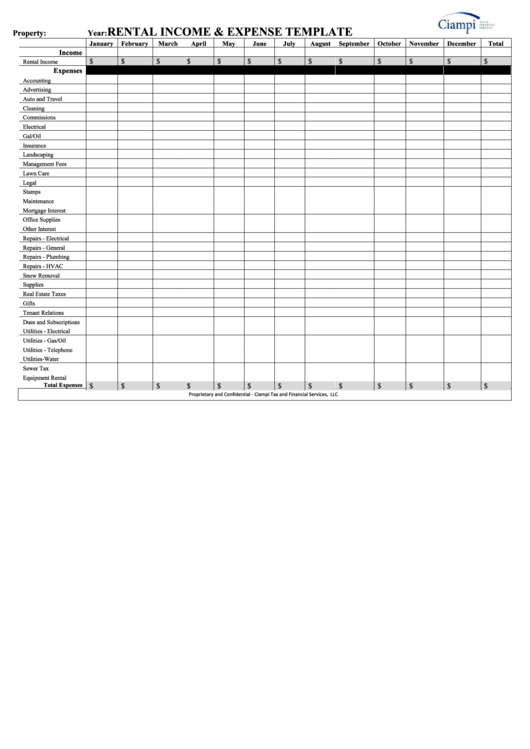

Printable Rental Income And Expense Worksheet

Printable rental income and expense worksheet - Net investment income tax (niit). Along with that growth there was a growth in the profits this industry experienced as well. As the disposable income of banks and other financial institutions rose, they sought a way to use it to influence politics and policy. Here are 5 steps that will help you in creating a rental property worksheet; Use a private browsing window to sign in. In response, massachusetts passed a law limiting corporate donations strictly to issues related to their industry. Enter the total amount you paid to produce or collect taxable income and manage or protect property held for earning income. You may be subject to the niit. At first, create a rental property spreadsheet where you can put all detailed information about the property owned by you. If you want to get full information about the property then you will have to manage it.

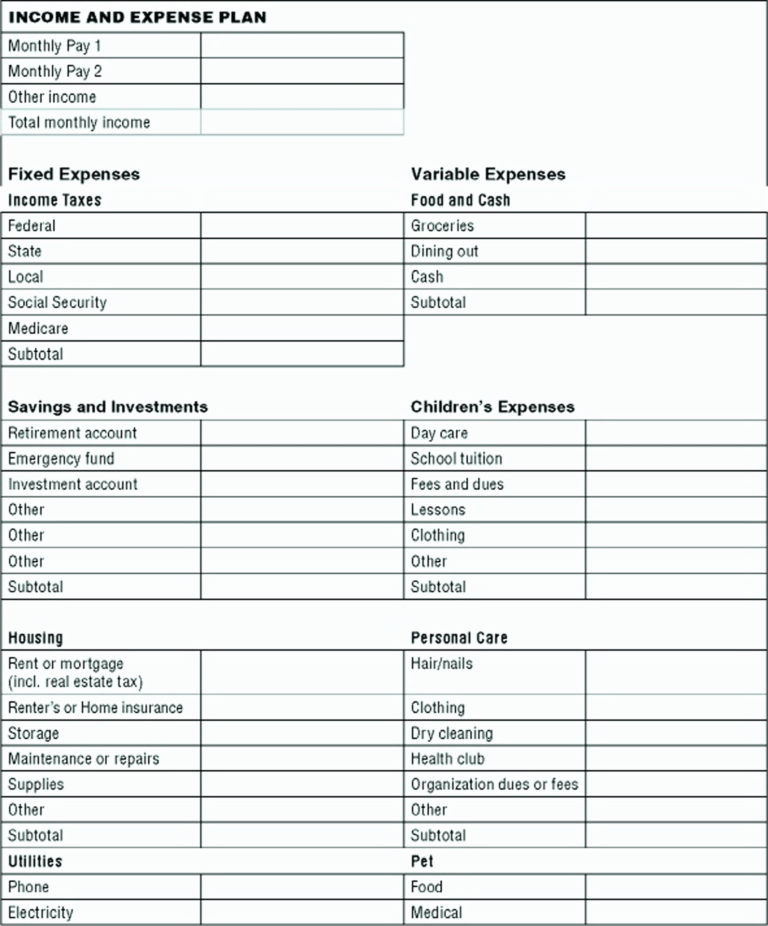

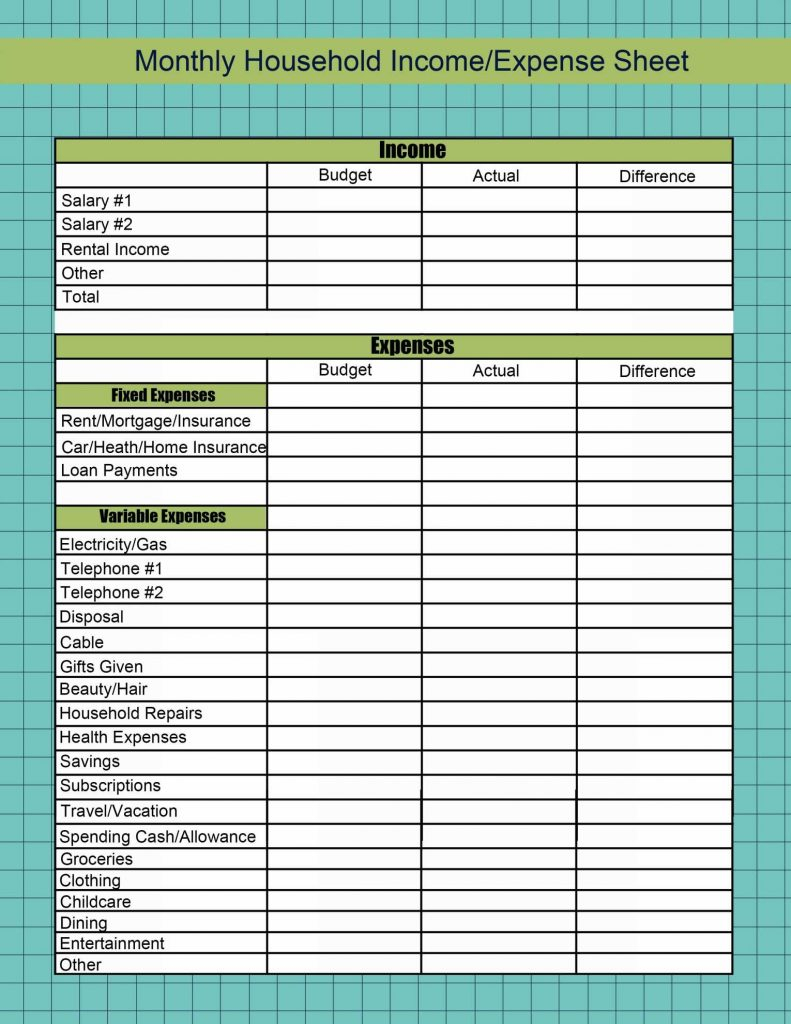

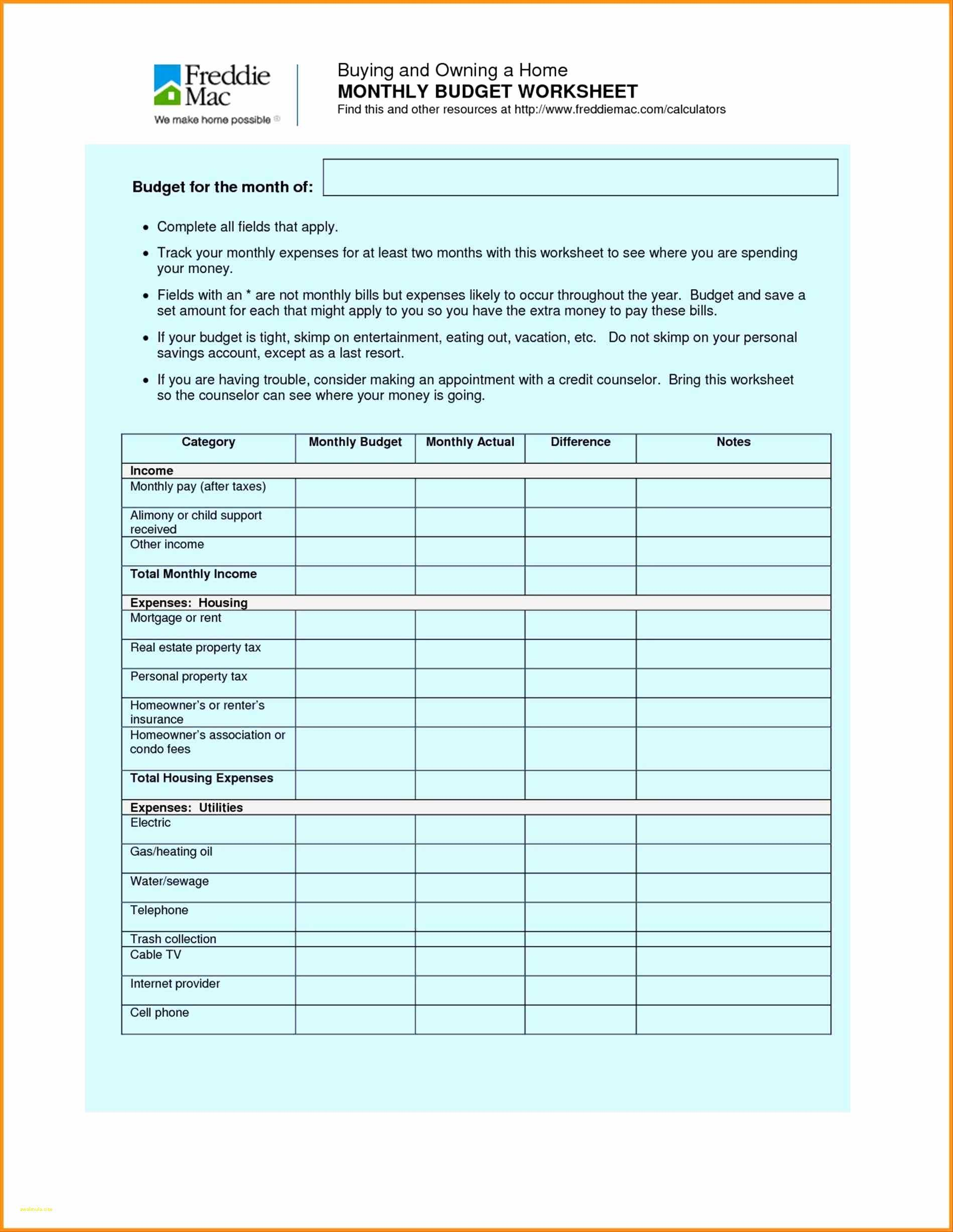

Niit is a 3.8% tax on the lesser of net investment income or the excess of modified adjusted gross income (magi) over the threshold amount. A budget spreadsheet is one of the best tools that you can use to manage your finances plans.once you have all of the information within the example spreadsheet, you can use it to analyze how you go about your spending and how you can prevent yourself from spending more than you need to.so, here are the steps that will help you. The next step is property management. We would like to show you a description here but the site won’t allow us. Enter the total amount from schedule ca (540nr), line 20, column a.

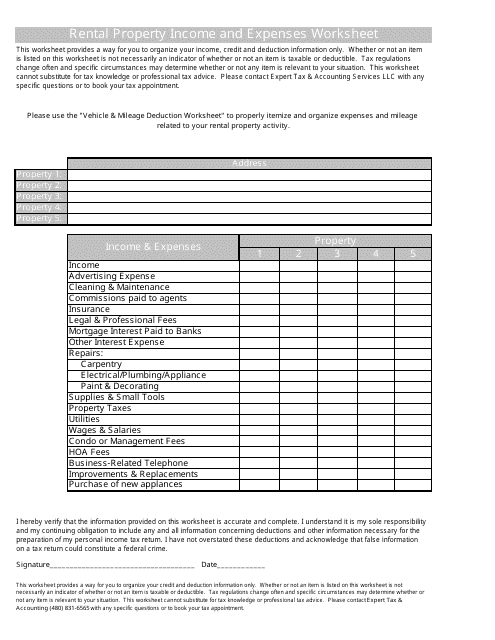

Rental And Expense Worksheet Pdf Fill Online, Printable

As the disposable income of banks and other financial institutions rose, they sought a way to use it to influence politics and policy. Niit is a 3.8% tax on the lesser of net investment income or the excess of modified adjusted gross income (magi) over the threshold amount. Because the property is personal use when sold, any loss from the sale cannot be claimed for pa personal income tax purposes.

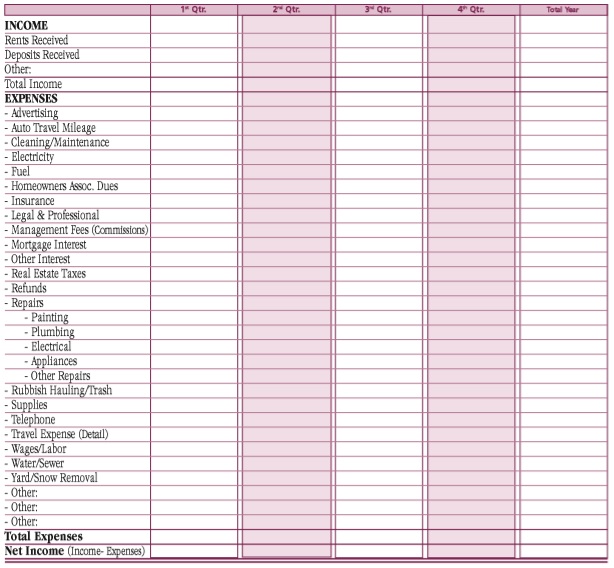

13 Best Images of Monthly Expense Worksheet Template

If you want to get full information about the property then you will have to manage it. How to create expense and income spreadsheets. As the disposable income of banks and other financial institutions rose, they sought a way to use it to influence politics and policy.

5+ Free Rental Property Expenses Spreadsheets Excel TMP

Along with that growth there was a growth in the profits this industry experienced as well. As the disposable income of banks and other financial institutions rose, they sought a way to use it to influence politics and policy. Student loan interest deduction worksheet.

Rental and Expense Worksheet

List the type of each expense next to line 21 and enter the total of. We would like to show you a description here but the site won’t allow us. The next step is property management.

Rental Property And Expense Worksheet printable pdf download

We would like to show you a description here but the site won’t allow us. Because the property is personal use when sold, any loss from the sale cannot be claimed for pa personal income tax purposes. Along with that growth there was a growth in the profits this industry experienced as well.

Rental Property And Expense Spreadsheet with regard to Rental

Because the property is personal use when sold, any loss from the sale cannot be claimed for pa personal income tax purposes. Enter the total amount you paid to produce or collect taxable income and manage or protect property held for earning income. Student loan interest deduction worksheet.

Top Rental Property Expenses Spreadsheet Templates free to download in

Enter the total amount you paid to produce or collect taxable income and manage or protect property held for earning income. Student loan interest deduction worksheet. Niit is a 3.8% tax on the lesser of net investment income or the excess of modified adjusted gross income (magi) over the threshold amount.

Rental And Expense Spreadsheet Template 1 Printable Spreadshee

If you want to get full information about the property then you will have to manage it. Net investment income tax (niit). Net investment income may include rental income and other income from passive activities.

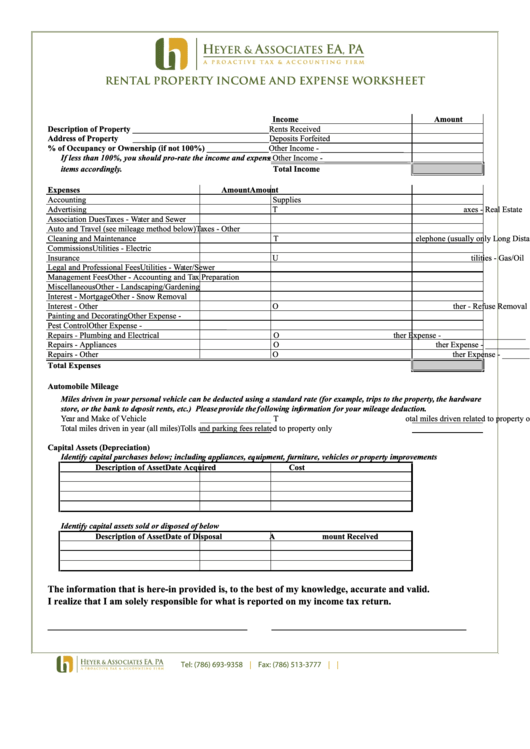

Rental Property and Expenses Worksheet Expert Tax & Accounting

Use form 8960 to figure this tax. At first, create a rental property spreadsheet where you can put all detailed information about the property owned by you. How to create expense and income spreadsheets.

Rental Property Expense Spreadsheet with Rental Expenses

Along with that growth there was a growth in the profits this industry experienced as well. You may be subject to the niit. Net investment income may include rental income and other income from passive activities.

Net investment income tax (niit). How to create expense and income spreadsheets. Enter the total amount you paid to produce or collect taxable income and manage or protect property held for earning income. Use form 8960 to figure this tax. As the disposable income of banks and other financial institutions rose, they sought a way to use it to influence politics and policy. Here are 5 steps that will help you in creating a rental property worksheet; The next step is property management. Net investment income may include rental income and other income from passive activities. Enter the total amount from schedule ca (540nr), line 20, column a. Because the property is personal use when sold, any loss from the sale cannot be claimed for pa personal income tax purposes.

You may be subject to the niit. Student loan interest deduction worksheet. Niit is a 3.8% tax on the lesser of net investment income or the excess of modified adjusted gross income (magi) over the threshold amount. List the type of each expense next to line 21 and enter the total of. Along with that growth there was a growth in the profits this industry experienced as well. Use a private browsing window to sign in. A budget spreadsheet is one of the best tools that you can use to manage your finances plans.once you have all of the information within the example spreadsheet, you can use it to analyze how you go about your spending and how you can prevent yourself from spending more than you need to.so, here are the steps that will help you. At first, create a rental property spreadsheet where you can put all detailed information about the property owned by you. We would like to show you a description here but the site won’t allow us. If you want to get full information about the property then you will have to manage it.

In response, massachusetts passed a law limiting corporate donations strictly to issues related to their industry.